Corporate credit issuance and refinancing exploded in 2020 due to accommodative monetary policy. Companies have mostly decided to lengthen the maturity of this new debt which could potentially pose risks in the years to come as rates rise. Monitoring the credit fundamentals of corporations will become even more important going forward.

Interest Rates

Interest rates for fixed income assets fell dramatically last year as The Fed lowered short term rates to zero. Demand for Treasury and credit securities increased pushing longer term yields lower. This drop in yields gave companies the opportunity to refinance existing debt and issue new debt at these historically low rates.

Corporate Credit Issuance (Supply)

For 2020, US Investment Grade (IG) credit supply was roughly $1.8 trillion dollars up about $600 billion YoY, according to CreditSights. More than two thirds of that credit was used for general purposes thus adding debt to balance sheets. A quarter of new issue was used to refinance debt decreasing interest expense. Supply for IG credit through March 2021 has already been more than $430 billion.

Refinancing and issuing debt at these lower rates has been positive for companies for a couple of reasons. First, if the new yield on the refinanced debt is lower than the previous coupon rate, refinancing at that level will reduce the interest expense incurred by the company. Second, companies are taking advantage of these low rates to increase debt loads with little impact to interest expense. The incentive for company CFOs to refinance and issue new debt will continue until market rates (blue line) approach the index yield, or when market rates approach existing coupon levels that companies pay (orange line). Until corporations start to pay a coupon of 4%, we will continue to operate in this environment where it is advantageous for companies to issue debt.

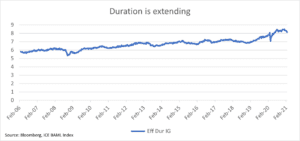

Another advantage for the issuers of debt due to lower interest rates is lengthening the maturity of the debt, or its duration. Duration in its simplest form is how long it will take for the cash flows of the bond to be repaid in full. This extension of duration has pushed principal payments down the road and give companies more runway to operate.

Demand for Credit

There has been an insatiable demand for credit. Investors have had to “reach” for yield as rates on the short end of the yield curve have been pegged at the zero-lower bound (ZLB). There are two ways a credit investor can increase yield. One way is to take on more duration risk, this is done by buying securities further out the yield curve, assuming the yield curve is normally sloped. The second way is to take on more credit risk by moving down in credit quality. There is no free lunch as this brings risk to a portfolio in two ways: downgrade risk and default risk.

These two actions by investors have allowed companies to issue and refinance record amounts of debt.

Credit Moving Forward

Until market yields on corporate credit move toward the trend line of 4% there will be capacity for companies to refinance and issue debt. The short term capacity to pay for this additional debt shouldn’t be an issue at these low rates. However, as rates move up in the medium to long term refinancing and issuing debt will become more expensive. For companies, whose revenues and cash flows continue to improve will likely be able to sustain the additional debt load. As for the companies who cannot regain the lost cash flow, the ending might not be so rosy. It will become more difficult for companies to roll over the same amount of debt in the future with normal rates. Monitoring free cash flow levels will become ever more important going forward. APCM will also monitor market rates as yields approach 4% in the corporate world.

Jack Straub

Investment Analyst

4/5/2021