At Alaska Wealth Advisors we have a deep commitment to continual growth and education. You will see our newer associates announce their CFP™ accomplishment as the second step in their professional ladder after passing their securities exam. We also ask seasoned advisors to look at a deeper specialty that will create a circle of expertise to serve client wealth needs.

To that end, I am starting the Chartered Special Needs Consultant® program through the American College of Financial Services. I have been deeply committed to the Elder Long Term Care side of this field and was honored to be able to present some of my work at our Smart Money gathering in May. This ChSNC® program expands my education to include special needs children (under 18), adults (18 to 64), and elders (65+). What we know is that special needs do not discriminate by wealth or age and if we haven’t asked you if there is anyone in your life that might not be independent in the future, expect to hear that question at a future review.

The needs of these individuals can vary greatly by age, abilities, and specific conditions. We know that the type of assets that are invested for each of these individuals can help or harm them financially – all assets aren’t created equal. The collaboration between exceptional elder law attorneys and skilled tax CPAs reveals a gap in recommending assets for funding special needs trusts and other advantageous accounts. With this designation, I aim to enhance and expand upon this important work.

Families and caregivers may be planning to build independence or planning for independence to decline. Their risks may be the loss of a primary caregiver, or the loss of a special needs person. Their challenges are financial, legal, and emotional both for their family member with special needs and the rest of the family. Solutions are nuanced and in their best moments solutions are empowering for our clients and for our teams. We can positively impact the lives of our clients as we help them grow their wealth. We can stand with them if they need to support someone who might not be independent.

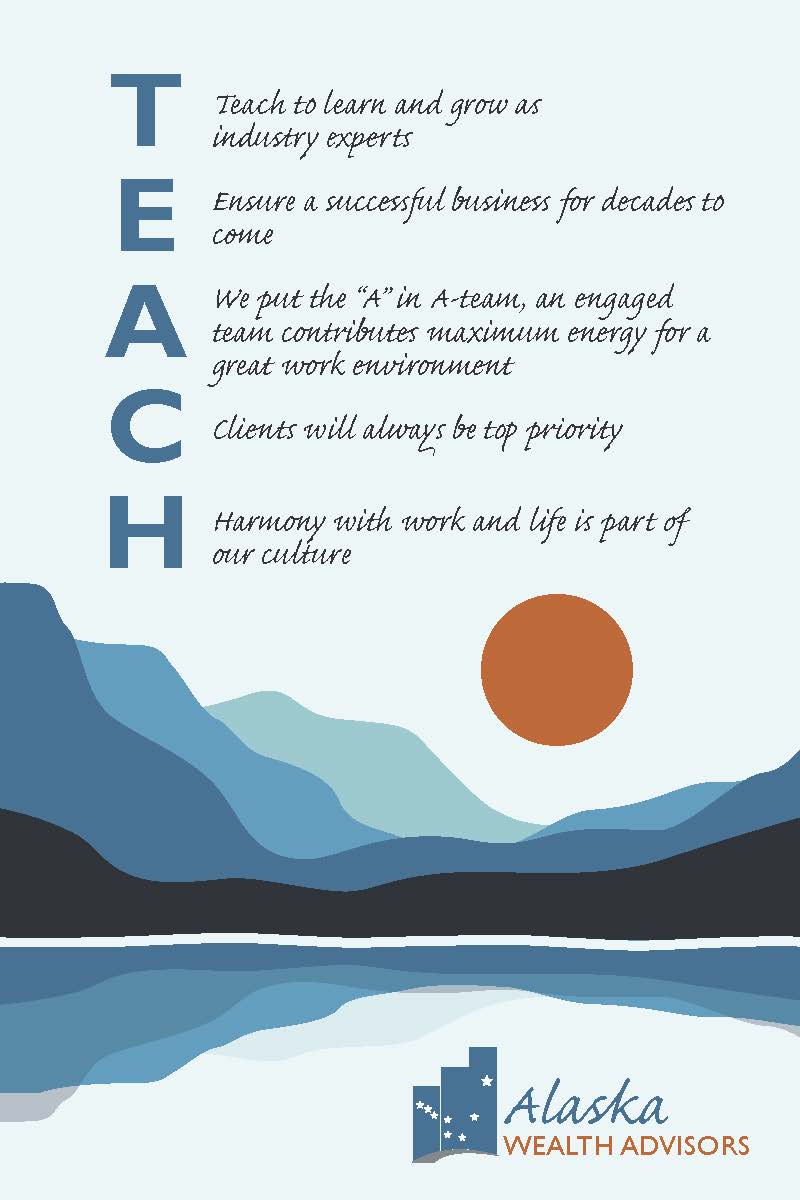

Learning and growing as an industry expert is one of Alaska Wealth Advisors’ core values. In fact, it is at the top of the list on a placard that sits beside my desk. Growing and learning in an area that gives much-needed support, guidance, and peace of mind to those who need it most makes walking into this office and working with this team a privilege every day.

Marietta “Ed” Hall, CFP®

Senior Financial Advisor

Alaska Wealth Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Alaska Wealth Advisor’s investment advisory services can be found in its Form ADV Part 2 and/or Form CRS, which is available upon request.

Alaska Wealth Advisors does not provide accounting, tax, or legal advice. Economic and market forecasts presented herein reflect a series of assumptions and judgments as of the date of this presentation and are subject to change without notice. These forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. These forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. Alaska Wealth Advisors has no obligation to provide updates or changes to these forecasts.

The opinions expressed are those of Alaska Wealth Advisors. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Forward-looking statements cannot be guaranteed.

Certified Financial PlannersTM (CFP®) are licensed by the CFP® Board to use the CFP® mark. CFP® certification requirements include: Bachelor’s degree from an accredited college or university, completion of the financial planning education requirements set by the CFP® Board (www.cfp.net), successful completion of the CFP® Certification Exam, comprised of two three-hour sessions, experience requirement: 6,000 hours of professional experience related to the financial planning process, or 4,000 hours of Apprenticeship experience that meets additional requirements, successfully pass the Candidate Fitness Standards and background check, agree annually to be bound by CFP® Board’s Standards of Professional Conduct, and complete 30 hours of continuing education every two years, including two hours on the Code of Ethics and Standards of Professional Conduct.