The year 2026 is poised to bring significant changes to the tax landscape, if no new legislation addresses a series of tax provisions collectively known as the “2025 Tax Sunset”. These provisions were introduced through various legislative acts and have had a significant impact on individual and business taxation. As the potential expiration date approaches, it’s essential for taxpayers to understand how these changes might affect them if Congress does not act and take proactive steps to prepare. In this blog post, we will delve into what the 2025 Tax Sunset entails, the key provisions that are set to expire, and talk about how to navigate these changes.

Key Provisions Set to Expire

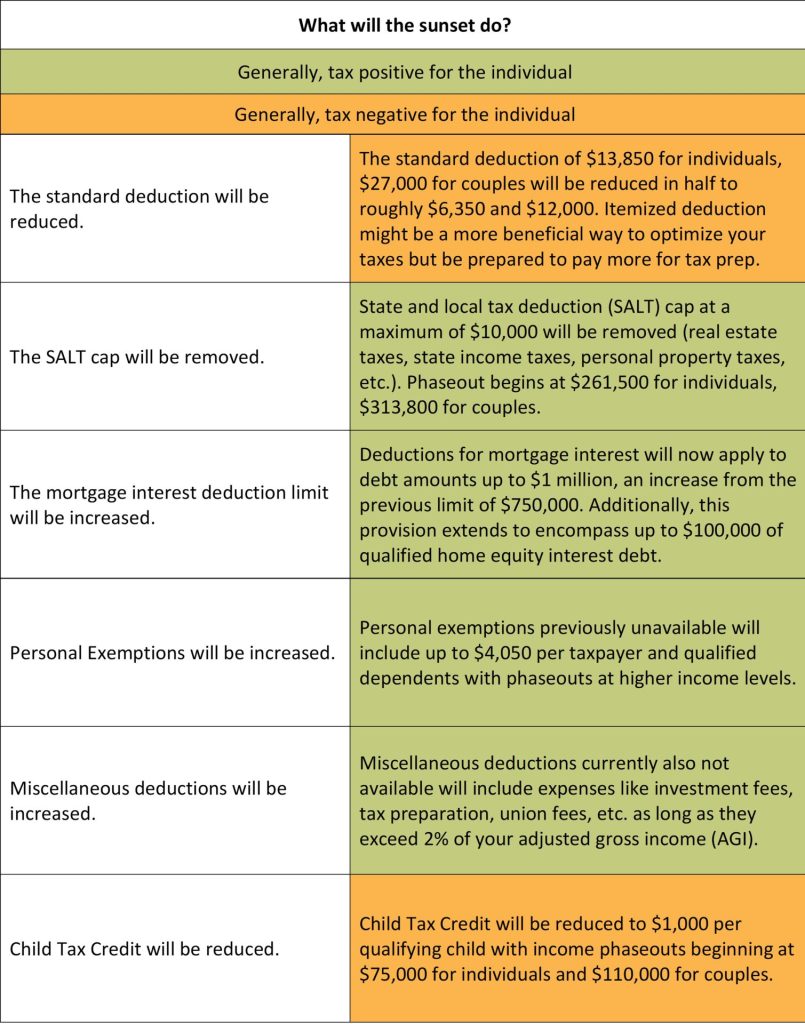

Individual Tax Provisions: The 2025 Tax Sunset will impact various tax breaks for individuals, such as changes to tax rates, deductions, and credits. The expiring provisions may include adjustments to marginal tax rates, child tax credits, education-related deductions, and more. Taxpayers should anticipate potential changes to their tax liability and financial planning strategies.

Source:

The material presented has been derived from sources considered to be reliable, but accuracy and completeness cannot be guaranteed. 2026 tax rates are estimates adjusted for inflation.

1) https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2023

2) https://www.cbo.gov/budget-options

Estate and Gift Tax Provisions: Estate planning is another area affected by the 2025 Tax Sunset. Changes to estate and gift tax exemptions and rates may impact how individuals plan their estates and transfer assets to heirs. For example, the lifetime estate and gift tax exemption will be cut in half from $12.92 million to around $6.2 million after adjusting for inflation. Keeping abreast of these changes is crucial for those with significant assets and complex estate plans. High-net-worth families might find it prudent to contemplate a gifting strategy aimed at transferring wealth prior to the impending expiration of the existing gift and estate lifetime exclusion.

Deductions:

Source:

The material presented has been derived from sources considered to be reliable, but accuracy and completeness cannot be guaranteed. https://www.irs.gov/newsroom/individuals

Preparing for the Changes

Stay Informed: Knowledge is your greatest asset in times of tax change. Regularly follow reliable sources of information, such as the Internal Revenue Service (IRS), tax and financial advisors, and financial news outlets, to stay updated on potential legislative developments and their implications.

Plan Ahead: Talk to your financial advisor, tax professional, trust officer, and estate attorney to assess how the expiring provisions could impact you, your investment portfolio, your estate plan, or major purchases or sales.

By taking a proactive approach and adapting your financial strategies accordingly, you can mitigate potential challenges and continue to manage your tax obligations effectively in the evolving tax landscape of 2026 and beyond.

Stan Moiseev

Associate Financial Advisor

Alaska Wealth Advisors does not provide accounting, tax, or legal advice. The information in this presentation is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. Tax and legal counsel should be engaged before taking any action. This should not be construed as accounting, tax, or legal advice. You should always consult with your tax professional with regard to specific tax questions and obligations. You should always consult with your accountant with regard to specific accounting questions and obligations. You should always consult with an attorney with regard to specific legal questions and obligations. The opinions expressed are those of Alaska Wealth Advisors. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Forward-looking statements cannot be guaranteed.