During the transition from your working years to retirement, your investment strategy takes center stage. The principles of derisking, diversifying, and rebalancing are key to navigating the changes that individuals experience. While this transition can be unnerving, our team at Alaska Wealth Advisors is here to help finesse your finances to align with your goals. In this article, we’ll explore portfolio risk management strategies and what they mean for both young savers and retirees.

Why Your Derisking Transition Matters

Derisking an investment portfolio is when you shift the balance of your asset classes from emphasizing riskier assets like equities, to a more diversified approach to include a heavier allocation to fixed income or alternatives.

Derisking your portfolio is crucial for a variety of reasons, but potential market volatility during retirement is a critical one. It helps maintain the balance between the required risk to meet your goals and potential investment returns. Your risk tolerance and capacity changes with age, making a customized approach essential.

Tailored Strategies for Different Ages

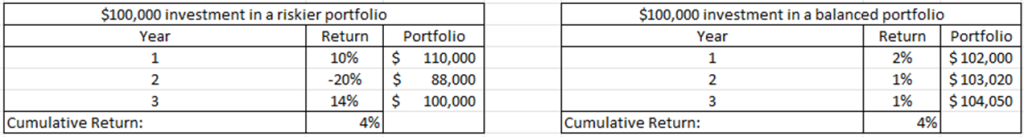

For young savers, time and volatility are allies. While assets that are covered in news headlines have flashy returns and are enticing, balanced investments that prioritize compounding and minimizing risk tend to perform better over time. It’s important to remember that the path of your return matters, not just the percentage year over year.

For illustrative purposes only, this is not intended to provide investment advice or expectations.

Your sequence of returns matters. Both portfolios have a cumulative return of 4%, but one is money ahead and one is simply breaking even. Diversification across equity, fixed income, and alternative asset classes remains vital.

On the other hand, retirees focus on income streams and preserving their hard-earned nest egg. This can be done through prioritizing income-generating assets, like bonds, that provide stability. Despite a shift towards stability, intentional diversification among asset classes is still imperative. For investors that are beginning to derisk, you’re in luck! Due to the rate hikes by the Federal Reserve over the past two years, fixed income is finally providing real returns and portfolio protection that we are excited to see.

Rebalancing’s Role in Derisking

Rebalancing ensures that your chosen asset allocation stays on track. It leverages the age-old ‘buy low, sell high’ philosophy with an unemotional and disciplined approach since investors typically pick an annual, semi-annual, or quarterly basis to do so. Your allocation should adjust when you’ve made a conscious decision to do so, not when certain assets classes outperform others in your portfolio.

Why a Professional Advisor Matters

Your team of financial advisors offer invaluable insights throughout the many changes that individuals experience throughout life. Our expertise allows us to tailor strategies to your unique circumstances and help us guide you toward informed decisions. It’s also important to recognize that emotional biases can lead to impulsive decisions. Having us in your corner can help you uphold discipline, accountability, and avoid short-term trends of fear or exuberance – depending on what the market(s) are up to.

The shift from accumulation to distribution can absolutely be an uncomfortable pivot, but having our team on your side can help make for a smooth transition. Appropriate derisking can help you navigate toward a secure retirement and is a conversation you might consider having with your advisory team since there isn’t a ‘one size fits all’ solution to the nuances that your investments require. Your portfolio’s investment mix should reflect your goals and should balance stability and growth for your ideal retirement.

Katelynn Toth, CFP®

Associated Financial Advisor

Alaska Wealth Advisors, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Alaska Wealth Advisors’ investment advisory services can be found in its Form ADV Part 2 and/or Form CRS, both of which are available upon request. Material presented has been derived from sources considered to be reliable, but accuracy and completeness cannot be guaranteed.

Certified Financial Planner (CFP®) is licensed by the CFP® Board to use the CFP® mark. CFP® certification requirements include: Bachelor’s degree from an accredited college or university, completion of the financial planning education requirements set by the CFP® Board (www.cfp.net), successful completion of the CFP® Certification Exam, comprised of two three-hour sessions, experience requirement: 6,000 hours of professional experience related to the financial planning process, or 4,000 hours of Apprenticeship experience that meets additional requirements, successfully pass the Candidate Fitness Standards and background check, agree annually to be bound by CFP® Board’s Standards of Professional Conduct, and complete 30 hours of continuing education every two years, including two hours on the Code of Ethics and Standards of Professional Conduct.