With the increasing question regarding the longevity of inflation proof bonds or “iBonds” as a leader in the fixed income industry, building this reference point allows you to take this information and customize it for your unique circumstances. If one thing is for sure in this industry, it is that there are so many questions asked by clients without one, simple answer; instead, the answers often feature the phrase “it depends…”

The question above is no different:

Deciding to hold onto iBonds or not can be confusing considering the holding requirements and the changing interest rates, so below is an analysis on iBonds and an option for what to do with them moving forward:

iBond interest rates over the past couple of years: (Singletary, 2023)

- May 2021: 3.54%

- Nov 2021: 7.12%

- May 2022: 9.62%

- Nov 2022: 6.89%

- May 2023: 4.3% (fixed rate of 0.9% and adjusted annual rate of 3.38%)

Clearly, we see evidence of the extremely high interest rates cooling down, and, depending on when you first purchased the iBonds, it may make sense to sell them soon; however, before we address that topic, we need to understand the unique characteristics of iBonds.

Features of all iBonds:

- Must hold onto for 1 year.

- If sold within the first 5 years, the last 3 months of interest earned is lost.

- Provide inflation protection where combined rate increases when inflation increases.

- Ability to contribute interest earned towards higher education expenses tax free based on income.

In considering whether to cash in iBonds before the 5-year marker, some things to consider are whether the return is noticeably larger than the current iBond interest rate and the overall return considering the loss of the previous three months of interest if you do cash them in early.

We can help you analyze your outlook moving forward by looking at the current rates of the iBonds listed on treasury direct, and the time of purchase. While we know there is no penalty for selling iBonds after 5 years, it should be considered whether it makes sense to sell them sooner.

Here are a few examples of potential returns on iBonds based on when they were bought and sold according to Jeremy Keil.

- You likely bought iBonds either between November 2021 – April 2022 to get the initial 7.12% interest, or between May 2022 – October 2022 to get the highest ever 9.62% inflation rate.

- If you bought your iBonds between November 2021 – April 2022 you will likely hold for 21 months or more. At the 21-month mark your rate of return would be 6.72% over that time frame.

- If you bought your iBonds between May 2022 – October 2022 you will likely hold for 15 months or more. At the 15-month mark your rate of return would be 6.51% over that time frame.

With that being said, once the new rate comes out and you think “I want to cash out before 5 years”, part of the analysis is whether you want to hold onto the iBonds for an additional 3-months to keep the higher returns from the past rate.

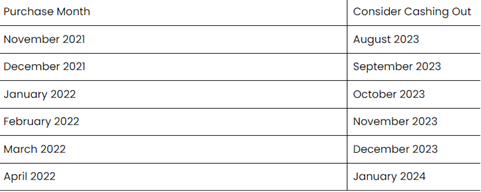

Here is a sample chart of when purchased vs. when we believe you should consider cashing out:

What’s great about iBonds is that you can see the renewal rate before it affects you and then determine both when you want to cash out, and where you will put your money next.

In summary, it seems the optimal approach may be to wait one quarter (3 months) beyond the point at which interest rates dip below the anticipated returns of your investment portfolio before deciding to sell or not.

Sterling Retzlaff

Summer Intern

7/24/23

Firm Disclosure: Alaska Wealth Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Alaska Wealth Advisors’ investment advisory services can be found in its Form ADV Part 2 and/or Form CRS, which is available upon request.

Commentary: The opinions expressed are those of Alaska Wealth Advisors. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed.

Recommendations/Holdings: This is not a recommendation to buy or sell a particular sector.

Sources: Material presented has been derived from sources considered to be reliable, but accuracy and completeness cannot be guaranteed. Singletary, Michelle. “https://www.washingtonpost.com/business/2023/05/03/may-ibond-rate-43/”. https://keilfp.com/blogpodcast/when-to-cash-out-i-bonds/.

Past performance: Past performance is not indicative of future results. There is no guarantee of any Alaska Wealth Advisors’ portfolio. All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met.