Together, We’ve Planned for This

Market Noise and Investor Behavior

APCM Views – Election 2020

A Case for Rational Optimism: A Parallel of Two Decades

Risk – Run From It or Work With It

Planning for the Unplanned

Your all-weather portfolio

Don’t Bring Me Down: Recession Risks in Brief

We can all agree that 2018 was not the market’s best year. With the S&P 500 down 4.4% and volatility levels near that of 2015, markets disconnected from strong underlying fundamentals such as better-than-expected corporate earnings growth and a positive 3% GDP. This disconnect created concerns that a recession may have been imminent. Although we […]

Can the “Fed” Do a Miracle?

What a difference a year makes. The Fed over the last 12 months has moved from a “hawkish” view point (US economy overheating, inflation moving up – so rate hikes are warranted) to a more “dovish” view (US economy slowing, inflation in check – so rate pauses or even declines are warranted). At the most […]

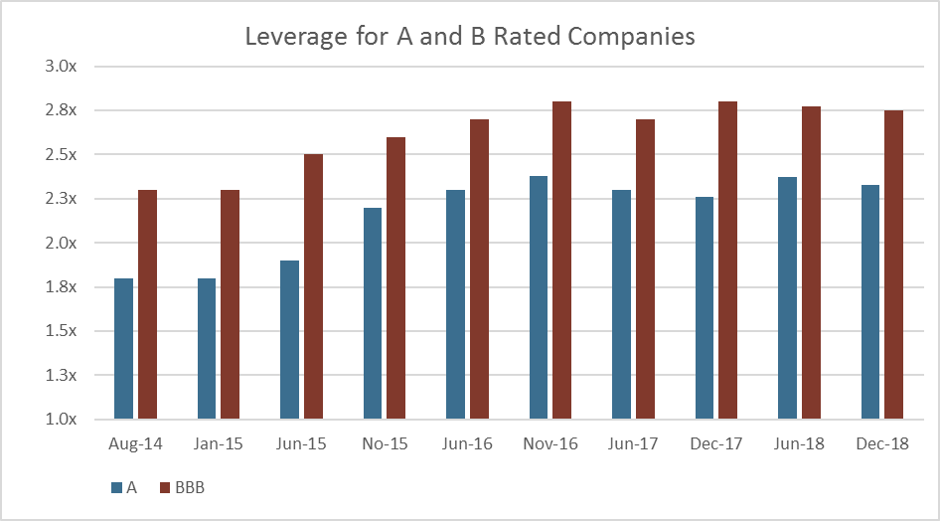

BBB Rated Debt and The Downgrade to High Yield

Credit cracks have started to develop, and the market took notice in October and November. Corporate bond returns were -1.46% and -0.17% for those respective periods. Negative performance was driven by credit downgrades, such as GE and Anheuser-Busch. We have taken stock of these movements and have had a cautious outlook to corporate bonds. A […]