Before account aggregation software, you were stuck tracking every purchase on your own. Now, there are awesome apps like Mint, You Need A Budget, Personal Capital, Tiller, and so many others that utilize account aggregation software to track what goes in and out of your accounts as it happens.

What’s even better, now these apps have improved their guessing game, usually placing your purchases in the correct categories, saving you the hassle. Yes, Safeway means groceries and not education expenses. Want to make custom categories and identify which purchases fall into that category? You can do that too.

So back to the question, how does this help? To build a budget you need to calculate your expenses, record your spending, and track your progress, all things technology will now do for you. You don’t need to fill your pockets with receipts, write down every purchase as you make it, or spend hours filling a spreadsheet with all your purchases from that month (unless you’re into that sort of thing). Month by month, the software will track your purchases and categorize them, while you sit back and watch how well you’re sticking to your plan.

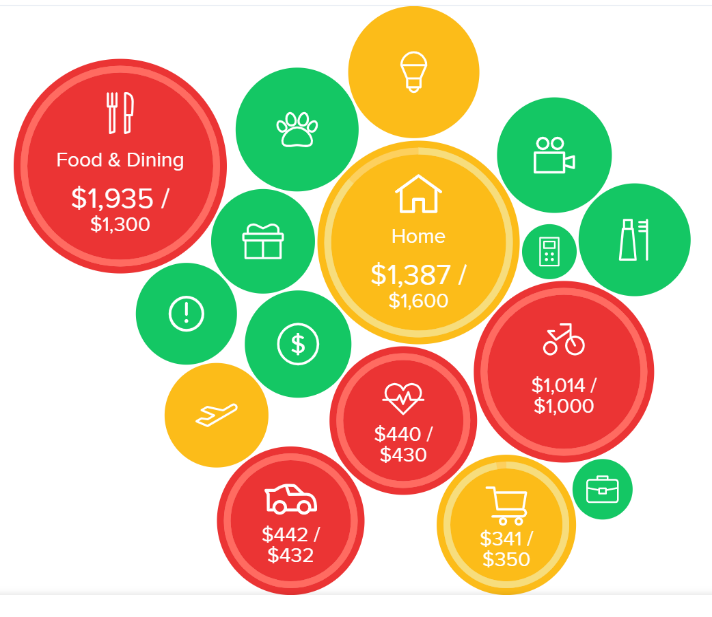

Take-a-look at how our professional budgeting software shows you how you’re doing.

If you gave up on using these apps, or you’ve never given them a chance, it is worth trying them in 2019. There are many apps out there, so be sure to look for the features that matter to you. If you’re worried about security, make sure the one you choose has duo authentication. If you’re worried about managing your bills, make sure to choose one with bill management. If you don’t want advertisements while you’re working on your budget, make sure to pick one with a fee. If you don’t care about ads, pick the free one.

Let technology help you make budgeting easy, and if you need some extra help, be sure to watch out for our next budgeting workshop. You can stay up to date on our events by following us on Facebook or connecting on LinkedIn.

Connor Michael

Associate Financial Advisor

1/23/19