If you are the kind of person who keeps up with headlines or the happenings of the finance industry, I’m certain you have heard of cryptocurrencies (known also as ‘crypto’) and their incredible volatility. The concept of these holdings is simple: a currency that is based entirely in the digital space. Beyond that, understanding cryptos can get muddled. While crypto is all the rage, it is important to bear in mind that it is still a developing future technology. This is not, however, discounting its future potential. I hope to bring some clarity to this subject by addressing key terminology, defining what crypto is, exploring the technology behind it, and explaining why it matters to you.

Key Terminology

When talking about crypto, some of the key terms for understanding include the following:

- Cryptocurrency – A digital currency that can be used to buy or sell goods and services.

- Blockchain – An advanced digital record-keeping technology.

- Fungible – Goods or assets that can be exchanged for other goods or assets of the same kind.

- Non-Fungible Token (NFT) – A unique digital identifier for an asset.

These terms get tossed around a lot in the finance world, and in related conversations or memes, and it is important to have an understanding of this jargon in your back pocket.

What is Cryptocurrency?

Currencies exist in many more spaces than just a country’s money supply. Businesses create their own currencies all the time, such as rewards programs in which you spend money to accrue points that, in turn, can be spent on other goods and services. Another example, one more prominently known, is the chips used by casinos for patrons to play each specific casino’s games.

Cryptocurrency is another kind of currency, one difference being that it occupies digital space rather than a tangible space like a bill or coin. Like other currencies, cryptos can be used to buy and sell goods or services online. The key point of cryptos is that they leverage a relatively new technology called ‘blockchain’ that secures the integrity of transactions. This is not to say that crypto is a viable currency since it is far from widely accepted, and its value is incredibly unstable. Imagine if your employer proposed that they begin paying your wages in a cryptocurrency, how would that make you feel?

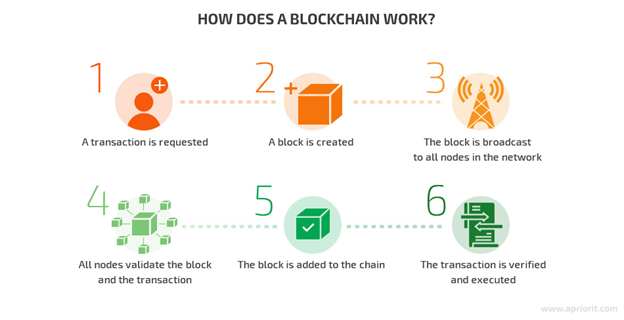

This visual illustrates a simplified version of how a transaction occurs in a blockchain.

Source: https://www.apriorit.com/dev-blog/638-blockchain-how-can-blockchain-secure-iot-networks

What is Blockchain Technology?

Blockchain technology may be able to provide quicker, safer, and more secure transactions in more industries outside the realm of crypto, but it could also revolutionize processes in the financial, real estate, and art industries. Each cryptocurrency has its own blockchain, and blockchains can be created by anyone who knows how to code or build one.

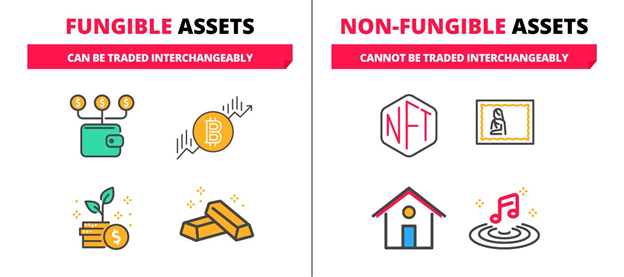

An important part of blockchains is non-fungible tokens. These are identification codes stored in a blockchain and are defined as objects that are entirely unique. An example of this would be if you assigned an NFT to your car. If you lent your car to your neighbor, they cannot return any car to you. They must return your specific car since any other car would either add or detract value from your original car. On the contrary, an example of a fungible token is if you gave your neighbor $10 USD, they could return any mix of $1, $5, or $10 bills to you as long as it still amounts to $10 USD.

This visual illustrates the difference between fungible and non-fungible assets.

Source: https://www.dbs.com.sg/personal/articles/nav/investing/nfts-explained

A case study of blockchain technology can be observed by way of Non-Fungible Tokens, colloquially referred to as NFTs. When purchasing physical art, there is typically an extensive and expensive appraisal and authentication process in which experts assess the piece and ensure that it is being bought or sold at an appropriate price while verifying that it is, in fact, an original work.

NFTs remove that need.

This is done by assigning a valuable art piece an NFT that is introduced to the digital space and having it become a part of a blockchain. Having the art in a blockchain allows for the original owner to be identified, traces all past owners, and removes all means to edit or adjust the art’s ownership history. NFTs currently reside on blockchains and allow for any asset to be “tokenized.”

Why Does This Matter to You?

Cryptocurrency and the application of blockchains is revolutionary technology that allows for the potential removal of a variety of industries if properly implemented and monitored. There would be no need for title insurance because the rightful owner of a property would be indisputably the person whose name is included at the top of the blockchain. Since the blockchain cannot be edited, there is no possible potential for mix-ups regarding the ownership of a thing—whether it be art, a house, or even a business.

This is just the tip of the iceberg in terms of cryptos and the code behind them. With these new technologies being explored every day, the impact of crypto and blockchain networks on financial institutions, the economy, and daily life is ineffable. That being said, there is no better time than the present to acquaint yourself with crypto and its many moving parts and to keep up with its continuing developments. AWMI aims to communicate financial news to clients in a way that is understandable and conducive to your goals.

Please note, we are not investing in or advising clients on cryptos. We do however encourage them to ask questions about how headlines and industry advancements may affect their portfolios.

Katelynn Toth

Intern

8/30/21