I have a riddle for you.

I am one of the largest purchases you may make. It’s likely that you’ll be purchasing me for someone else. Before you buy me, I want you to know that my final price is unknown, that my true intrinsic quality is unknowable, and if you want to know how great a job I’ll do for the person you’re giving me to? Well, good luck! What am I?

I want to you give you a minute to think about this one.

Really this space is just so that the answer won’t be right next to question.

Imagine the theme to Jeopardy is playing.

The answer to the riddle, of course, is post-secondary education. The amount that people spend for college, university, or trade-school has increased far more quickly over the last 30 years than the base rate of inflation. While the economic news of late has focused quite a bit of attention on year-over-year inflation and the potential for Russia to take a literal bite out of Ukraine, there’s a certain segment of us who, as our children are wrapping up applying for college, are thinking about inflation and the bite that paying for college is going to take out of our wallets.

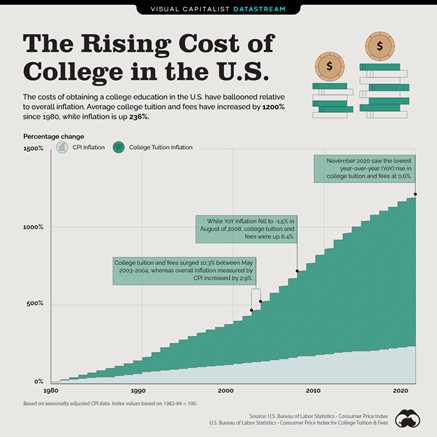

In my house, our eldest son has turned 18 and just finished his final college application. I was in the same position 30 years ago. In the end, I attended St. Lawrence University (SLU), a small private school, which at the time charged the princely sum of $22,500 for tuition, room, and board. Now, I attended SLU for substantially less than the price of in-state tuition in Vermont because of a combination of good grades, coming from very modest means, and SLU’s generosity. You need $45,806 in today’s dollars to have the same purchasing power as $22,500 had in 1992. The current CPI is 204 percent of what it was in 1992. Now, SLU’s full ticket price this past year was roughly $75,000 or 333 percent of what it was in 1992. In short, the gross price to attend SLU increased 50 percent faster than base inflation rate. It turns out that SLU has done a good job, by higher education standards, of managing gross price inflation. On average and since 1980, the cost of college has gone up 1,200 percent and the CPI is up nearly 240 percent (see below). For most institutions the cost of college has increased more than twice the rate of inflation.

There are two thing I want to point out to you. The first is that you may have noticed that for much the paragraph above I distinguish between “price” and “cost”. The second is that in the figure above the curve showing college price inflation noticeably steepens after the early 2000s. Here’s why those things matter:

- Over the last 25 years lawmakers have taken several steps to increase the amount of credit available to parents for paying for college. So, instead of focusing on making college less expensive or more efficient we increased people’s ability to borrow. The higher-education sector did what any self-respecting institution would do when their clients have a greater ability to pay- they raised prices. The net effect is that increasing access to credit both increased the ability to attend institutions but also expanded pricing power and drove up prices.

- Higher education institutions, both for-profit and non-profit, figured out that even with the internet, parents and students are terrible (in aggregate) at shopping for higher education services. There’s a lot of emotion and uncertainty in college shopping and it’s really difficult to know exactly what you’re buying. The net effect, and you’ve likely noticed this if you’ve been in the college market, is that colleges, excepting in-state tuition rates, all price their products about the same regardless of perceived quality. The idea is that they’ll charge top price to people who REALLY want to be at that school, can afford it, and/or aren’t very savvy, they’ll offer a discount to customers they want (good students, students who round out geographic and cultural diversity, etc.), and they’ll can take a portion of the excess money they generate from the first group to offer deep discounts to a certain number of students who couldn’t afford the institution otherwise. If this sounds a bit like what airlines have done you should know that higher education institutions, particularly selective institutions, practice the same yield management techniques.

There’s so much to this topic that one could write a book about it. In fact, someone did write a book about it and the name of the book is The Price You Pay for College by Ron Lieber. I highly recommend it if you have a child approaching college or you like books about economic markets. The other thing that I recommend is to be that savvy shopper and here are two tools to help you:

- You need to know where you and your student sits in the college market and what the net return from an institution or a degree is likely to be. If you’re a high-income earner and your student is competing at a school with a sub-10 percent acceptance rate, don’t expect much of a discount. That school has lots of willing buyers and will price accordingly. However, if you’ve got that same student and they’ve got good grades, etc., you can shop the second tier and they’ll tell you how much of a discount you get. Those discounts go under the code “net cost calculator” and most colleges have them hidden on their websites. You can find out before hand who is most likely to offer your kid a price discount (or not).

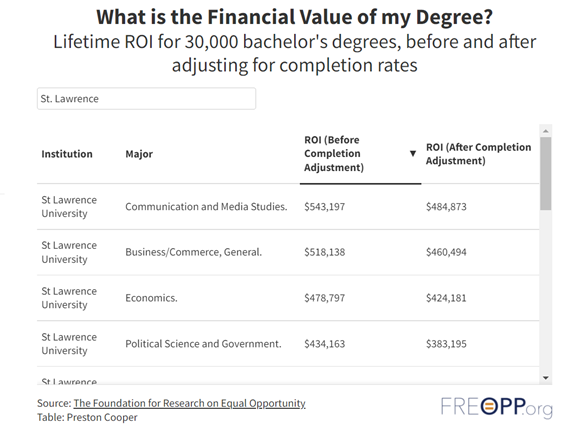

- You and your student should do the research on the expected return on investment (ROI) from your school and specific degrees. A median bachelor’s has an ROI of $306,000, but a shocking 28 percent of degrees have negative ROIs including some degrees at that fancy high price institution your child may have always wanted to attend. Fortunately for us, a smart person has put the time into generating ROIs for nearly every school in the US. You can find that calculator here about 80 percent of the way down in this article. Below are the top ROI degrees from SLU as an example. I’ve run out of space for this blog, but I can confirm from personal experience that SLU’s economic degree pays off.

Jonathan’s Takeaway: Post-secondary training, whether college or trade school, is a major component in earning more in your career (saying nothing of the benefits that come from broader critical thinking skills). Getting that training while being a savvy shopper only increases your chances of financial and career success.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 24 years of social science consulting experience, including 18 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.

2/22/22