A number of months ago I wrote about the work of economist Raj Chetty and his peers at Harvard with the Opportunity Insights project. Their non-partisan non-profit tracks changes in the ability of children to achieve the American Dream as defined by the aspirations that all children have a chance at economic success regardless of background and that each generation of Americans will be better off than the generation before it. Mr. Chetty and his peers have become very adept at merging disparate, big datasets to create insights into the American economy. Well, they’re back in action with insights into how the COVID pandemic is affecting the economy including insights into the Alaska economy and how Alaskans are minding their pocketbooks. Everything that I’m about to show you can be found at https://tracktherecovery.org/.

Consumer spending drives the US economy. As Alaska’s economy matured over the decades spending by consumers has played an increasing role in driving Alaska’s local economies. Let’s take our first look at what’s happened to all consumer spending with the global pandemic. The figure below shows total spending by all consumers in Alaska as tracked by the team at Opportunity Insights. We were doing well between January 15th and March 16th when public schools closed. Spending pitched off a cliff at this time and hit a bottom on April 8th, 2020 when consumer spending was down 34.9 percent from January levels. As of August 2nd, we’ve clawed back much of the losses, but we’re still down 6.9 percent from January spending. I’ve often referred to this event as creating a “long winter” and I feel like these numbers reinforce that concept. Consumer spending in our economy is below even that of January levels which means we’re missing out on the usual surge in summer spending by tourists and locals alike. The summer surge is often the key to keeping retail businesses in business through the winter.

Figure 1. All Consumer Spending, Alaska 2020

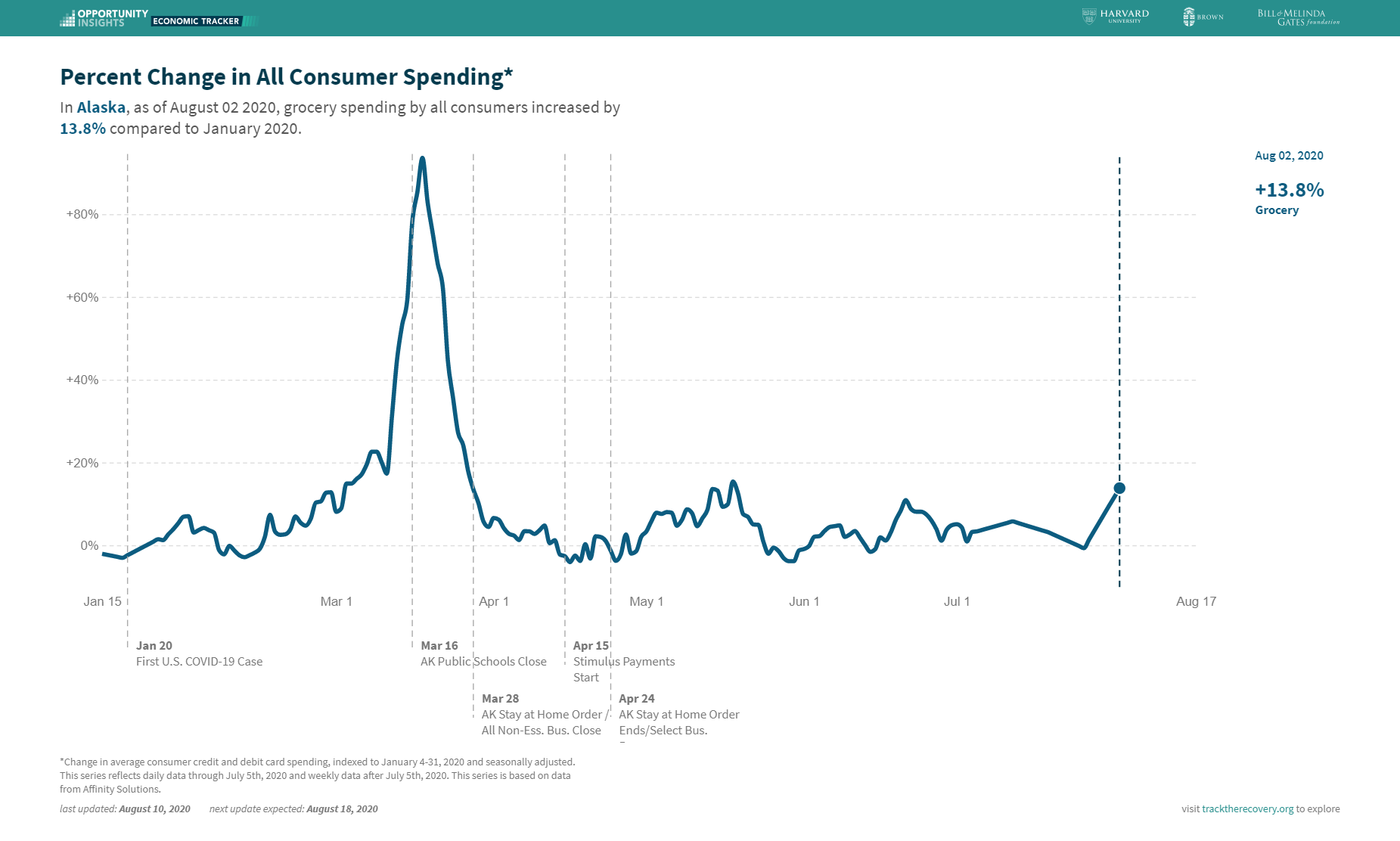

As in all things economic, the damage is not equally spread. First, let’s start with who is doing “okay”. Consumer spending in the grocery sector is currently 13.8 percent above January levels. More interesting though is the massive spike where spending into the sector doubled as everyone realized they might be in their homes for a while. That’s what those empty shelves in March and April look like in graph form.

Figure 2. Grocery Sector Spending, Alaska 2020

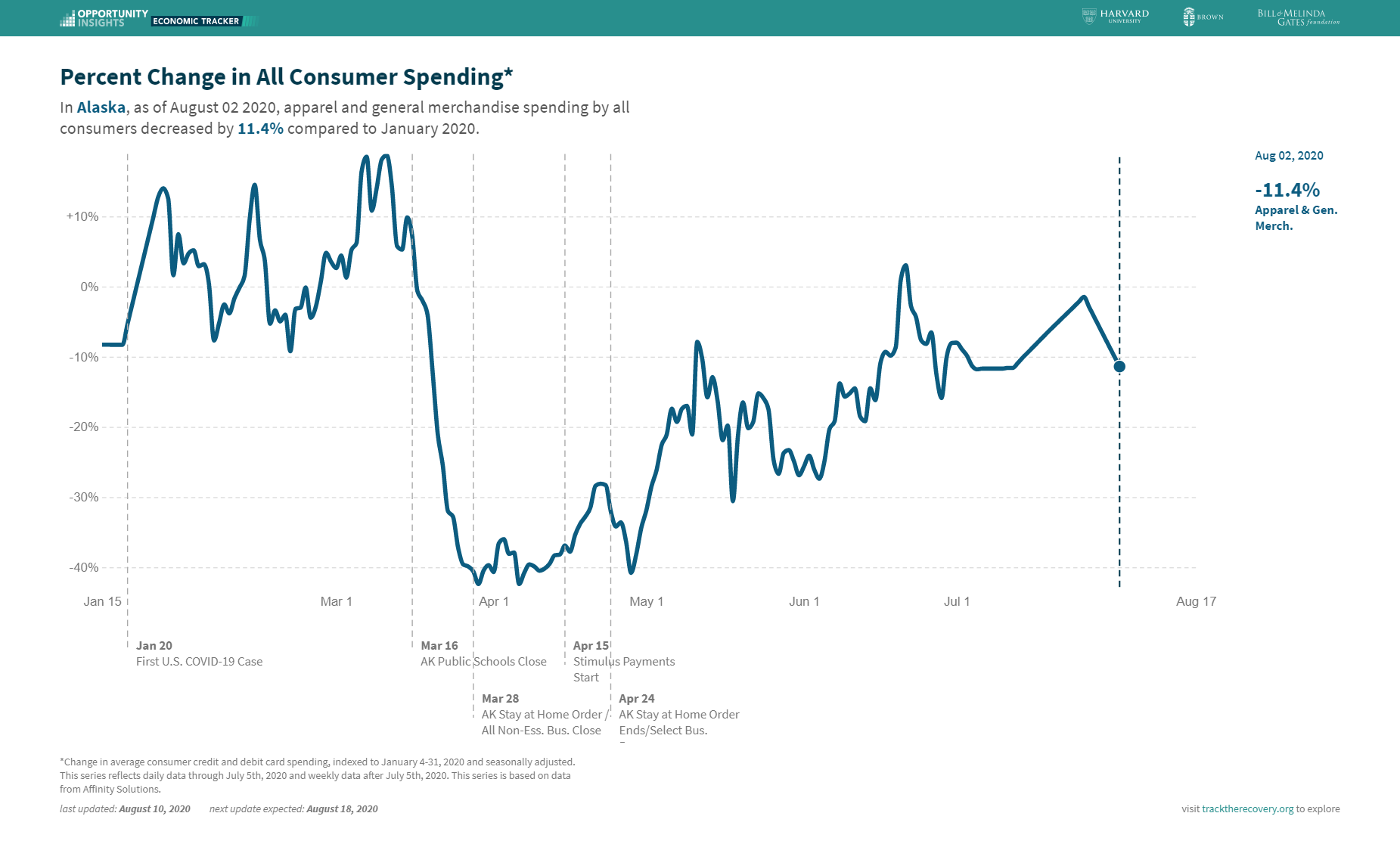

Next up is apparel and general merchandise. Here we swing from a sector that’s doing relatively okay to sectors that are struggling. Consumer spending in this sector is down 11.4 percent compared to early January numbers, but well off the bottoms of 40 percent reductions seen between April and May.

Figure 3. Apparel and General Merchandise Sector Spending, Alaska 2020

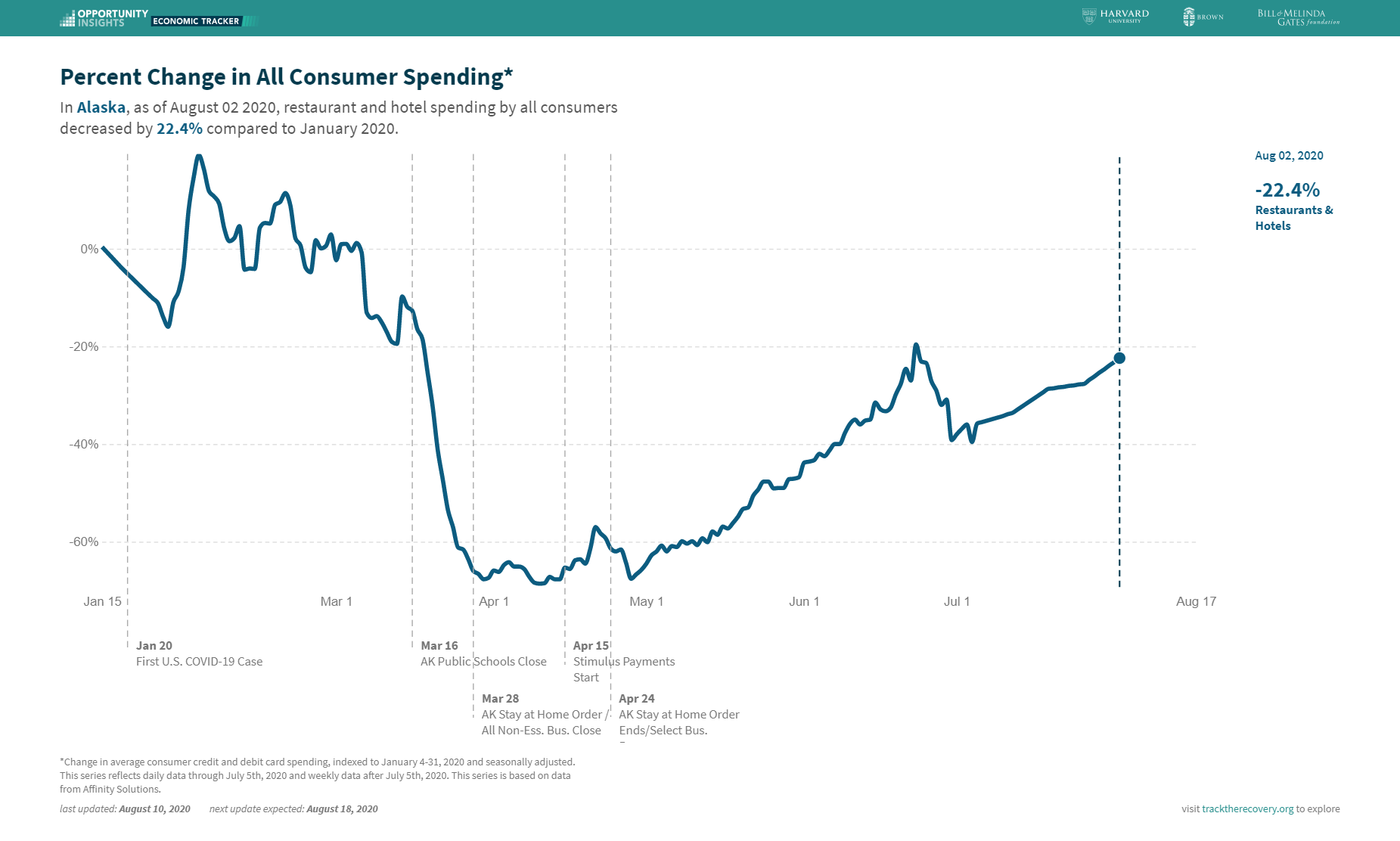

A bit further down the list is a sector that’s been in the news a lot recently – restaurants and hotels. Consumer spending in this sector is down nearly one-quarter from January levels. We know that many restaurants barely make ends meet during January and some even close for the month because business is so poor. Right now, that sector is trying to survive on one-quarter less than January conditions. It’s just a terrifying turn of events.

Figure 4. Restaurant and Hotel Sector Spending, Alaska 2020

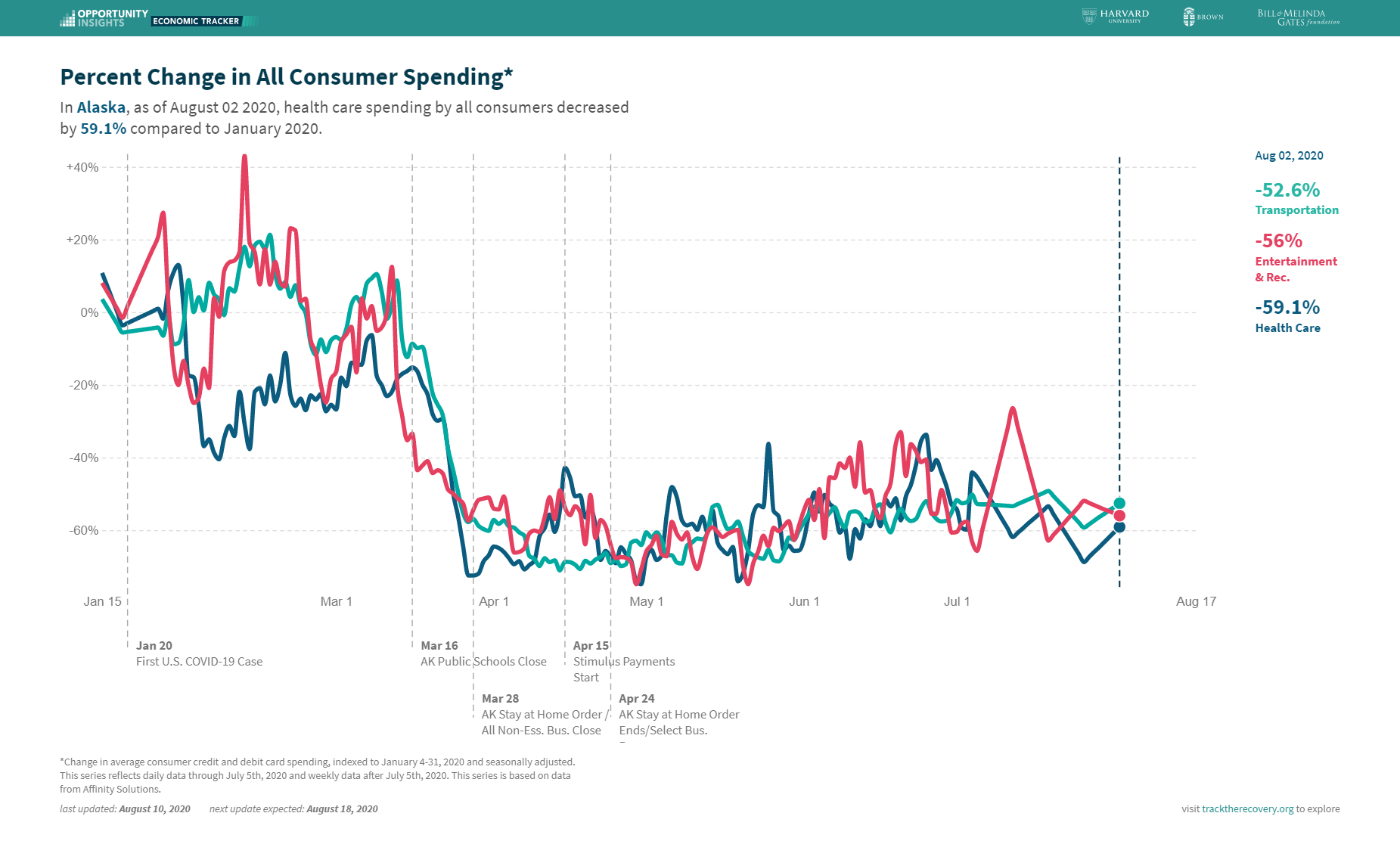

When I started considering this data for a blog post I presumed that restaurant spending would be down the most or at least close to the bottom. There are three sectors where consumer spending is down more than twice as much, on relative percentage terms, than the restaurant and hotel group. These are transportation, entertainment and recreation, and health care. Each of these sectors is down between 50 and 60 percent from January levels and haven’t shown any significant signs of recovery. Transportation and Entertainment are not very surprising if you think about it: Who’s buying plane tickets these days? Health care is a bit more surprising. Who would think that health care spending would decrease in a pandemic? Well it turns out that many of us are avoiding going to our primary care providers, our dentists, our optometrists, and are delaying elective procedures. This impacts the plurality of care providers who have no direct role in fighting the pandemic. My gut says that we see these sectors spring back when there is an announcement of a vaccine and a plan to distribute it. Until then, it’s going to be very thin in these markets and that’s going to hold back any significant economic recovery.

Figure 5. Transportation, Entertainment, and Health Care Sector Spending, Alaska 2020

The Good News Section

Every month brings some good news in the fight against COVID19 and towards building an economic recovery:

- The FDA has cleared the way for a saliva-based home test for COVID which was developed by Yale University and the NBA Players Association. This type of test is used widely in other countries. Asymptomatic spread is a major issue with COVID, and this test will help fight that spread.

- Scientists are seeing signs of durable immunity from even mild COVID infections and there is some discussion that prior exposure to other coronaviruses could be helping create early herd immunity in some locations that have been heavy hit by the virus.

- There are now 8 vaccines is Phase 3 trials. Expect early results in late October or November.

Jonathan’s Takeaway: Our economic recovery depends not just on oil and government spending but the willingness and ability of the consumer to spend money. We’re still a ways off from a real recovery and this fall will be rough, but keep an eye out for green shoots as the good news starts to pile on in the coming months. It will take years to recover from this event, but that recovery will come.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 23 years of social science consulting experience including 16 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.

08/17/2020