Alaska’s economic train is getting ready to leave the station after a brutal 14 months. Now, I happen to really enjoy train travel. My first trip by train was in 1989 in the former Soviet Union when as a high school student my cultural exchange group traveled the overnight train from then Leningrad to Petrozavodsk. The train wasn’t fast, but it was very classy right down to the hand carved wood paneling in the four-person sleepers and the freshly brewed tea served by the carriage attendant. I’ve also had the chance to do long-distance train travel in Kenya and city-to-city train travel in Europe. I’ve loved it all from workhouse short-haul trains to the longer-haul experiences. Train journeys all seem to start the same way- with a bit of a clunk and lurch. You can hear and feel each car engaging with the pull of the engine. It makes sense that the start of train journey is a bit bumpy. Trains are big, inertia is a powerful force, and starting one is a little more complicated than pulling a Prius gently out of a parking spot.

Economies share a lot with trains- lots of mass, lots of inertia, more complicated than pulling a Prius into traffic. As we’re learning right now, it’s a lot easier to shutdown an economy than it is to start one back up. Take the current “sturm und drang” over the service sector’s attempt to fill jobs. Job postings are up 68 percent over January 2020 (per-COVID) levels and that’s largely because the service sector and the tourism sector are all trying to fill positions that were eliminated during the pandemic all at once (see Figure 1).

Figure 1. Estimated Change in Job Postings, Alaska

Now, from the right side of political spectrum you’re hearing a lot of argument that people are staying home because of pandemic unemployment support while on the left side of the political spectrum you’re hearing arguments that businesses should pay more. My take is that there’s been a near 100 percentage point shift (from -30 percent below January 2020 level to +68 percent above January 2020) in job postings over five months (January to May) and any time you have a shift that big in short amount of time there’s going to be a bit of a jolt. What’s going on in the service sector is complicated. Yes, we have expanded unemployment payments, but we also have:

- a smaller workforce than two years ago from retirements;

- competition for a limited pool of job seekers;

- exhaustion from the Pandemic;

- unsettled systems in education, childcare, and elder care.

It’s the last point in the list above that is really getting missed in the conversation. Women are not returning to the labor force at the same rate as men and that’s not because of increased unemployment payments. It’s in part because of a lack of (affordable) childcare options. Women make up a disproportionate percentage of the service sector economy especially the leisure and hospitality sectors. If they can’t find someone to watch their children or if they don’t have stable school schedules they’re less likely to come back to the workforce. It’s going to take some time to get these systems up and running and I don’t expect labor markets in this sector to start normalizing until the September when more traditional school schedules are in place and childcare options have increased.

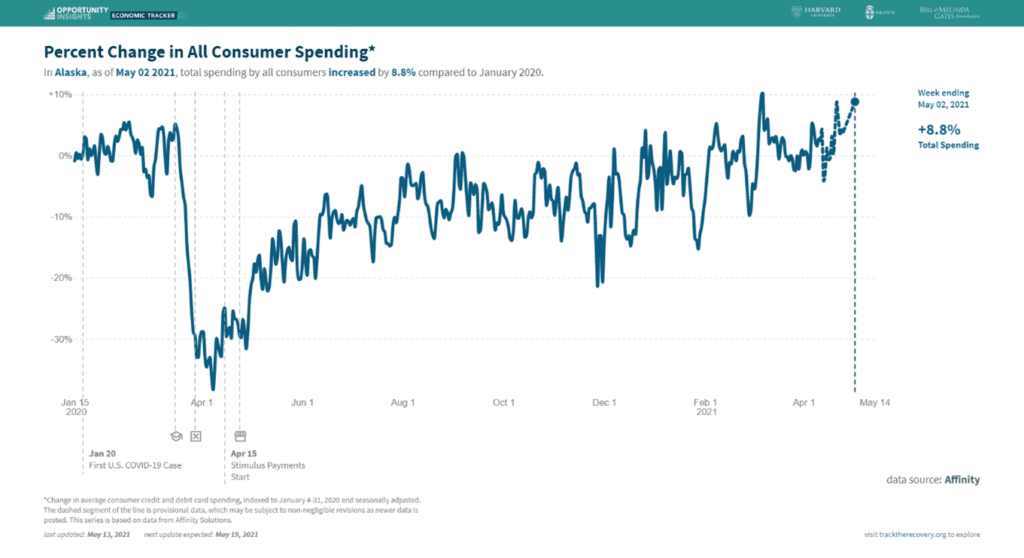

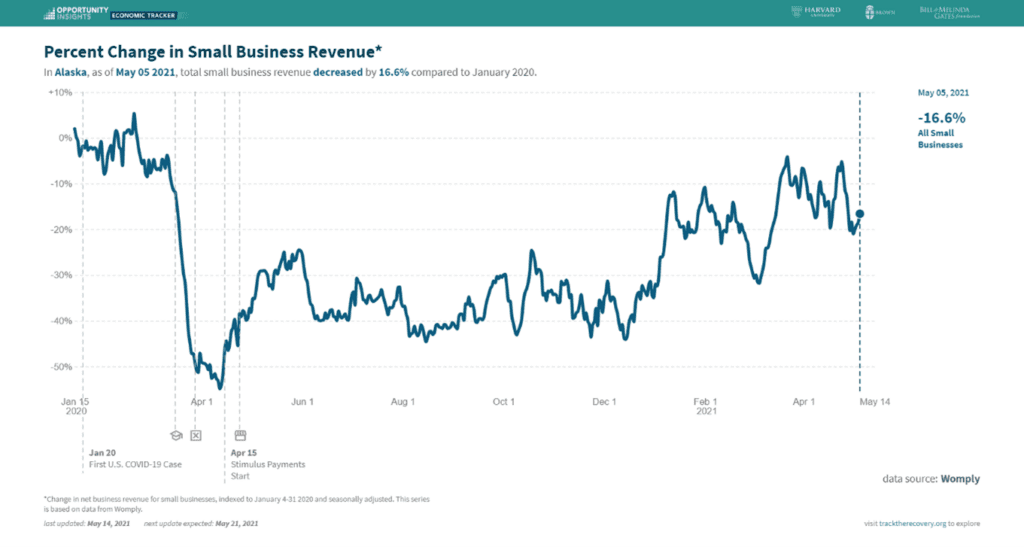

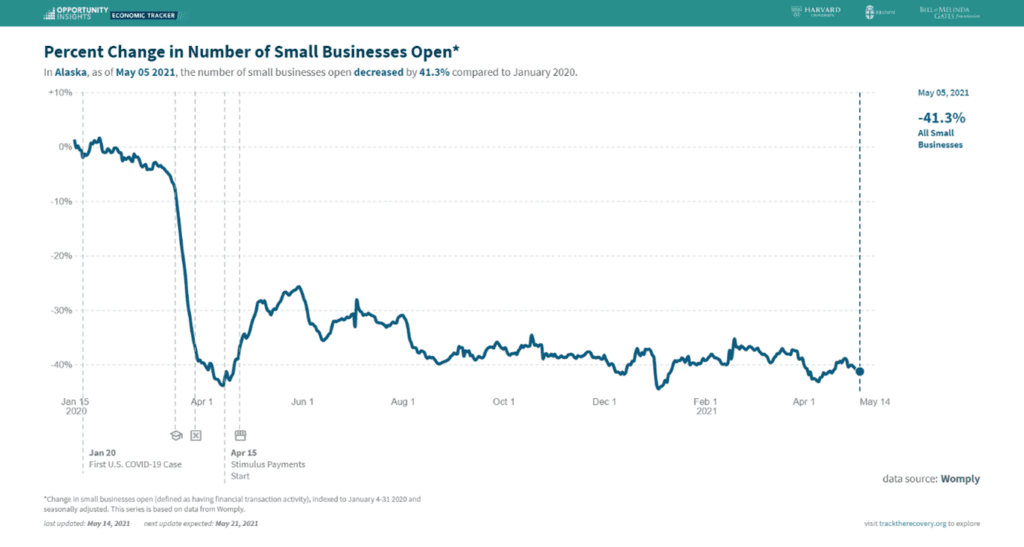

There are three additional data points that I want to touch as we look for the first signs of healing in Alaska’s economy: consumer spending (see Figure 2), small business revenue (see Figure 3), and small business openings (see Figure 4). The data from TracktheRecovery.org show that:

- Consumer spending in Alaska is up 8.8 percent over January 2020 levels with the shift into positive territory coming over just the last month or two as people have felt safer moving around. The acceleration towards and through zero started in late January as vaccinations started to become available for certain groups and it became clear that vaccine doses would be available for most Americans in a couple of months.

Figure 2. Estimated Change in Consumer Spending, Alaska

- Small business revenues are still down compared to January 2020. This deficit reflects the fact that consumer spending shifted towards online sales with big online retailers reporting record earnings in the past quarter; Amazon’s sales alone were up 44 percent year-over-year. Unfortunately, while retailers like Amazon are extremely convenient, especially when you’re trying not to leave your house, every dollar spent there is a dollar that adds zero to Alaska’s economy (unless you’re buying from an Alaska business who sells on Amazon). It looks like we have several months to go before small business revenues reach January 2020. Of course, with Alaska’s seasonal economy the time is short to make money before winter closes in again.

Figure 3. Estimated Change in Small Business Revenues, Alaska

- There is not yet an emerging recovery in the number of small businesses that are open; we’re basically in the same place we’ve been since the effects of the pandemic became clear. So, while many small businesses that are open are in a hiring mode, there are far fewer open than there were in January 2020. The rub of an event like the pandemic is that the strong survived and get to benefit from less competition as the recovery kicks into gear. For consumers there are fewer options to choose from, but the remaining businesses are bigger, stronger, and better than they were before the pandemic. I expect small business formation to pick up as the economy recovers. As brutal as it is for those businesses that closed and their owners, employees, and staff, this process is how the creative destruction of capitalism works. We will recover and find new opportunities, but it will take time.

Figure 4. Estimated Change in Small Businesses Open, Alaska

Jonathan’s Takeaway: The green shoots of recovery are appearing just as spring gets into full swing. We should be excited for the prospect, but patient with struggles of an economy that is trying to find a rhythm. There’s been too much disruption over the past 15 months to expect the Lego pieces to go back together exactly as they did before. We should also be aware that the peoples’ and business’ behaviors will often be driven by factors far more complex than the conventional “hot take”.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 24 years of social science consulting experience, including 17 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.