As you read this post the State of Alaska’s 31st legislature will have gaveled into session. The budget situations the legislature faces is not all that different from years past. State general fund revenues have recovered somewhat off their lows of less than $1 billion (B) a year and are now projected to $2.38B for FY 2019 and $2.77B for FY 2020. The rub of course is that $2.X billion in general fund revenue isn’t going to cover a $4.X billion dollar operating and capital budget. Since FY 2015 the state’s Constitution Budget Reserve (CBR) has helped us fill the gap between revenues and expenses. The value of the fund has dropped from $10.1B to $2.4B. The fund can no longer afford the multi-billion dollar withdrawals that incurred between FY 2015 and FY 2018. In fact, the fund is so low that further large-scale withdrawals will affect the state’s ability to pay its bills in a timely manner. The CBR acts as the state’s reserve checking account. Revenue to the state is “lumpy”, but expenses are more consistent throughout the year. The state pulls cash from the CBR when it needs liquidity and replaces it when revenues arrive. The legislature limited the FY 2019 draw on the CBR by instituting the Percent of Market Value (POMV) system for managing the Permanent Fund Earnings Reserve. POMV is essentially a retirement accounting approach to managing the earnings reserve; draws from the reserve are limited to maintain the health of the fund and those draws are split between any operating revenue shortfall and the Permanent Fund Dividend. With this approach Alaskans received a $1,600 dividend in October 2018 and the legislature closed the budget gap to $0.67B or 75% less than the FY 2018 gap. Even this smaller gap is unsustainable; the Legislative Finance Division warned early in August that despite progress the budget picture needs to change in the next 2-3 years or the CBR will be expended.

Table 1. FY 2018-FY 2020 Unrestricted General Fund Budgets, Enacted and Proposed

| Budget Item | FY 2018 Enacted | FY 2019 Enacted | FY 2020 Proposed |

| Unrestricted General Fund Budget | 5.25 | 5.76 | 7.10 |

| Operating Budget | 4.33 | 4.55 | 4.86 |

| Capital Budget | 0.15 | 0.19 | 0.25 |

| PF Dividend | 0.76 | 1.02 | 1.99 |

| UGF and PF Transfer Revenues | 3.10 | 5.10 | 5.49 |

| Unrestricted General Fund (UGF) | 2.34 | 2.38 | 2.77 |

| PF Transfer for Operations | 0.00 | 1.70 | 0.73 |

| PF Transfer For PFD | 0.76 | 1.02 | 1.99 |

| Deficit | -2.15 | -0.67 | -1.61 |

Source: https://www.omb.alaska.gov/

If that issue isn’t challenging enough, the big gap is back this year-at least on paper. Alaska’s Governors are required to submit the next fiscal year’s budget to the legislature by December 15th of each year and they can submit revisions to that budget until mid-February. While the administration submits a proposed budget, it’s the legislature that controls the purse strings and they can build the budget as they see fit. The Governor, however, has the power to veto the budget, line item veto certain elements, and/or call the legislature back into session. As in all election years, the new administration had scant time between being sworn into office and the December 15th budget submission deadline. In FY 2020, unrestricted revenues are expected to increase $0.40B while UGF capital and operating expenditures would increase $0.37B. However, the big change is in the line item set aside for the Permanent Fund Dividend which increases from $1.02B to $1.99B. The net result is an increase in the deficit from $0.67B to $1.61B. It’s worth noting here that because oil prices were higher than expected earlier this year it looks like that state’s actual deficit will be much less than $0.67B for FY 2019. Of course, prices have collapsed by $20 a barrel in the last couple of months basically putting us back to where we started last fiscal year.

So, the writing is on the wall here. If we’re going to fund a statutory dividend check and keep withdrawals from the PF Earnings Reserve at healthy amounts, then we must reduce the amount of reserve funds flowing to the operating budget which means raising revenues, drawing from the CBR, or reducing operating expenditures. The first is likely off the table for political reasons, the second is likely at some level given our past history (but we don’t have the capacity to draw as much as we did previously), and the third is very likely given the new Governor’s campaign. So, let’s presume for the sake of discussion that the legislature agrees to the statutory PFD amount (i.e., what’s in the proposed budget) as opposed to the POMV amount (i.e., last year’s PFD check), they’re willing to draw another $0.6B from the CBR (thus reducing the CBR to below $2B and threatening the state’s liquidity), and that the Capital budget is sacrosanct (it’s basically to the bone already). Under those conditions, we still have a $1B deficit gap that must be reconciled by cuts. So, where do you get the cuts?

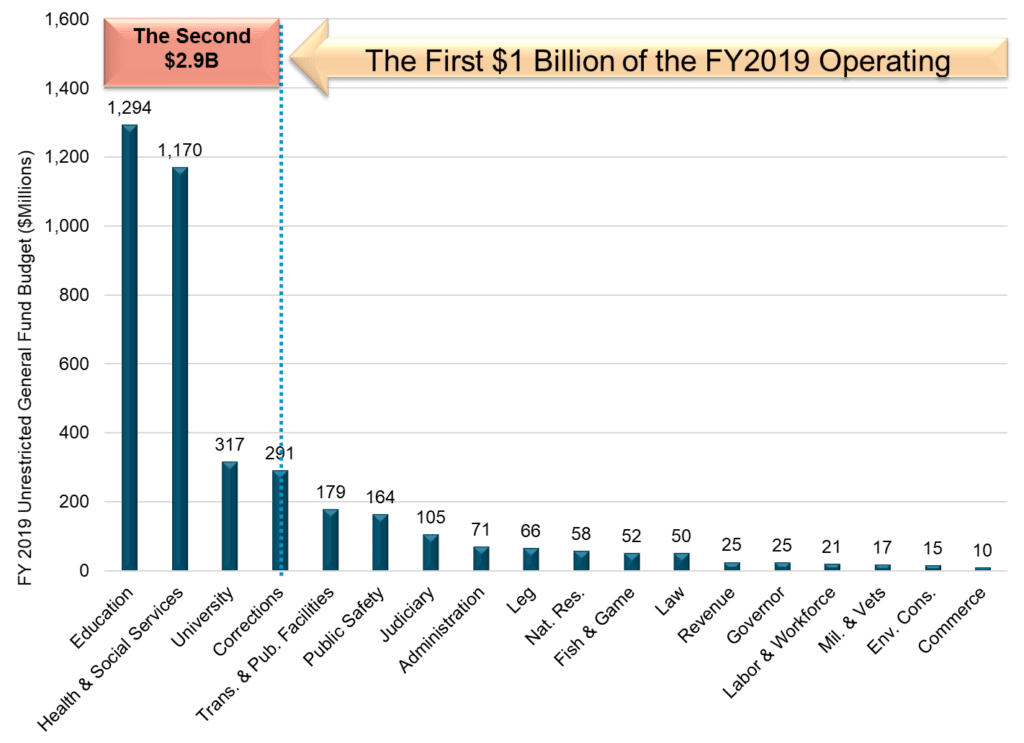

It turns out there are very few places to get that kind of cash out of the budget. Please allow me to introduce you to “Swoop” figure. Last year as Senate Finance Aide we had to build one budget binder per staffer and legislator assigned to any department finance sub-committee. The Swoop’s purpose is to remind staffers and legislators where each department sits in the grand scheme of the budget. The takeaway-We can fund every department in the Alaska state government excepting Health & Social Services, Education and Early Development, the University System, and about half of Corrections on $1B. We will not make much headway towards saving $1B from any of these agencies; the vast majority of $1B in cuts must come from the left-hand side of the figure.

Substantial structural reductions in Alaska’s UGF budget require tackling the DEED and HSS budgets. Everything else, frankly, is a side show with respect to reducing the budget by anything close to $1B. If those budgets are tackled it’s relatively easy to predict which sectors of the economy will get hit first before the effect of the cuts ripple to secondary sectors such as retail, hospitality, and real estate. However, let’s not get ahead of ourselves. It’s Day 2 of the legislative session and the game has hardly begun.

Jonathan’s Takeaway: Where the FY 2020 budget ends up depends on the answers to a couple of key questions:

- What is the appetite of the legislature to increase the PFD for October 2019? An increased PFD is the largest driver of the larger “on paper” FY 2020 deficit.

- How much is the legislature willing to take from remainder of the CBR? The legislature has been warned that the CBR has shrunk to the point where it could affect the State’s cash liquidity.

- What is the appetite for cutting K-12 education and Medicaid? When people talk about cutting DEED and HSS, K-12 funding and the Medicaid program are what they really mean.

The answers to these three questions will play a significant role in the late 2019/early 2020 economy.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 21 years of social science consulting experience including 15 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.

1/16/19