The world usually changes slowly and then there are moments when it changes in what seems like an instant. In the first seven trading days of 2020, the price per barrel of Alaska North Slope (ANS) crude averaged $68.86; a price which, if sustained over a year, would generate between $2.2 billion and $2.4 billion in revenue for Alaska. In the last seven trading days, ANS crude averaged just $14.13 per barrel; a stunning 80 percent decline in the per barrel price in just four months. This price is up 40% from the average ANS price of last week, but even at this level ANS crude has almost no economic value at the wellhead after accounting for the transportation costs of moving the product to market. Alaska’s expected revenues have taken a sizeable hit has well with unrestricted oil production revenues expected to contribute just $716.6 million to Alaska’s coffer in Fiscal Year 2021. This revenue projection presumes a further price recovery. Without new revenues, an elimination of the Permanent Fund Dividend, or significant budget cuts, the Constitutional Budget Reserve will soon contain just $500 million. A decline of 95 percent from the FY 2015 high of over $10 billion.

This moment of crisis in the oil markets is one that is almost certain to define Alaska at least over the next half-decade and possibly over the next several decades if we think about our long-term state revenue and spending picture. Full exploration of this topic would take more than 1,200 words, so let me hit the high points.

Warning to the Reader: There is some humor injected below because frankly that’s one of the ways that I deal with stress and this situation is admittedly stressful.

The World is Awash in Oil

In modern times the world can almost always produce more oil than it can consume. This fact is one reason why the Organization of Petroleum Exporting Countries (OPEC) formed in 1960; to ensure that world supply didn’t outstrip demand and to maximize long-term revenue for producers. In recent years, Russia frequently joined OPEC in a relationship called OPEC+. OPEC’s internal relationship has always been fractious, and the addition of Russia has only made the relationship more complicated. In early 2020, recognizing that world oil demand was softening, there was an exchange between the countries that basically went like this:

Kingdom of Saudi Arabia (KSA): Dear Russia and OPEC, we should reduce oil production to support the current price.

Russia: Dear KSA, we don’t really think that strategy works for us any longer. We’re better off pumping more oil.

Kingdom of Saudi Arabia: Ooh, really? You think more oil works for you? We’ll here’s more oil for ya’.

The KSA called Russia’s bluff and returned production to pre-OPEC+ deal levels and added an additional 2 million barrels per day at discount prices to boot. The move immediately shaved 30 percent off the value of a barrel of oil. You can read more about how this series of events went down in this article and here.

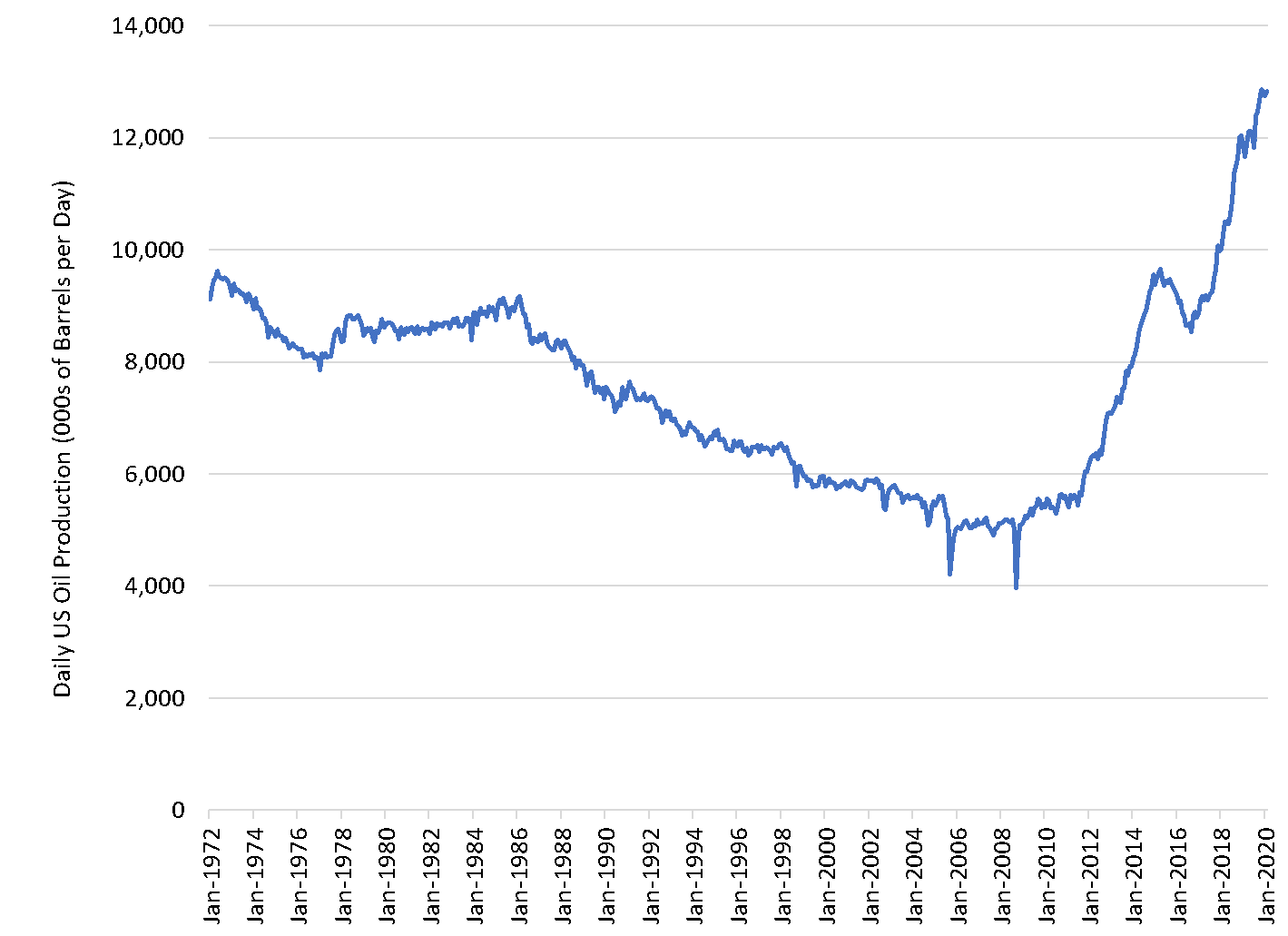

Now underpinning the angst between the state-run oil producers is the rise in US oil production. In early 2020 US oil production hit an all-time high of 12.8 million barrels per day. In the last decade total US daily production has more than doubled adding 6+ million barrels per day to the oil market (see Figure 1). A supply/demand imbalance of around 2 million barrels per day caused the 2014 oil price collapse so you can see what a headache increasing US production is for OPEC+. US production is not controlled by a single national oil producer which makes it a wild card in the market. Over the past decade cheap money and improvements in technology have increased US production and made life harder for OPEC+. Both the KSA and Russia would benefit from lower US oil production because markets would be easier to influence.

Figure 1. US Oil Production, Daily Average in Thousands of Barrels

Source: http://tonto.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRFPUS2&f=M

Demand is in the Dumps

Are you still with me? Good, because here’s where the story really starts cooking. At the same time as US production hits a record high and the KSA and Russia start an oil price war, COVID-19 enters the picture and says “Amateurs! Hold my beer…” The International Energy Agency estimates that the economic effects of COVID-19 will, temporarily, wipe 29 million barrels a day (30%) of demand from the market and reduce demand to 1995 levels.

If you take away just one thing about the oil markets from this post take let it be this statement: The 2014 price decline from near $100 a barrel to $27 a barrel was caused by a market oversupply of 2 million barrels per day. The current market dislocation is nearly 30 million barrels per day. The dislocation in the market is so severe that pipeline companies that ship oil are asking permission to store oil in their pipes.

Implications for Alaska

World oil markets will heal, but that’s going to take time. The 30 million barrel a day overhang will be worked off by a combination of reduced production and (eventually) a return of demand. During the process of healing, Alaska is going to feel economic pain just as it did from the 1986 and 2014 oil downturns. How long will depend, in part, on how long oil prices remain depressed. The industry needs at least $45 a barrel to fully cover costs and $65 is much healthier. At the same time, we will be dealing with the economic damage and reshaping associated with the COVID-19 pandemic. I don’t know exactly what’s going to happen, but here are data points that I’m factoring into my thinking:

- Since the opening of the Trans-Alaska Pipeline System, negative oil price shocks have resulted in recessions in Alaska. The last one in 2014/2015 saw employment in the oil sector fall ~40%, triggered a 3-year recession costing roughly 15,000 jobs, and resulted in a significant reduction in the size of state government expenditures. Without evidence to the contrary, and based on history, we should expect another multi-year recession. Here again, the length of the oil price dip matters and will be a key factor in how this shock affects Alaska.

- Unlike in 2015 when the recession started in the oil sector and then spread to other sectors, there’s a concurrent COVID-caused employment loss that has resulted in more than 70,000 Alaskans applying for unemployment benefits in the last two months. Sectors like tourism, which was largely untouched by the last Alaska recession, are getting crushed by COVID. The best-case scenario for this sector is an 18-month “long winter” that ends next spring. We should also expect retail and hospitality (restaurants) to remain significantly depressed and for business closures to start adding up.

- This recession will restructure how we finance state government in Alaska. Our strategy from 2015-2018 might be described as “cut spending, start using permanent fund resources, cushion with savings, and pray for an oil price rebound.” Our non-Permanent Fund savings are now effectively depleted; a situation which will force our collective hand without a massive rebound in oil prices. Our choices include a combination of raising taxes, eliminating the Permanent Fund Dividend, and massively restructure state government to eliminate core state services Alaskans have enjoyed for 40+ years.

There is always opportunity in crisis. Opportunity doesn’t mean fun and it doesn’t mean easy; what it means is a set of circumstances that make it possible to do something which previously was not possible. It’s up to Alaskans to identify the opportunity and make it reality. As Andy Durfrense, once said “It comes down to a simple choice. Get busy living or get busy dying.” Personally, I’m always for the former option, but it takes courage and bravery when times look so tough.

Jonathan’s Takeaway: We’ll still be here when the page turns on this Alaska’s history. The question is really whether we have the gumption and willingness to work together to make lemonade from the lemons.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 23 years of social science consulting experience including 16 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.

05/08/20