There are two economic trends right now which are getting rather long in the tooth (a phrase by the way which comes from the fact that horses’ teeth grow throughout their lives and were considered a reliable measure of judging age). The first trend is the U.S. economic expansion which is now over a decade old having started in 2009. The second is the Alaska’s employment recession which started in 2015. Besides the obvious difference between recession and expansion one of the biggest differences is that recessions tend to resolve themselves over a period of time without that resolution being attached to a specific event. On the other hand, expansions’ deaths tend to be attributable to a specific event or behavior (e.g., oil price shocks, retraction of credit by banks, over production in the manufacturing/consumer sectors, borrowers failing to repay loans). In short, expansions don’t tend to die of old age, but, in a way, recessions do. Eventually both trends will falter and here’s what I’m looking for to signal the end of the expansion in the broader U.S. economy and a return to growth in Alaska’s economy.

U.S. Economic Expansion

The current U.S. economic expansion started in 2009 after the end of the “great recession” which lasted from 2007 into 2009. The reason we call that recession that “great recession” was that the rate of job loss was greater than any recession since the Great Depression of the 1920s and 1930s. The country lost more than 8 million jobs in 2008 and 2009 and more than six percent of all jobs in the country disappeared. The current expansion, while long in tenure, has been characterized by a much lower growth rate than prior expansions. During the previous longest period of growth in the U.S. from 1991-2001, the average annual employment growth was 2 percent and average growth in the value of the economy was 3 percent. In contrast, this expansion has averaged annual employment growth 1.4 percent and average annual growth in the value of the economy has been 2.3 percent. At no point has this expansion reached an annual growth rate of 3 percent or better. When this expansion dies, and it eventually will, here’s what I’ll be looking to signal that the end is nigh.

Erosion of Business Sentiment

Last week Morgan Stanley announced that their economic tracking index fell by the largest amount ever in a single month. The index fell from 45 to 13 between April and May with every component of the index falling except the credit market component. This decline mirrors in steepness and magnitude the gains seen in coming out of the Great Recession. It’s not clear if this shift in sentiment is a “one off” reflecting the flooding in the center of the country and/or the current saber-rattling around trade policy or if it’s an early signal of something greater. At least the credit market component is holding steady which means that banks aren’t withholding lending just yet.

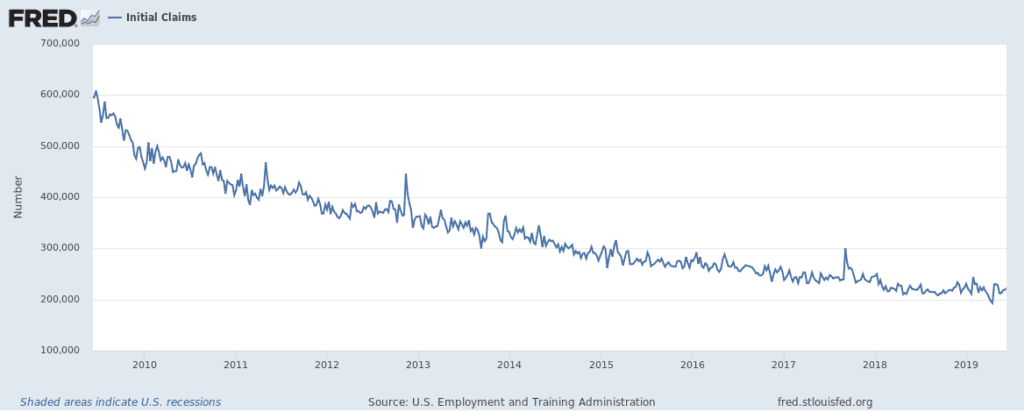

Slowing of Hiring Trends and Increases in Jobless Claims

In May the U.S. economy added just 75,000 jobs compared to an average for the year of 164,000 jobs per month and an average in 2018 of 223,000 per month. It’s not uncommon for monthly jobs numbers to be lumpy and the monthly numbers have been known to contain the occasional goose egg; once in both 2016 and 2017 the U.S. added almost no new jobs in a month. The economy continued to lumber on just fine in spite of the misfire. A number that I find much more interesting than the monthly hiring number are the weekly jobless claim numbers. These people are generally losing jobs involuntarily; they didn’t leave jobs so much as they were laid off. While the May jobs number wasn’t good, there’s no sign job growth is being undercut or overwhelmed by job losses as expressed through initial jobless claims (see Figure 1).

Figure 1. Federal Reserve Initial Jobless Claims (Seasonally Adjusted)

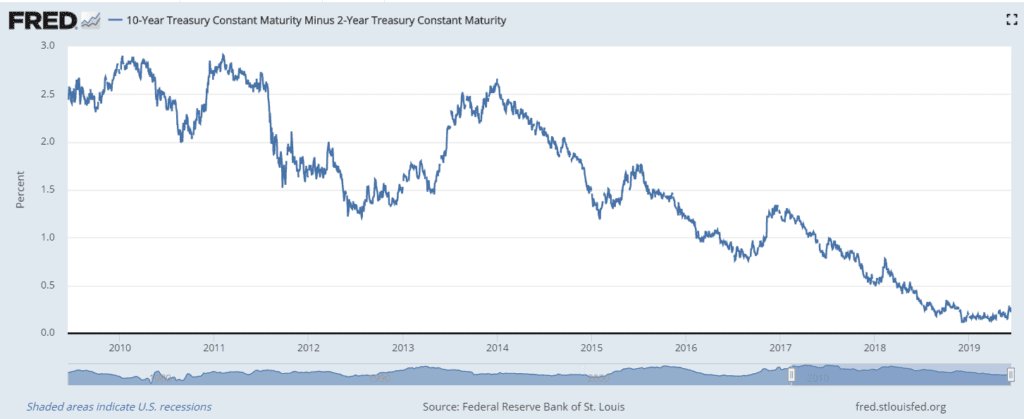

Inversion of the Yield Curve

“Inversion of the Yield Curve” is perhaps the geekiest indicator out there for a potential recession. Here are the basics. Normally, the yield (interest rate) paid on government bonds is greater in the future than in near-term which makes sense as investors demand more “yield” to lock up their money for a longer period. In an “inversion” the yield on longer dated (e.g., 10-year) government bonds falls below the yield on closer dated bonds (e.g., 2-year) meaning that investors expect interest rates to fall in the future reflecting weaker economic conditions. Right now, the difference between the 10-year and 2-year bonds is just 25 basis points (0.25%). Early in 2018 the spread between the two bonds was nearly 50 basis points and the underlying rates were significantly higher. Back in 2010 and 2001 the spread nearly 300 basis points.

Figure 2. Federal Reserve 10-Year/2-Year Spread

There are no signs that a recession in the U.S. economy is imminent, but some indicators are shifting from green to a less comfortable shade of yellow. If the trade wars continue, look for indicators to continue to weaken and the probability of a 2020 recession to increase.

Alaska’s 2015-20?? Recession

When it comes to Alaska’s “current” recession there’s just two sources of data that I’m really interested in reading: the Alaska Department of Labor and Workforce Development Employment Monthly Employment Survey data and the Quarterly Census of Employment and Wages. As you may have read in the paper Alaska has strung together several monthly job gains in the first half of this year. I’ll be analyzing this data for next month’s article and we’ll assess where the Alaska economy is at the mid-point of the year.

Jonathan’s Takeaway: It’s not uncommon for Alaska’s economy and the U.S. economy to move in a countercyclical pattern. The US economy may be shifting from signaling green to yellow while the Alaska economy is shifting towards green. Historically, oil prices driven this dichotomy, but right now oil prices are in the background with other forces (maybe include ‘such as…’) in play.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 22 years of social science consulting experience including 16 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.

6/26/19