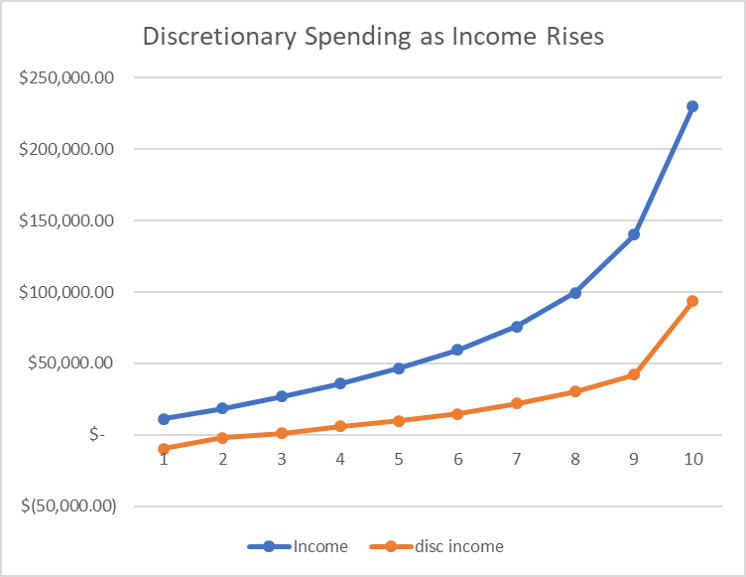

It’s January so it’s time to talk budget. This isn’t about keeping a detailed daily ledger, it’s about knowing what part of your spending is core and what part is discretionary. As financial planners, we partner with you to set a reasonable budget in retirement. Do you plan to retire on 60% to 80% of pre-retirement income? The BLS graph below shows that people in the top 10% of income earners (that’s $140,197+ in 2018 income with a mean of $229,771) spend 60% of their income on core expenses and 40% on discretionary. If you agree with the BLS’s definition of core expenses, and you are ready for a scale back, your plan should be in good shape.

There’s just this little problem called lifestyle creep. It can harm both your ability to make your savings goals and it can create a challenge in scaling back your lifestyle when you do retire. There are two typical spikes in lifestyle creep. The first is in your mid-twenties to early thirties when you land your first well-paying job – spending increases with income and former luxury items become necessities. You might start spending on things that require ongoing payments or maintenance like gym memberships or housekeeping. The second common occurrence happens near retirement when people can be in their highest earning years, may have paid off long-term debt like a mortgage, and find new discretionary income as empty nesters.

The best defense against lifestyle creep is a plan and an annual review of that plan. The best cure if you suspect you could be afflicted with lifestyle creep as you are approaching retirement is to practice living on your retirement budget. You get three benefits: you can decide if this budget meets the lifestyle goals you’ve been saving all these years to achieve, you get to put away some extra savings, and you may get a reality check before you make the decision to leave your highest earning years.

Retirement planning can be overwhelming as there are a lot of different factors to consider. Our team of financial planners specialize in helping people set, navigate and adjust their plans as necessary throughout retirement. For those with questions about how much you will need to live on in retirement, we can assist with answering that question as well as strategizing and optimizing your plan to meet your retirement goals.

Sources: https://www.bls.gov/cex/home.htm

Marietta Hall, CFP®

Financial Advisor

1/29/20