Every year in August, the National Football League starts its annual pre-season games. While accompanied by some fanfare and overtime increased television coverage, the games are meaningless in regular season standings and even somewhat meaningless for team development. As fans know, the formal season starts in September and the games that REALLY matter start in January. Alaska’s budget rollout follows the same pattern as the “world away” season of the National Football League. The Administration releases their budget in December on what essentially amounts to a statement of principal and an outline of negotiating positions with the legislature. The budget pre-season ends with the annual presentation by the Alaska Legislative Finance Division on the Governor’s Budget and the formal season begins with legislature opening. As long-time legislative watchers know, the games that REALLY matter don’t start until the end of the legislative session and the two-game “Super Bowl,” first between the conference committees and then between the legislature and the governor. As I write this paragraph, we are in the moment between the last pre-season game (Leg Fi’s presentation on the budget) and the opening of the legislative session on January 19th. I am not going to pontificate on the politics of the moment around the budget, but I will lay out the fiscal and economic realities facing elected officials as the budget games begin.

Dude, We’re Broke…

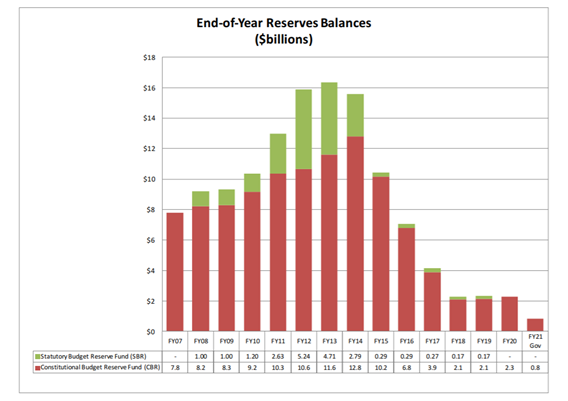

Alaska is in its ninth consecutive fiscal year of deficit spending despite significant budget reductions. Since 2012 our non-Permanent Fund reserves have fallen from just over $16 billion dollars to just over $2 billion dollars; an 87 percent reduction (see Figure 1). The Governor’s Budget would reduce these reserves to $0.8 or less than 20 percent of a typical year’s non-dividend spending. Budget watchers will remember that the state has frequently said that it needs $2 billion in reserve just to meet liquidity needs.

Figure 1. End-Of-Year Reserves, Billions

Source: Legislative Fiscal Analyst’s Overview of the Governor’s FY2021 Request

…Except for the Permanent Fund

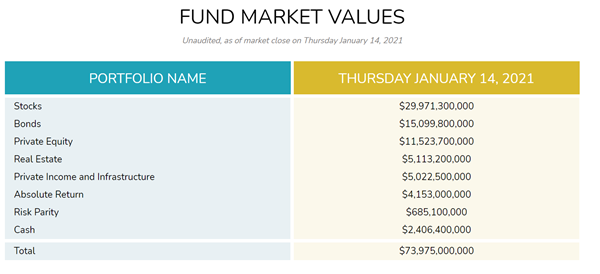

The Permanent Fund is Alaska’s largest source of wealth and revenue. At this point in our history, it is the golden goose and the egg that it produces is the Percent of Market Value (POMV) revenues that the legislature authorizes annually which acts as our largest single revenue source and the money used to pay Permanent Fund Dividends. The unaudited value of the fund is roughly $74 billion (see Figure 2); a 13 percent increase in the value of the fund compared to the year end 2020 value of $65.3 billion. The Governor’s Budget plans for roughly a $3 billion draw using the POMV formula while oil and other revenues would add another roughly $2.0 billion to the state’s unrestricted general fund coffers. This approach gives the state roughly $5 billion in UGF spending power without any deficient spending. That’s enough to cover the proposed operating budget ($4.4 billion), a minimal capital budget ($0.14 billion), and leave enough change left over to give every Alaskan a $650 PFD. That’s not a bad place to be for a state that saw a 33% reduction in tax revenue over the last year.

Figure 2. Current Unaudited Permanent Fund Value

…Alaskans are in Financial Pain

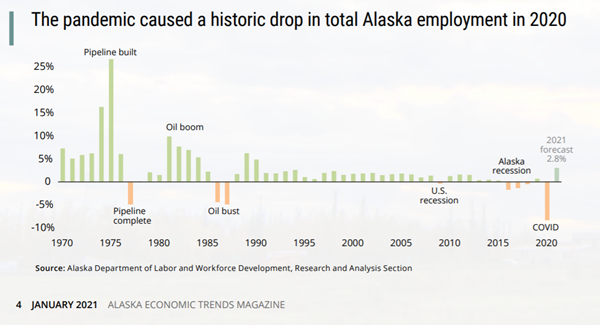

Let’s face it, 2020 was easily the worst year economically in Alaska since statehood with an estimated annualized loss of 27,200 jobs (see Figure 3); an amount which dropped employment back to 2003 levels. According to TracktheRecovery.Org, job losses are concentrated amongst low-wage workers where employment has fallen by more than 25 percent. At this point, I don’t know of any economists who are predicting a return trip to 2019 employment levels that does not take less than a couple of years minimum. Personally, I don’t think we will return to the 2015 employment highs before the late 2020s or even after 2030. There is no economic driver on the horizon that heralds that level of growth. Alaska’s Department of Labor does expect that we will gain back about 1/3 of the jobs we lost in 2020, but that still leaves us with a hit greater than what we experienced in the 2015-2018 recession.

Figure 3. Historical Annual Changes in Employment

Source: Alaska Economic Trends, January 2021.

A Grand Bargain?

The budget watchers I talk with are wondering if this session is the year of a grand bargain where there’s a horse trade for some form of meaningful increase in revenues, a resolution of the “size of PFD” debate, and a one-time supersized PFD perhaps under the guise of COVID relief. I’m not holding my breath, simply because I think the rebound in the size of the permanent fund might make it easier to kick the can for one more year and because grand bargains require people to compromise.

In any event, “Let the (budget) games begin!”

Jonathan’s Takeaway: Sometimes extraordinary times yield extraordinary changes. Jonathan places no bets that this time is one of those moments, but he wouldn’t be unhappy if it were.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 24 years of social science consulting experience including 17 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.

1/18/21