The world economy is trying to snap back like a rubber band and, just like a rubber band returning to form, the process is messy and not entirely predictable. I was watching the PBS NewsHour the other night and a picture caught my attention. It was of parked cargo ships waiting to unload at the Port of Los Angeles. Last year when the COVID-19 pandemic hit, manufacturers raced to shut down production to limit the effects of the pandemic on their cash positions and balance sheets. Now, with COVID-19 vaccines available and effective treatments beginning to emerge, these same manufacturers are racing to restart production and meet the pent-up consumer demand for everything from vehicles to consumer electronics to everyday household items.

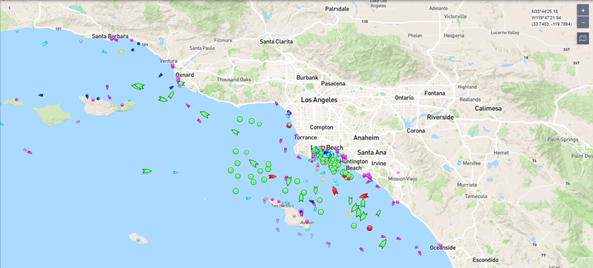

Figure 1. Cargo Ships Waiting to Be Unloaded at the Port of Los Angeles

Source: Mario Tama, BBC News, 2021.

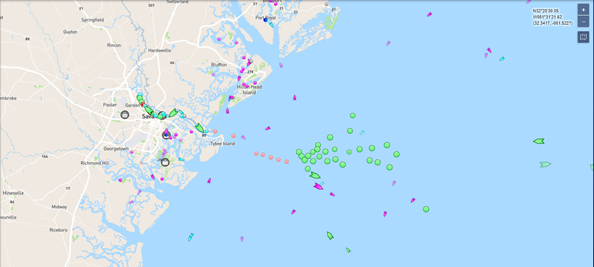

Our manufacturing systems, our logistical systems, or our aging underlying infrastructure- none of it is designed to push the proverbial pig through the python. For the last thirty years our aggregate focus on efficiency and short-term results has created a highly efficient (when things are going well), but highly fragile logistical system. I want to show you how deep the logistical challenge is right now. The figure below displays current (Friday, 10/15) marine vessel traffic outside the Ports of Los Angeles, Long Beach, Savannah, and Houston/Galveston. Every green dot is a parked container ship, and every red dot is a parked tanker. For every one of those parked ships there’s another one (or two) arriving to take its place. The logistical jam is so bad that even with the Port of Los Angeles moving to 24-hour operations, it isn’t projected to resolve until late next spring. Now I want to ask you to think beyond the immediate picture. Remember that when a ship is waiting to be unloaded it’s unavailable somewhere else and that every one of those ships represents hundreds of truck trailer loads of delayed manufacturing or consumption. This congestion is giant brake on our entire economy and an inflation driver.

Figure 2. Marine Vessel Traffic, Outside the Ports of Los Angeles and Long Beach (Top), Savannah (Middle), and Houston/Galveston (Bottom).

Conceptually, this blog is about Alaska economics so where is the tie-in for AK? There are both challenges and opportunities for Alaska in the logjam. The challenges are for the Alaskan retailers. Immediately after the first draft of this blog was written Alex DeMarban covered this issue for the Anchorage Daily News. Store shelves are going to continue being thinner than normal for at least the next half-year and there’s some indication that vehicle production is going to be reduced for the next couple of years. If you have something special that you want to buy for Christmas order sooner rather than later.

I remember several years ago watching a presentation by the Port of Alaska (then Port of Anchorage) which noted that if container ships came here and then trucked goods down the AlCan Highway that the shipping company would save time and money on the delivery. Thus far, shippers are not pivoting to the Port of Alaska. As I write the only ship in port is the Sandy Bay; a Panamanian-registered bulk carrier that arrived here from Korea. It wouldn’t surprise me if there were conversations underway to bring more traffic to Alaska. It’s the right time with the right pressures for someone to consider a move like this one that would help break their own personal logjam. The biggest logistical challenge is likely the lack of truck drivers and trucks right now. This move wouldn’t necessarily help Alaskans (much) since most goods bound for Alaska are mixed in with other goods heading to the broader U.S. which then get sorted and sent up here.

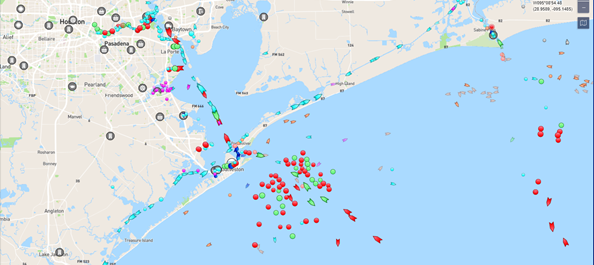

So, who in Alaska is benefitting from the rebound (definitely) and the container shipping logjam (probably)? Ted Stevens Anchorage International Airport (TSAIA). At TSAIA, outbound freight volumes from January through April (the last month of available data) are running 41 percent ahead of the five-year average. Since most of the cargo leaving from here comes from somewhere else departures are good indicator of through traffic. Even February, traditionally the slowest month of the year for cargo, was a smoking month at the airport with volumes that were higher than any month in 2016 and better than most months in 2017, 2018, and 2019. Air cargo will never move the volumes that container ships move, but it’s got to be a great time working in administration at TSAIA right now. Here’s to hoping their jump upwards is more than a temporary phenomenon.

Table 1. Outbound Freight, Ted Stevens Anchorage International Airport, Millions of Pounds, 2016-2021

Jonathan’s Takeaway: Whenever you hear an air freighter taking off in Anchorage that’s the sound of money being pumped into Alaska’s economy and right now it’s being pumped in like never before.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 24 years of social science consulting experience, including 18 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.