Over the course of writing this blog for five years there are exactly two editions which if I could pull back and rewrite I would. The first is my late 2017/early 2018 blog where I predicted that Alaska’s recession was ending. Just a couple of weeks after APCM published that edition the Alaska Department of Labor and Workforce Development (ADOLWD) announced that they were changing the way they calculated monthly employment estimates because they felt that the U.S. Bureau of Labor Statistics’ (BLS) method didn’t survey more rural states like Alaska well. The revised time series clearly showed that we were still in recession and history shows it took us another 8-10 months to get back on a growth footing. “If only” I’d picked up the phone and called my friends at ADOLWD before walking out on that plank. The second blog I’d rewrite is last May’s edition on inflation. I’ll be honest the level of inflation we’ve experienced is well beyond what I thought possible. I expected demand-side inflation because our national fiscal policy since mid-2020 was clearly designed to stimulate consumption and avoid the worst socioeconomic effects of the pandemic. What I did not foresee was the supply-side issues we’ve faced- chip shortages, traffic jams at container ports, the effects of China’s “zero COVID” policy, the Russian invasion of Ukraine, and the magnitude of the fundamental shift in the national labor supply. In the immortal words of Luke Wilson- I did NOT see that coming.

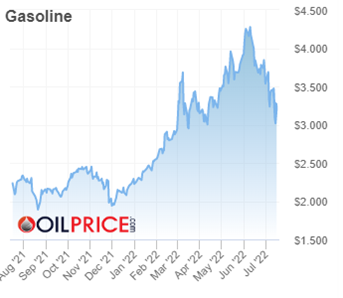

By the time you read this edition, if you live on a road system, you will likely have noticed a significant drop in local gasoline prices. I was collaborating with a client this past week in the Mat-Su Borough (MSB), and I noticed several stations selling gasoline for $5.09 or $4.99 per gallon for regular unleaded. As I had left Anchorage the price was $5.49- a $0.40 per gallon differential. Anchorage has a $0.10 per gallon tax, so the price is usually $0.10 lower in the more urban areas of the MSB, However, that still leaves a $0.30 per gallon differential unexplained.

Earlier this week BLS released both their June Consumer Price Index and Produce Price Index estimates. Both readings were painful with consumer prices up 9.1 percent year-over-year and producer prices up 11.3 percent year-over-year. The May/June energy spike noticeable in the figure above materially affected both indices and the July readings will benefit from the 20-25% drop in refined petroleum prices over the last thirty days. Beyond refined petroleum, we see evidence of falling prices in several key areas which will eventually feed into consumer prices. For example:

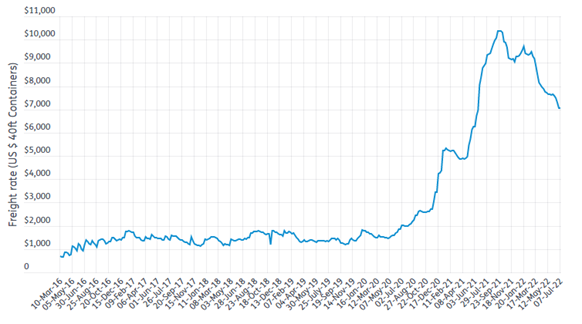

- The Dewry World Container Index, which tracks container shipping prices, is 21 percent lower than it was a year ago and prices are down one-third from the September/October. While still nearly four times the shipping rate of late 2020, the decline in prices is material.

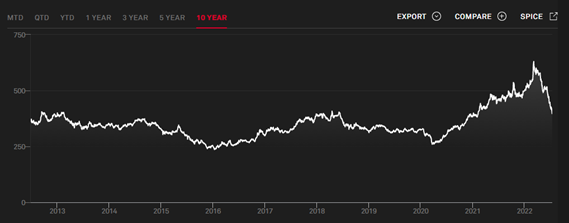

- The S&P GSCI Industrial Metals Index, which tracks a basket of metals including aluminum, copper, lead, nickel, and zinc, is off more than 30 percent from its March 2022 high and within 5 percent of 10-year “highest price” levels.

- Core PPI, the PPI minus the volatile components of food, energy, and trade, fell for the third consecutive month from an annualized rate of 7.1 percent in March to 6.4 percent in June.

- The Food and Agriculture Organization of the United Nations’ Food Price Index fell for the third consecutive month from 159.7 in March to 154.2 in June.

In no way am I saying that inflation is going away. They teach us in Econ 101 that prices tend to be sticky upwards and that inflation, once rooted, takes effort and time to unroot. At least on the supply side, where governments have less influence, there are pockets of falling prices even if those prices remain above long-term historic norms. Time will tell if these price declines represent a normalization of price trends or are just a temporary reflection of recession fears. The other side of this equation is, of course, the demand side where governments have more influence through monetary and fiscal policy. In the last six months our monetary policy has shifted away from stimulative/expansionary towards contractionary. Our fiscal policy is also returning to a more neutral stance. I think that there’s a solid chance (barring geopolitical events) that June’s inflation reading will represent the peak or near-peak of inflation. Additionally, it’s nearly certain that the Federal Reserve will further tighten monetary policy with another large rate increase (or two) to further reduce consumer and business demand. The Fed was late to the party, but they’re no longer messing around. Their actions, combined with declining prices for producer inputs, will eventually reduce inflation.

Additional Reading You Might Enjoy

China’s Economy has Slowed Dramatically

Jonathan’s Takeaway: I expect inflation rates to remain high for the next several months, but as policy changes take effect and the year-over-year comparables get much harder, inflation should fall in late 2022/early 2023 barring additional geopolitical instability.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 24 years of social science consulting experience, including 19 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.