We can all agree that 2018 was not the market’s best year. With the S&P 500 down 4.4% and volatility levels near that of 2015, markets disconnected from strong underlying fundamentals such as better-than-expected corporate earnings growth and a positive 3% GDP. This disconnect created concerns that a recession may have been imminent. Although we still expect slower growth than what we’ve previously seen, the first quarter of 2019 has turned out well so far. GDP was 3.2% quarter-over-quarter and US stocks were up over 13%. Though the quick turnaround has helped alleviate some recession concerns, the fact that we are in the tenth year since the Great Financial Crisis and are exiting the low-volatility expansion we’ve experienced post-2008 leaves the thought of recession lingering in many peoples’ minds. Although an unforeseen, exogenous shock could lead to more turbulent markets or an earlier-than-expected downturn, conditions are broadly different than those prior to the Global Financial Crisis and near-term recession risks remain low.

What Qualifies as a Recession?

You may have heard the term “excesses” before when referring to recessions. Just like an excess of dessert can expand my waistline to a point beyond normality, so too can excesses in the economy over-exaggerate prices, demand, etc. beyond what they would be in equilibrium. Thus, a correction must be made. If the correction is long enough and deep enough – voilà, you have yourself a recession! A recession is generally characterized by negative economic growth (GDP) for two or more consecutive quarters. Following is a brief summary of some recession indicators and our analysis of them. To be clear, these are not causes of recessions but are simply tools to help us see imbalances that can potentially lead to recessions.

Recession Indicators à la Carte

Wage growth has been in the news for some time now – spurred on by low unemployment – and can be an indication of too few workers with respect to demand. Unemployment continues to fall, with consensus estimates landing between 3.4% – 3.6%. With a tighter labor market, employees have higher pricing power and can charge more for their labor. This can hurt firm profit margins. It is true that wage growth has seen some life (ending 2018 at 2.8% YoY vs the average 2.3% since 2008), but productivity levels have partially offset wages and helped keep profit margins elevated.

Consumer health, or consumption, is another indicator we like to focus on. Consumption makes up roughly 70% of GDP so it is important for consumers to be able to purchase goods and services in a sustainable fashion. So do we see a healthy consumer sector? Yes. Private sector incomes (households and businesses) are still greater than spending, suggesting that growth is sustainable at its current level, and household savings rates are much more prudent than we saw during the housing bubble.

The Federal Reserve provides both current monetary policy and forward guidance on expected market conditions. For example, an aggressive Federal Reserve that raises rates too quickly could result in an economic cooldown. But recent guidance from the Fed shows them having a dovish, or mild, view for 2019 hikes.

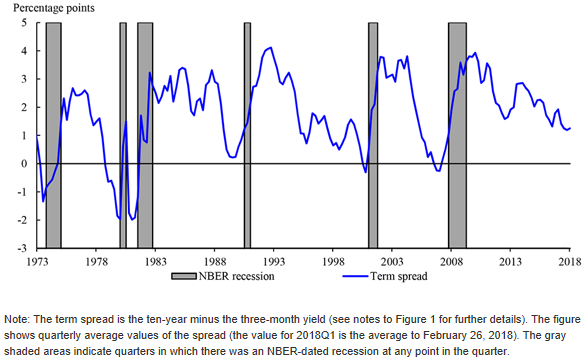

The yield curve has recently inverted, and this has been a point of apprehension since an upward-sloping curve generally implies bullish markets while a downward-sloping curve generally implies bearish expectations. When looking at the curve though, only the middle of the curve is inverted (ranging from 6-month to 7-year maturities). A common tool of the Federal Reserve to gauge recession risk is the “10-year yield minus 3-month yield” spread. This spread was negative for the dot com bubble and 2008 Financial Crisis but is currently still positive. This doesn’t mean a recession won’t occur, but when taken into account with our other indicators, we still do not see any flashing red lights.

Source: Board of Governors of the Federal Reserve System, Federal Reserve Bank of New York, NBER

Going Forward

Although slower growth and increased volatility is expected compared to what we’ve experienced post-crisis, decisions cannot be made on any single indicator alone. When analyzing overall conditions from multiple indicators, outside of an exogenous shock, traditional measures of excesses associated with recessions are not worrisome and we should expect the current expansion to continue into the short-term. Longer-term headwinds do exist though, such as unfavorable demographics and high debt levels and we at APCM expect growth to slow towards its long-term potential of 2% in the U.S.

Nolan Cady

Operations Analyst

5/2/19