Happy New Year! Budget Season officially begins tomorrow (January 18th) with the first day of the Alaska Legislature’s annual session. It’s been some time since I’ve covered budget issues and that was a deliberate choice. With COVID rearranging the economy and the quagmire that our annual budget process became last year, it just felt appropriate to let the topic rest. However, this moment feels like the right time to turn our attention back to Alaska’s annual budget.

For those who have never paid much attention to the budget (which drives a significant portion of our economy) let me try to broadly describe the process as succinctly as possible.

- The governor must publish his/her/their proposed budget by December 15th each year.

- The Legislature is the only branch of our government which can appropriate funds to the budget. It convenes on the third Tuesday in January, and it must approve a budget before it adjourns. Approving a budget is literally the only legislative achievement that an Alaska Legislature must do each year.

- The House and the Senate each convene their finance committees. These committees then form sub-committees, each tasked with analyzing a specific department’s budget. These committees propose department budgets for the upcoming year and forward those proposals to their respective finance committees.

- The finance committees assemble their own complete budget which then goes before their respective assemblages for amendment and approval. In Alaska, the House usually finishes its version of the budget before the Senate.

- Once each body has approved a budget a conference committee negotiates differences, and the outcome goes before the bodies for final approval.

- Once the budget receives final approval, it goes before the governor who may sign the budget in its entirety or use the line-item veto to eliminate portions of the budget. The governor may not add funding to any item as that power is reserved for the Legislature.

- The Legislature may choose to try and override gubernatorial vetoes via a supermajority vote, or it can let the vetoes stand. At this point the budget process is finished if the budget is balanced (i.e., expenditures=revenues + transfers).

- The governor may ask the Legislature to approve supplemental budgets either via special session or during the regular session at which point the legislature starts over around step 2 and 3.

In 2021 the process took a long time for several reasons but the two most important are that the legislature is divided along multiple fault lines regarding revenue generation and the role of the Permanent Fund Dividend and because there’s a major difference in opinion between the legislature and the governor.

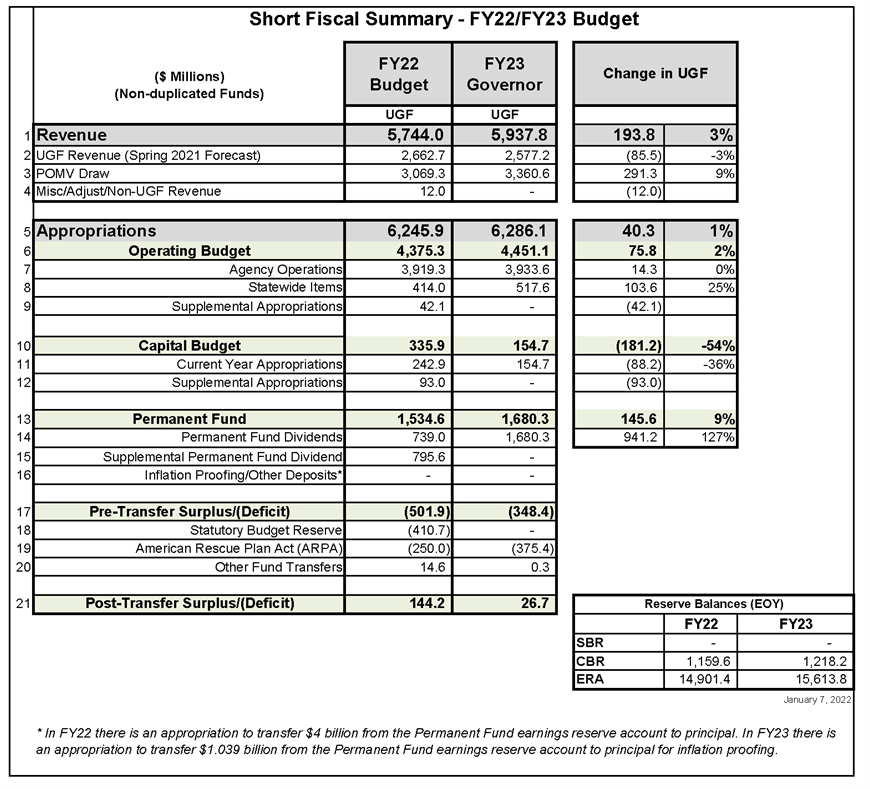

At this moment we’re at Step 1 and we’re about to hit Step 2 so let us turn to the current budget and the governor’s proposed budget. The figure below comes from the Alaska Legislative Finance Division’s (hereafter Leg Fi) Legislative Overview of the Governor’s Budget which Leg Fi published Friday, January 14th. There is a lot to breakdown in this table. As they say, “The devil is in the details”. I love the details so let’s tackle a couple of them along with the surface picture.

If we look at the top line numbers in each of the major sections, it looks like the proposed budget for FY ’23 and the approved budget for FY ’22 are very similar. We have proposed revenue totaling $5,937.8 million vs FY ‘22 revenue of $5,744 million while on the appropriations side we have a proposal of $6.286.1 million vs FY ’22 at $6,245.9 million. So, we’re expecting revenues to come about $200 million more in FY ’23 than FY ’22, but we’re planning on spending just $41 million more. Deficit spending (transfers from savings) would fall from $501.9 million in FY ’22 to $348.4 million.

On the surface, it looks like we’re expecting minor changes in the budget. However, if you look deeper into the table you find that the Governor’s proposed budget includes $931.7 million in supplemental spending for FY ’22 of which $42.1 million would go into the Operating Budget, $93 million would go in the Capital Budget, and $795.6 million would become a supplemental Permanent Fund Dividend. So, the proposed budget is looking to increase the current year (FY ’22) budget by over $900 million and maintain that increase, plus an additional $41 million in the coming year. Nearly all this increase is loaded into the Permanent Fund Dividend. The proposed budget provides for an extra $1,100 dividend for FY ’22 and a $2,400 dividend in FY ’23. These changes would increase spending on PFDs from the currently approved $739 million in FY ’22 (unsupplemented) to $1,534.6 million in FY ’22 (supplemented) and $1,680 million in FY ’23. If we look at the non-PFD items the changes are relatively small with the largest difference being that the proposed budget looks to reduce state spending on the Capital Budget from $242.9 million (unsupplemented) or $335.9 (supplemented) to $154.7 million in FY ’23. The Capital Budget has been small in recent years and the state will still benefit in a big way from the new federal infrastructure law with billions of dollars of investment expected over the next decade.

The state is currently running a fiscal deficit with expenditures greater than revenues. On the surface it looks like the proposed budget results in a small pre-transfer deficit with no draw on the Alaska’s statutory budget reserve. How can this be when the proposed budget increases spending from an unsupplemented amount of ~$5,315 million in FY ’22 to over $6,286 million in FY ’23? Here again the details matter. Astute observers will notice that the proposed budget includes increasing the money taken from the Permanent Fund by roughly ten percent from $3,068 million to $3,360 million and includes $375 million in one-time funding from the American Recovery Plan Act (ARPA). In short, the proposed increases are non-sustainable and a similar budget in FY ’24 would require replacing the $375 million in ARPA funds with a further increased draw on the Permanent Fund, transfers from dwindling reserves, or increased tax revenue. On the surface the proposed budget looks more balanced the unsupplemented FY ’22 budget, but it’s a deal dependent on one-time federal monies which doesn’t change Alaska’s long-term structural deficit.

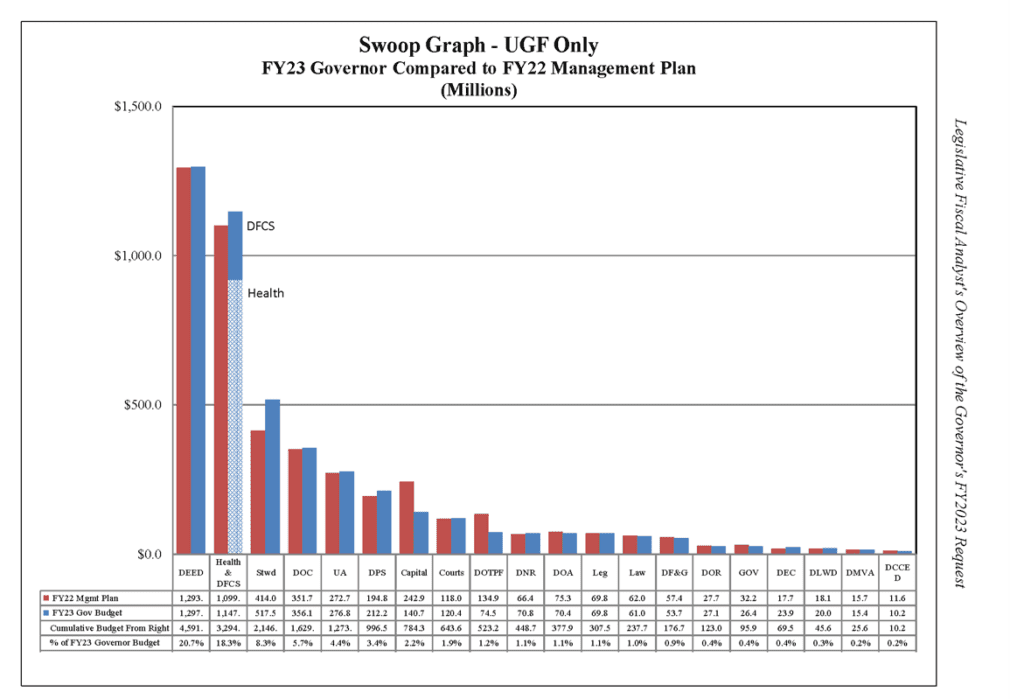

I have left myself very little space to talk about department-level changes in funding. The figure below shows proposed FY ’23 departmental funding compared to FY ’22 funding from the unrestricted general fund (UGF). State tax revenues provide the bulk of UGF and this funding source is our most flexible source of funds. As you can see, it’s largely a “steady as it goes” budget for most departments a noticeable increase at Heath and Human Services (which the Governor proposes splitting in two) and noticeable decrease at the Alaska Department Transportation and Public Facilities. Another noticeable element of the budget is a slight increase in funding for the University of Alaska System (UA). This year was supposed to be the third year in a budget compact which reduced UA funding in a stair-step fashion. I’m sure the apparent change in course is welcomed by UA proponents and constituents.

That’s all the space I have for this month. With apologies to Arthur Conan Doyle, “The budget game is a-foot!.”

Jonathan’s Takeaway: Municipal, state, and federal budgets reflect our priorities as a society. As citizens we owe it to ourselves, our forerunners, and posterity to be involved in the budget process. The first step in that process is educating ourselves on what’s in the budget and why it is there.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 24 years of social science consulting experience, including 18 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.

1/17/22