At some point, if you’d been around me in 1991 while I was tooling around Vermont as teenager in my “vintage” Mercury Tracer SW you would have heard the following song lyrics emanating from my car:

I saw the decade in, when it seemed the world could change

At the blink of an eye

And if anything,

Then there’s your sign of the times

Fresh on the heels of a 1989 trip to the Soviet Union, several opportunities to host Soviet teenagers and adults in our home, and with the collapse of the USSR itself, those were indeed heady times when the world could, and did, change in the blink of an eye. Thirty years later it’s clear that those lyrics still apply because the world did indeed change in the blink of an eye when, on February 24, 2022, Russia invaded Ukraine starting Europe’s first major land war since August 1945.

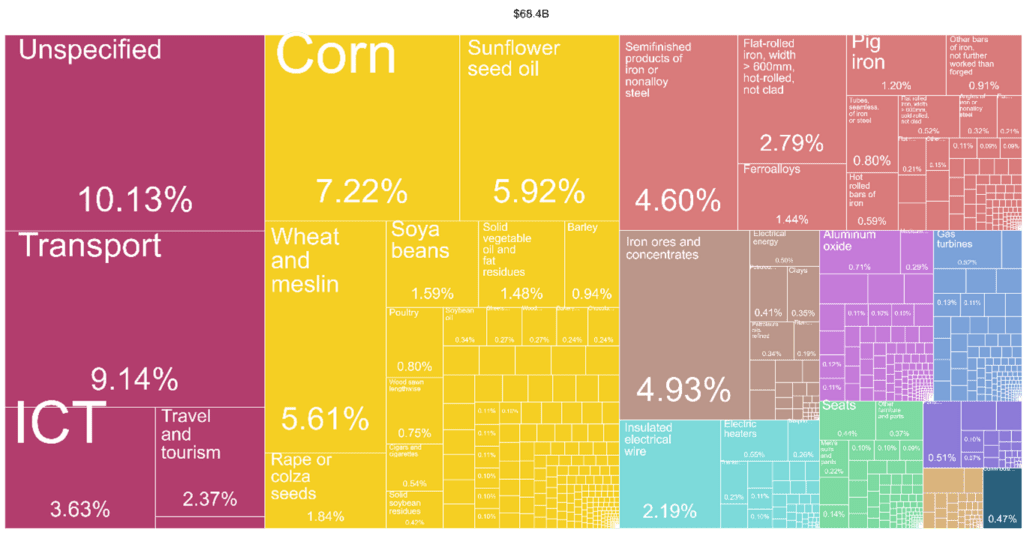

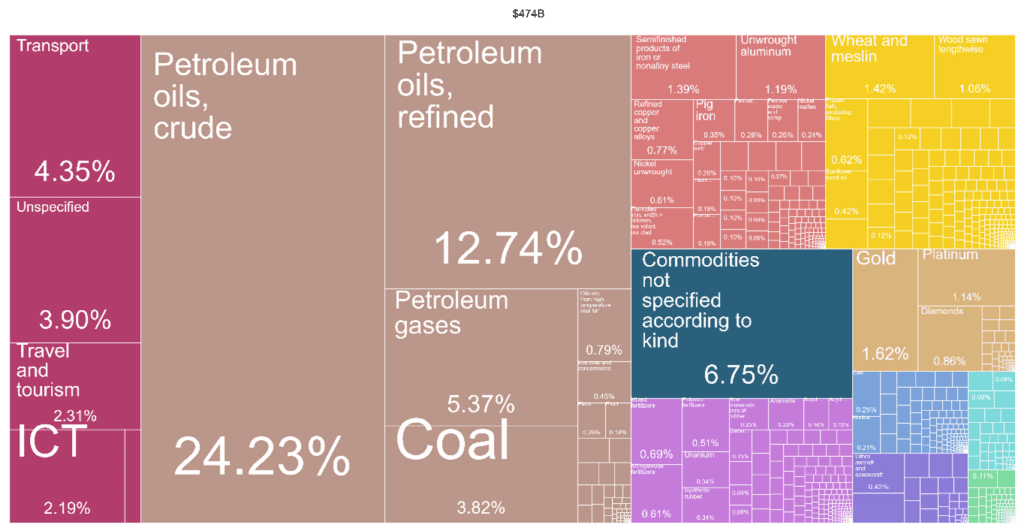

This blog could take several directions at this moment, but I’m going to focus on the short-term effects of the war on Alaska’s economy. Both Ukraine and Russia are major producers of certain commodities. Ukraine produces substantial amounts of grain products including corn and wheat as well as large amount of sunflower seed oil. The sunflower is so important to Ukraine that it’s national symbol. The yellow in the figure below shows the importance of agricultural exports to Ukraine’s economy. In addition to substantial agricultural exports, Ukraine is also a significant source of iron ore and iron products. In many ways, the economy of Ukraine is very similar to the commodity-based economy of the upper Midwest. Russia’s economy is energy export driven with that product sector making up more than 40 percent of exports by value. Overall, Russian exports of energy totaled $231 billion in 2019; an amount more than three times total Ukrainian exports of $68.4 billion. Russia also produces substantial grain (yellow) and metals (salmon).

Figure 1. Ukraine (Top) and Russia (Bottom) Exports, 2019

Source: The Atlas of Economic Complexity, 2021.

The United States isn’t a leading trading partner with either Ukraine or Russia. Just 4.5 percent of Russian exports and 2.1 percent of Ukrainian exports come directly to the U.S. and the U.S. represents similar percentages of those countries imports. However, their exports do feed the world market which then influences price of commodities and the cost of products that appear on our shelves.

What’s it all mean for Alaska’s economy? Let’s break down the short-term effects by topic/group:

Consumers-If you thought that inflation would moderate this year, well there’s a chance that’s not happening as soon as predicted. It’s not just the price at the pump where you could continue to pay more. Ukraine isn’t going to produce as much wheat, corn, or seed oils this year and that means continued pressure on food prices.

Resource Producers- Congratulations, resource producers including oil companies, hard mineral miners, fishermen, and farmers. Your well-head, farmgate, and ex-vessel prices are all going to be higher this year. The pricing, particularly for oil, will be highly volatile. Russian products aren’t disappearing from the market, they’re just trading at a discount and unavailable to Americans given sanctions. Other countries (e.g., India) are picking up Russian oil at substantial discounts.

Rural Communities– Rural communities get a special shout-out because they’re likely to face sticker shock starting this summer when the first fuel barges start to arrive. The way pricing for fuel works in most rural communities in Western, Interior, and Arctic Alaska is that fuel arrives a couple of times during the summer. The price in the community is based on the “lifting price” at the port where the fuel originated when it left that port. If the fuel “lifts” at a point when the price is high, that amount forms the base of the community’s price until the next “lift,” which can be up to 9 months away. As Alaskans we’re all “at the end of the road” to a certain degree when it comes to the price of basic goods, but pricing in rural communities reflects the fact that they’re “beyond the road.”

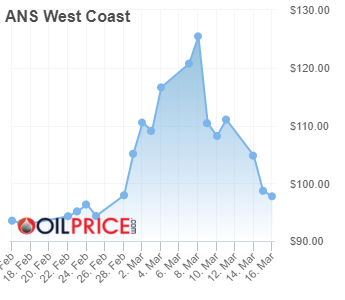

The State of Alaska– The State of Alaska is going to make more money this year than it made last year and there’s a good chance that it generates more revenue than it has in years. The progressivity of Alaska’s oil tax structure means that every $1 per barrel (bbl.) increase in the price of oil (sustained for a year) between $85/bbl. and $115/bbl. adds an additional $80 million to state coffers. The challenge this year is not just the pent-up demand for additional spending from years of reduced budgets, but the fact that oil prices will likely be very volatile. Case in point, check out the last 30 days of Alaska North Slope oil prices. This period covers a couple of days of before the Russian invasion until about 3 three weeks after the invasion. The price of Alaska’s oil went from $93/bbl. to $125/bbl. to $97/bbl. These prices are all good for Alaska’s fiscal health, but such volatility makes spending decisions more difficult, particularly if you have a desire to please everybody in an election year. There’s nearly a $2 billion difference between a year at $95/bbl. oil and a year at $125/bbl. oil.

Figure 1. Alaska North Slope Oil Prices, February 18, 2022-March 16, 2022

I’d be remiss if I didn’t mention that (1) no one knows the duration of this upswing in crude prices and (2) oil prices at these levels will accelerate the move toward sustainable energy. Both elements have implications for Alaska.

You may have noticed that I stated short-term effects. There are some that may argue that recent events herald a resource and fiscal renaissance for Alaska. While I agree that significant instability elsewhere increases our competitiveness and attractiveness as a resource producer, I am reticent to make such sweeping predictions. Resource projects in Alaska are notorious for taking years (decades?) to bear fruit and our current workforce is depleted from years of cuts. We’ll benefit from higher prices, but we shouldn’t get ahead of ourselves quite yet.

Jonathan’s Takeaway: The world can indeed change in the blink of an eye and when it does the results are often frightening and disconcerting. As with the pandemic we’re in for added uncertainty for the foreseeable future. Buckle up and hang on.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 24 years of social science consulting experience, including 18 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.

3/21/22