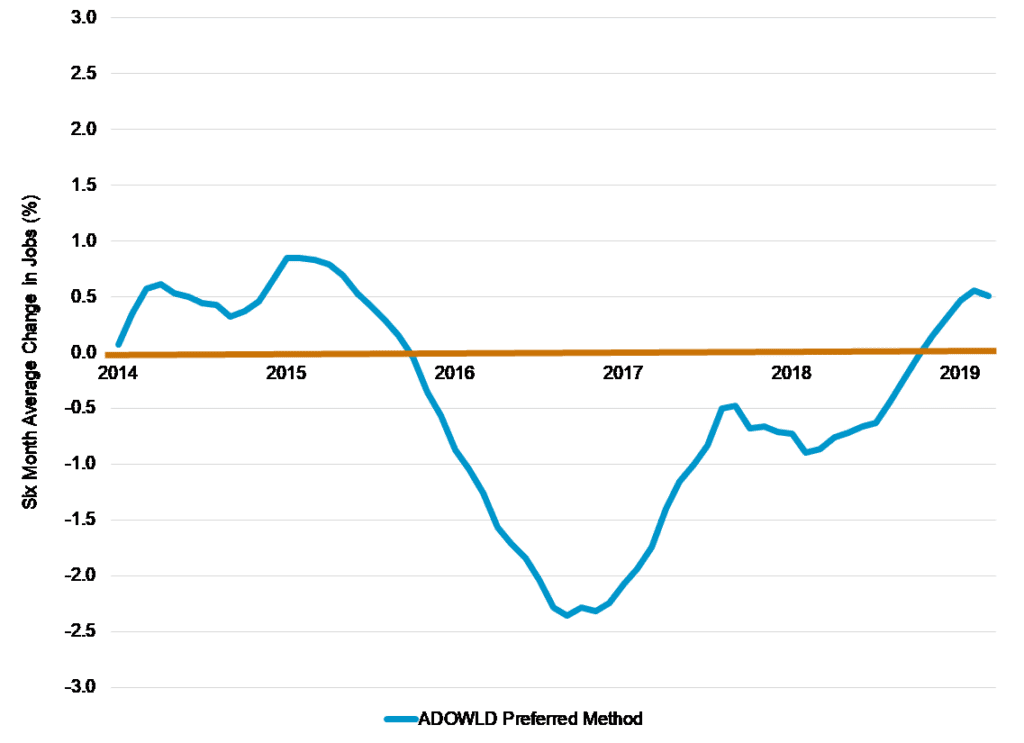

Let’s get right to the point- it looks like Alaska’s economy emerged from its employment recession in early 2019. Growth in our economy, as measured by employment, began slowing in early 2015 and we started losing jobs in late 2015. At the recession’s peak intensity, we were losing jobs at a rate of nearly 2.5 percent per year. For an economy of our size that was roughly 8,000 to 9,000 jobs per year at that peak rate. The recession slowed through 2017 to such an extent that I fell for the feint and predicted that we’d be out of recession in by early 2018. However, ‘twas not to be as a late 2017 round of cuts in the oil industry and associated industries like construction and transportation stalled any potential recovery. The secondary damage to service sectors such as restaurants and the national “retail apocalypse” kept us in a mild recession through the end of 2018. By the end of last year, the economy gained some traction with increased oil price seen in early 2018 (and an election year) resulting in higher spending by some key drivers to our economy. The short of it is that on a single month year-over-year basis Alaska’s had more jobs than it had the year before since October 2018. We’ve averaged roughly 1,500 more jobs in a month compared that month in 2017/2018 since October. It’s not a lot; roughly 0.5 percent growth. However, after three years in the desert I’m sure this economy is deeply thirsty.

Figure 1. Rolling Six-Month Average of Percentage Wage and Salary Employment

Before going further let me thank my eldest son for his work on this year’s blog. Summer left him with some free time and his father was happy to fill it by having him gather, format, and analyze the data. It was after creating the chart this exchange took place: “Dad, where is the growth in jobs coming from?”. “Well son, if you ask a question like that one we’re probably making another table.” You may be asking the same question so let’s not leave you hanging in the wind. The big winner in 2019 has been the construction sector which has really been off to the races this year compared to last year with a nearly 1,500 job increase thus far in 2019. Other winners have included the oil and gas sector, healthcare, and the hospitality sector. The big loser of the year is the manufacturing sector which is more than 5 percent year-over-year. My gut says this drop might be related to seafood and the ongoing trade war. Various white-collar parts of the service sector and state government also lost significant jobs. In our table, we get roughly half the sectors growing and half the sectors still shrinking. That’s not a picture of a vibrant and healthy economy, but it could be a picture of an economy gingerly on the mend.

Table 1. Sector Employment Comparison, First Five Months 2019 vs 2018

|

Jobs Sector |

Average Monthly Jobs January-May |

|||

|

2018 |

2019 |

Difference from 2018 |

||

|

Number |

Percentage |

|||

|

Total Nonfarm |

318,180 |

319,740 |

1,560 |

0.5 |

|

Construction |

13,840 |

15,320 |

1,480 |

10.7 |

|

Oil and Gas |

9,340 |

9,780 |

440 |

4.7 |

|

Educational and Health Services |

50,360 |

50,740 |

380 |

0.8 |

|

Leisure and Hospitality |

32,240 |

32,540 |

300 |

0.9 |

|

Trans/Warehouse/Utilities |

20,800 |

21,040 |

240 |

1.2 |

|

Local Government |

42,960 |

43,060 |

100 |

0.2 |

|

Non O&G Mining and Logging |

3,080 |

3,160 |

80 |

2.6 |

|

Wholesale Trade |

6,360 |

6,440 |

80 |

1.3 |

|

Retail Trade |

34,880 |

34,840 |

-40 |

-0.1 |

|

Other Services |

10,960 |

10,880 |

-80 |

-0.7 |

|

Federal Government |

14,680 |

14,600 |

-80 |

-0.5 |

|

Professional and Business Svcs. |

26,620 |

26,520 |

-100 |

-0.4 |

|

Information |

5,700 |

5,500 |

-200 |

-3.5 |

|

State Government |

23,880 |

23,660 |

-220 |

-0.9 |

|

Financial Activities |

11,540 |

11,280 |

-260 |

-2.3 |

|

Manufacturing |

10,940 |

10,380 |

-560 |

-5.1 |

As we close this month’s post out I want to note that this apparent recovery is not evenly spread. Downloading the same data for Anchorage we find that city is not out of recession. While Anchorage is seeing the same construction-job boomlet as seen in the state data, retail job and government job losses are holding recovery in Alaska’s largest city back. The impending closure of the Nordstrom’s store, and the budget cuts we’ll be talking about next month, will only add to these headwinds. The only region that looks like it’s solidly out of recession is the Interior where growth is likely driven by the impending arrival of the F-35s at Eielson Air Force Base and increased stability in oil & gas. The remaining regions of the state look like they’re in neutral economic growth territory. Again, after 3+ years of solid losses, even holding your own is going to feel good.

Jonathan’s Takeaway: It’s bittersweet to write about our apparent return to employment growth. In late spring it really felt on the streets like the economy was out of recession and even gaining traction. Just like summer, we should enjoy that moment while it lasts. Barring some sort of political miracle (and significantly better angels), next month’s discussion about the near-term future of the economy isn’t going to be a pretty one.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 22 years of social science consulting experience including 16 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.

7/17/19