At the start of 2021, APCM’s fixed income team identified several possible risks to the recovery of the economy. One of these was whether the Fed would ‘get it right’ about starting the process and timeline of raising interest rates.

The Federal Reserve has a dual mandate: promote maximum employment and maintain stable prices for the American people. As the economy recovers from the pandemic, the Fed’s challenge is to find the right balance between providing enough stimulus to return employment (and the economy) back to normal while avoiding elevated inflation levels that may occur if too much stimulus is provided.

At their last meeting the Federal Reserve kept interest rates near zero and maintained their Quantitative Easing plan to purchase $80 billion of US Treasury securities and $40 billion of mortgage backed securities each month. This announcement met market expectations for continued stimulative monetary policy. Fed Chairman Powell commented that while the economy is moving in the right direction, a full recovery is thus far incomplete and that risks to the economic outlook remain.

In addition to the general Fed statement, the FOMC issued an updated “dot plot” which is the committee members individual projection of rate expectations as well as the Fed’s economic projections.

- The dot plot showed that 13 of 15 policy makers (up from 7 in March) now expect the Fed Funds rate to increase in 2023. The median expected increase is for two rate hikes versus a median of zero in March.

- The FOMC projects GDP growth of 7% in 2021, up from the 4.2% they projected last December

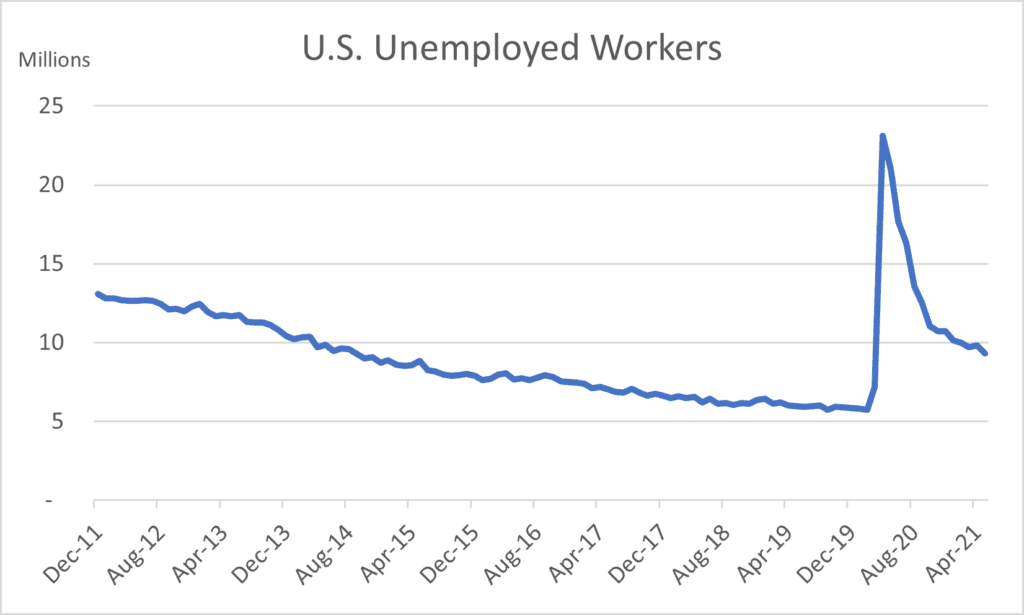

EMPLOYMENT

Employment remains well below pre-pandemic levels. The Bureau of Labor Statistics (BLS) reported the most recent Unemployment rate for June 2021 was 5.9%. This represents about 9.4 million individuals. The Fed currently projects unemployment will fall to 4.5% by the end of 2021 and to 3.5% by 2023.

US Unemployed Workers Total in Labor Force (in thousands); source: Bloomberg, Bureau of Labor Statistics

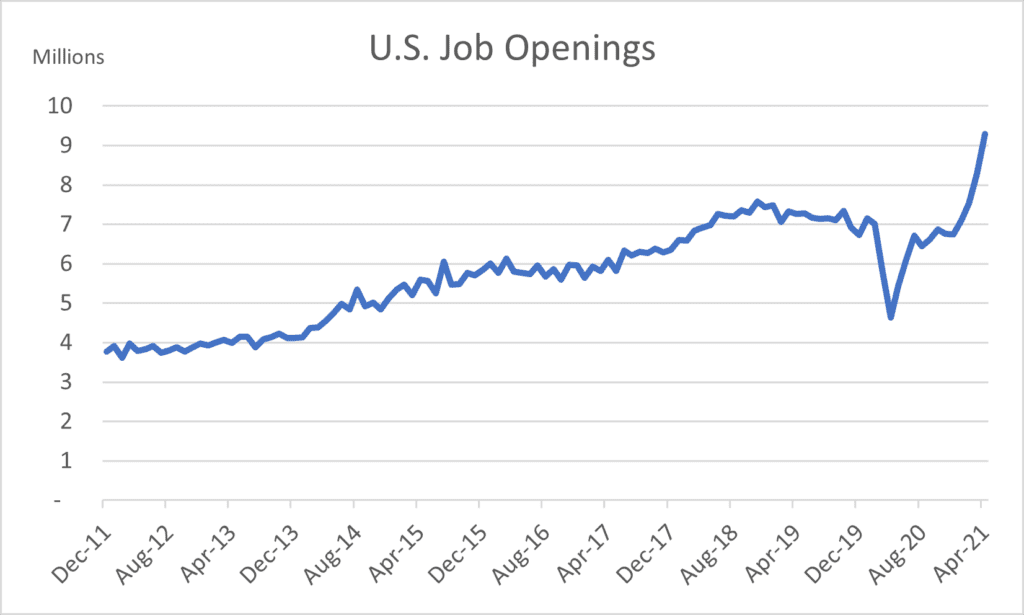

One interesting statistic comes from the BLS JOLTS (Job Openings and Labor Turnover Survey) data which shows that there are almost exactly the same amount of job openings as there are unemployed, roughly 9.2 million. Ostensibly, that’s a job for every person who wants one.

US Job Openings (in thousands); source: Bloomberg, Bureau of Labor Statistics

Factors which are holding back the pace of filling those jobs include:

- A very generous unemployment insurance program (which will either end or be diminished as we move through the summer and into fall)

- Concern about public-facing positions due to Covid-19 (which should be reduced as the amount of vaccinated individuals increases)

- Child care concerns (which should be mitigated when students return to school in the fall)

While it will take time for these concerns to be resolved, when considering the employment situation as a whole, Chairman Powell summed it up nicely, “as you look through the current time frame and think one or two years out, we’re going to be looking at a very, very strong labor market.”

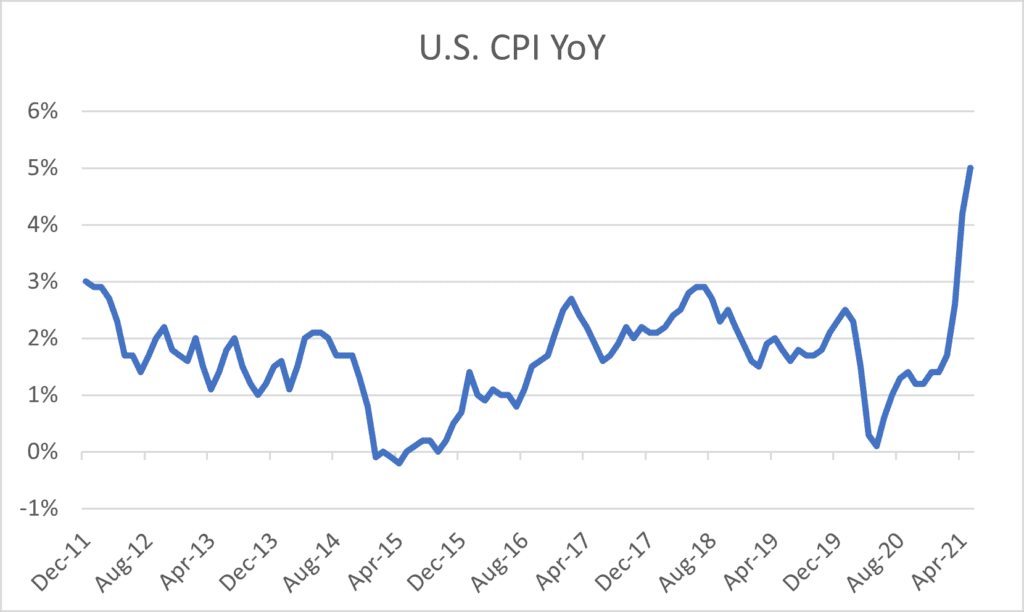

INFLATION

Concern over rising inflation is increasing. The May 2021 Consumer Price Index level was nearly 5% year over year led by Used Cars and Trucks (+29.7%) and Energy (+28.5%). However, the Fed believes this to be transitory as current levels are being compared to an extraordinarily unusual time period and a number of supply chain bottlenecks have emerged as the economy gets restarted.

The Fed has targeted a level of 2% inflation over time. As the economy returns to normal and both the supply chain and jobs market begin to resolve themselves, the Fed projects that inflation will be 3.4% in 2021 and will decline to 2.1% and 2.2% in 2022 and 2023, respectively.

Chairman Powell explicitly said that, “if we saw signs that the path of inflation… [was]… moving materially and persistently beyond levels consistent with our goal, we’d be prepared to adjust the stance of monetary policy.” Said another way, if sustained inflation rises much beyond 2%, expect that interest rates will go higher.

WILL THE FED ‘GET IT RIGHT’?

We are getting closer to knowing the answer to this question. Their current accommodative monetary policy is designed to grow the economy and thereby improve employment prospects. The risk that we continue to monitor is whether inflation will accelerate and be sustained above 2%. If this happens, the FED may be forced to raise rates to combat inflation before the economy is back to full employment. As part of this monitoring process, we will be watching future wage inflation data as wage increases tend to be ‘sticky’ and would be unlikely to be transitory.

Paul Hanson, CFA®

Portfolio Manager

7/12/21