Economic growth needs to slow for inflationary pressures to decline meaningfully, and currently, all eyes are on the Federal Reserve policy changes. However, movements in financial markets are another major factor important to assessing the economic outlook.

What Are Financial Conditions?

The term “financial conditions” describes the environment for business and consumer spending. When we say financial conditions are easy, we mean an environment that encourages spending; when we say they are tight, we indicate an environment that discourages spending. For example, when the Federal Reserve (the Fed) is raising rates, the ultimate goal is to dampen spending, i.e., tighten financial conditions, to slow an overheating economy, or demand that outstrips supply. Conversely, when lowering rates, i.e., ease financial conditions, the Federal Reserve is trying to speed a slow economy or encourage consumption that has been well below supply.

The Fed has a great deal of say over financial conditions, but it is not the only influence. If you think from a business or consumer’s point of view, anything that makes you feel more comfortable spending now will ease. Anything that makes you believe that you should save instead of spend would tighten financial conditions. Financial markets have identified some of the strongest and most common influences on financial conditions in an attempt to quantify whether conditions are tight or easy.

There are generally four components to financial conditions: the dollar, corporate bond spreads, equity market levels, and interest rates at different maturities. Changes in any of these components influence the economy in different ways. A stronger dollar acts to restrain growth via reduced demand for exports. Higher corporate bond spreads curtail lending growth and corporate investment. Lower equity prices suppress growth in consumer spending through the wealth effect. Finally, the overall level of interest rates is a critical component of mortgage rates and corporate borrowing rates. Federal Reserve monetary policy changes influence each of these factors, which then affect the broader economy.

Financial Conditions Today

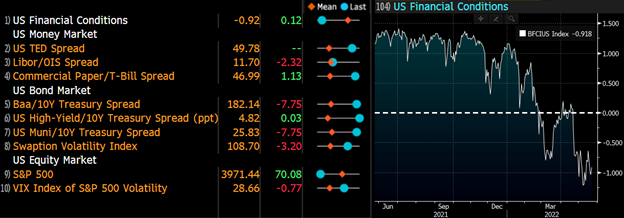

This year, financial conditions have tightened at a much faster pace than the previous cycle, which suggests the Federal Reserve’s recent rate hikes are having an impact. The stock market has been volatile because it is unclear if current conditions are tight enough to achieve slow (but still positive) economic growth and lower inflation or if the Federal Reserve will need to tighten further to achieve its goals. Currently, things seem to be moving in the right direction. Global economic growth indicators suggest growth is slowing, and inflation expectations continue to trend lower.

Source: Bloomberg

Portfolio Strategy

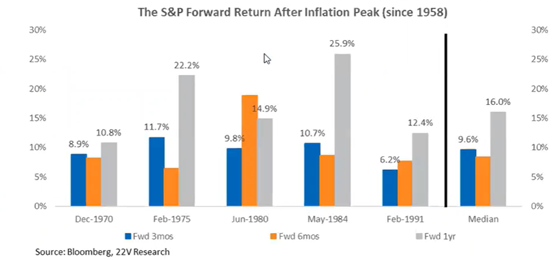

At APCM, we are certainly mindful of the rising odds of a recession, but we also acknowledge there is some probability that financial conditions may already be tight enough. If financial conditions are tight enough and we do not have a recession, markets could reverse and move higher. Below is a historical recap of S&P 500 returns after inflation peaks.

Significantly changing your portfolio strategy based on a directional macro call (recession or not) can be costly. If you make the wrong call, you could severely impact your ability to achieve the returns needed to meet your individual goals and objectives. Just as you can if you make the right call at the wrong time. Though often overlooked, you also likely need to make both calls correct – when the macro environment is poor and when markets begin to anticipate a turnaround. Markets move very quickly (think COVID), so getting back in at the right time to participate in the rebound is extraordinarily challenging.

Our long-term return expectations have not changed. The core of each client’s strategy draws from APCM’s reasonable, forward-looking return projections, which are long-term and incorporate both up and down markets. Including a drawdown of a much larger magnitude than what we have seen thus far this year.

While investors decipher the future path of growth and inflation, markets will remain volatile. APCM has moved to dampen exposure to near-term volatility without jeopardizing long-term goals. We have tilted equity exposure defensive via low volatility and high-quality companies, decreased portfolio sensitivity to rising interest rates, and increased diversification by raising alternative beta and cash exposures.

Brandy Niclai, CFA®

Chief Investment Officer, Multi-Asset Strategies

5/23/22