After three years of positive stock market returns (global stocks average annual return +20.18%), the start of 2022 has been more difficult. Global stocks have traded down -11.8% and U.S. bonds are -8.9% lower YTD through April 27th. However, recent volatility is well within reason and historical norms. APCM’s estimated portfolio volatility across our strategies suggests our client portfolios are still on-path to achieving projected returns over time.

Going into 2022, we did anticipate higher volatility and positioned portfolios to benefit from still positive economic growth, a Fed gradually raising interest rates, and robust consumer and business spending. Then, after the onset of the Russian/Ukraine war and the Federal Reserve’s more aggressive focus on inflation, we added lower volatility stocks and exposure to companies with higher quality earnings. In addition, we reduced sensitivity to rising interest rates within fixed income by reducing maturities and holding more cash. We are also utilizing alternatives to dampen volatility. As a result, APCM’s clients’ allocations across the risk spectrum outperformed both U.S. bonds and global stocks during the first quarter of 2022.

Historical Reflections

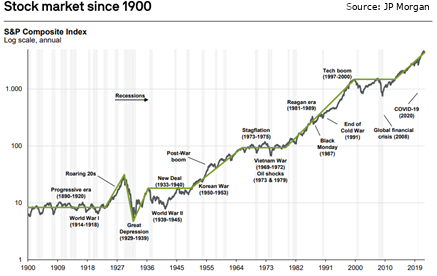

Market volatility is inevitable, prices tend to move around more than fundamentals (earnings, cash flows, etc.) which means there will be times when volatility increases and market prices fall, but over the long-term, the upward trajectory is clear, as shown in the graph below. If you have a short investment time horizon, it is essential to calibrate your exposure to volatility accordingly.

The chart below reminds us that the range of returns can be quite wide over short time horizons, while the range becomes much tighter as the time horizon extends. Therefore, if you have a short time horizon, you should own a higher percentage of lower volatility asset classes such as bonds or alternatives.

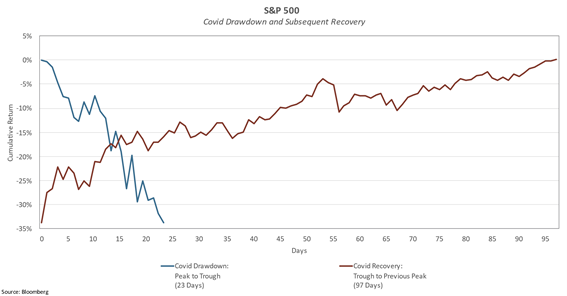

We also need to remind ourselves that markets can move quickly. For example, as illustrated below, during the pandemic, U.S. large-company stocks fell precipitously in just 23 days and recovered all those losses in just a couple of months.

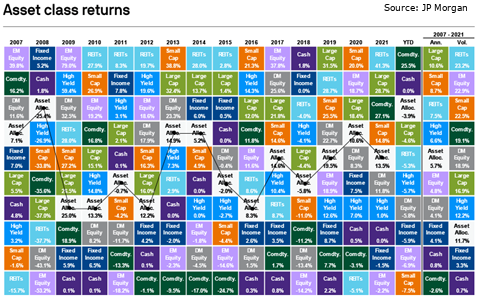

The chart below shows different asset classes’ historical performance and volatility and an annually rebalanced asset allocation portfolio. You can see the volatility in how much an asset class shifts to a different position in each column. The asset allocation portfolio incorporates the various asset classes exhibited and highlights that balance and diversification can help reduce volatility and enhance returns. At APCM, we construct customized portfolio solutions utilizing up to 16 asset classes.

Helpful Tips to Calibrate YOUR Exposure to Volatility

- Only take the risk necessary to achieve your return requirements

Most investors are trying to accumulate wealth to meet a specific future need. Quantifying a clear required return to meet your objective is essential and allows you to understand how much exposure to risk you need to reach your unique goals.

- Spending policies are a vital component of a financial plan as they can help to absorb some portfolio volatility

For example, suppose your goal is to create stable distributions through time. In that case, a well-thought-out spending policy structure can accomplish this even when stock market returns have a period of negative returns if the allocation’s long-term expected return is sufficient.

- Assess your exposure to loss throughout your investment time horizon and not just at its conclusion

This assessment allows you to determine how a short period of negative returns will impact your ability to meet your return goal over time. At APCM, we quantify the range of returns (both positive and negative) we expect a portfolio to experience most of the time. We also quantify exposure to loss in extreme market conditions, such as the pandemic or global financial crisis. Observing actual portfolio returns relative to expectations allows us to confirm our clients are still on a path that meets their goals even when markets are temporally depressed. - Carefully respond to current market conditions

Because markets can turn quickly, you should not dramatically change your portfolio based on current market conditions. You can easily get whipsawed (think pandemic) and miss out on sharply positive days that dramatically reduce your return.

Parting Thoughts on Current Market Conditions

Until there is more clarity on the implications of China’s rolling COVID lockdowns and the magnitude of the European and U.S. economic slowdown, the market faces headwinds, and volatility will persist. But, utilizing our preferred measures of stock market valuations, we do not think the equity market is overly expensive at these levels. Finally, remember risk is exposure to loss and a source of profits. Therefore, down markets can be an excellent opportunity to add to your portfolio while prices are depressed.

Brandy Niclai, CFA®

Chief Investment Officer, Multi-Asset Strategies

5/3/22