APCM understands that these sharp moves in the markets and alarming headlines are extremely unnerving. We aren’t immune to the anxiety ourselves as we think about what the current market environment means to our clients and the beneficiaries of the funds that we manage. But, we also have the benefit of understanding that over the long term, situations like these won’t derail the strategic plan that APCM and our clients worked side by side to put together. It is nerve-racking to be sure, but our clients’ customized strategic asset allocations take into account time horizon and risk tolerance (among other important inputs) for just such situations.

Market risk and exogenous shocks

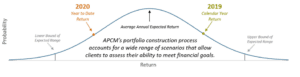

One of the most important ways that APCM works with clients to customize strategic asset allocations is through the portfolio construction process. This process includes modeling a wide range of scenarios from high probability to very low probability events. Of course, we don’t model viral outbreaks specifically, those are exogenous shocks and are unforeseeable and unpredictable. However, we do examine scenarios that are characterized by a turbulent market environment such as what we are experiencing now.

Graphic for illustrative purposes only.

Analyzing goal risk

Once we understand what to expect in turbulent market environments with different strategic asset allocations, we put those numbers into context for our clients. We quantitatively assess the impact of these events on items that matter to our clients most, both during the modeling horizon and at the end of the modeling horizon. This approach then allows clients to not only assess the strategic asset allocation’s ability to meet their specific financial goals, but also qualitatively assess the “comfort” level of each situation before they are faced with it, when emotions and worries run high.

Long term strategies are tuned to current market conditions

While APCM’s modeling of the strategic asset allocation has provided some guidance as to what is possible from a market risk perspective and a goal risk perspective, we also know that an assessment of the current environment can help us to either capture incremental return or mitigate some risk. With regard to the ongoing COVID-19 market environment, valuations, fluid policy responses, and the wide dispersion around virus containment expectations indicate that it is not prudent to sell into the recent market weakness. We maintain close to strategic asset allocation positioning with a conservative, dynamic rebalancing strategy informed by current developments.

Avoid reflexive decisions

Outside of modeling statistics, historical experience illustrates the value of sticking to a well-designed strategic plan. Those clients who remained invested during the Global Financial Crisis experienced a full recovery and subsequent gains.

Vinay Sharma, CFA®, CIPM®

Senior Investment Analyst

3/11/2020