One should consider a long list of data, information, and interactions when determining whether an asset should be included in a portfolio. The entire list would be too much to go into here. However, there is a quantitative measure that is very helpful in determining whether, over the long term, an asset would be a benefit or not to a portfolio.

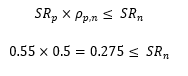

In the equation above, SR refers to the Sharpe Ratio (the amount of return expected above the risk-free rate for each unit of expected risk above the risk-free rate). The p and n refer to the portfolio without the new asset and the new asset, respectively. While ρp,n denotes the expected correlation between the portfolio without the new asset and the new asset.

We need to develop an expected return for the portfolio without the new asset and one for the new asset, expected risk for each, an expected risk-free rate, and an expected correlation between the portfolio and the new asset. Today, I’ll use the historical risk and correlations for the crypto-currency.

For this example, I’ll use Bitcoin for the crypto-currency asset since there is a regulated futures market. I’ll use one of APCM’s higher-risk strategic asset allocations for the portfolio. Looking back to the start of trading for Bitcoin, December 15th, 2017, the realized annualized standard deviation for Bitcoin has been 123.5%.

Next, we need expected returns for the portfolio, the risk-free rate, and Bitcoin.

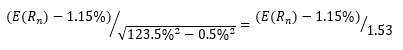

Every year, APCM’s investment committee discusses the long-term outlook for each asset class and determines reasonable, forward-looking expectations based on fundamental return drivers. That information drives our estimates for portfolio and risk-free return and risk. Based on APCM’s most recent forecast, the portfolio’s expected return [E(Rp)] is 7.4%, while the expected risk-free rate [E(Rrf)] is 1.15% with a standard deviation of 0.5%.

We have enough information to calculate the Sharpe Ratio for the portfolio now. Plugging the numbers into the equation, we get:

Next, we need the correlation between the portfolio and the new asset. Using historical data, I get a correlation of about 0.5 between the portfolio and Bitcoin. So now, the first part of our equation is complete.

Becomes:

APCM does not forecast Bitcoin risk and return because there are no reliable fundamental drivers for the price. Without fundamentals that drive returns, there isn’t a way to estimate a reasonable 10-year forward-looking return. So, we’re going to approach this differently. First, I will figure out what the expected return on Bitcoin would have to be for it to make sense to add to this portfolio. To do that, I’m going to fill in the Sharpe Ratio formula with everything I have so far, and let an algorithm calculate the expected return required for Bitcoin to be attractive to add to the portfolio. So, our starting point is:

I let the algorithm do its work to figure out the lowest expected return for Bitcoin that would make it beneficial to include Bitcoin in the portfolio, and I get:

35.1%

Crypto-currencies are high risk and have no fundamental drivers of return. Return expectations would need to be incredibly high, or risk expectations would have to be drastically below history for Bitcoin to make sense as an addition to client portfolios. When the price of a Bitcoin has dropped more than 50% at least three times since the end of 2017, it is fair to say that the market is uncertain of the value that a Bitcoin represents. How can APCM justify a recommendation to add these types of assets to a client’s portfolio when there is such high uncertainty about how much Bitcoin is worth?

When APCM builds a custom strategic asset allocation for a client, we focus on meeting that client’s financial goals over the time frame given to meet those goals with a prudent portfolio that takes the necessary risk to meet those goals. Because if we introduce unnecessary risk, we may jeopardize our client’s ability to meet the financial goals we were hired to help our client hit.

Vinay Sharma, CFA®, CIPM®

Senior Portfolio Manager

8/2/2022