After more than 10 years of relatively low market volatility, bouts of volatility are increasing in frequency which can be uncomfortable. But it is important to remember that while risk is scary, it is also the main source of investment profit. APCM views risk as something that needs to be identified, quantified, and navigated based upon the expectation of being compensated for it and the necessity of taking it. Essentially, investors should ask themselves “Am I taking as little risk as I can while still meeting my financial goals?”

To answer that question, three important (but not exhaustive) lenses to use when examining risk are market risk, goal risk, and implementation risk.

Market Risk – Uncertainty of Future Returns

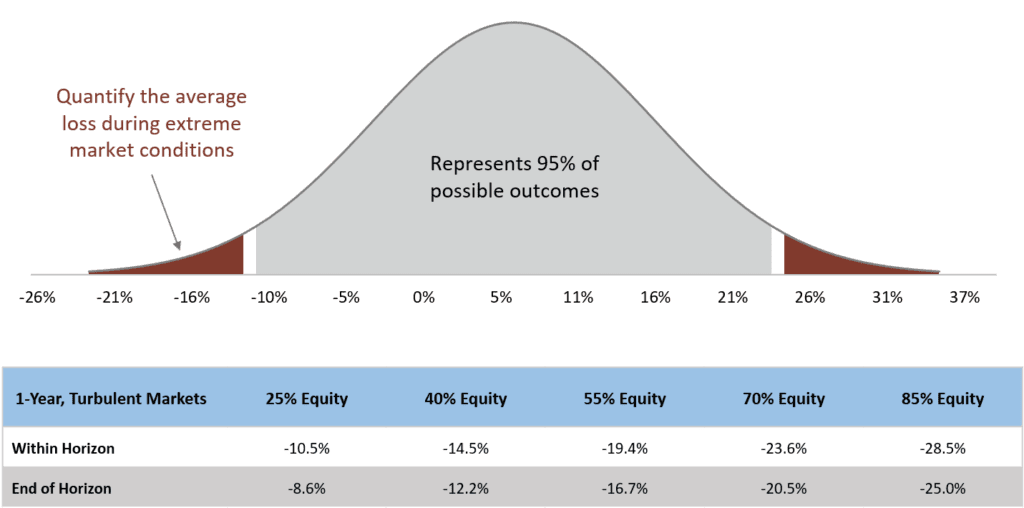

Analyzing the amount of discomfort or “volatility” that must be accepted to achieve a specified level of return can help investors identify their willingness to take risk. Assessing the projected (or observing historical) ranges of annual returns should give an investor an idea of the amount of volatility that can reasonably be expected to occur over long- and short-term horizons. Extending the assessment to include stressful market conditions provides a more holistic picture.

For example, APCM may analyze potential losses in extreme market conditions by quantifying the average loss in such conditions (technically this is the conditional value at risk for the portfolio, which measures the average loss based upon the distribution of expected returns that have a 2.5% or less probability of occurring).

Goal Risk – Likelihood Investor Will Achieve Financial Goals

Observing the range of possible wealth outcomes associated with different levels of market risk helps an investor quantify their ability to take risk. The specific analyses necessary to provide the range of wealth outcomes will be investor specific, because each investor has unique goals, circumstances, and constraints. Maybe there is a minimum required return, a market value that the portfolio can’t fall below, or a required level of distribution stability. Analyzing market risk within the context of the investor’s unique goals and circumstances is an important part of the planning process.

For example, APCM can analyze distribution stability to help clients understand the range of values a specific distribution policy is likely to provide. APCM can even provide stress testing of distribution amounts to help clients understand what the impact of extreme market conditions could be.

Implementation Risk – Ability of Actual Portfolio to Match the Strategic Plan

First, it is important to understand that all investors take on some level of implementation risk because they must purchase the portfolio modeled during the strategic planning process. However, investors have a couple of levers that can be pulled to manage the level of implementation risk.

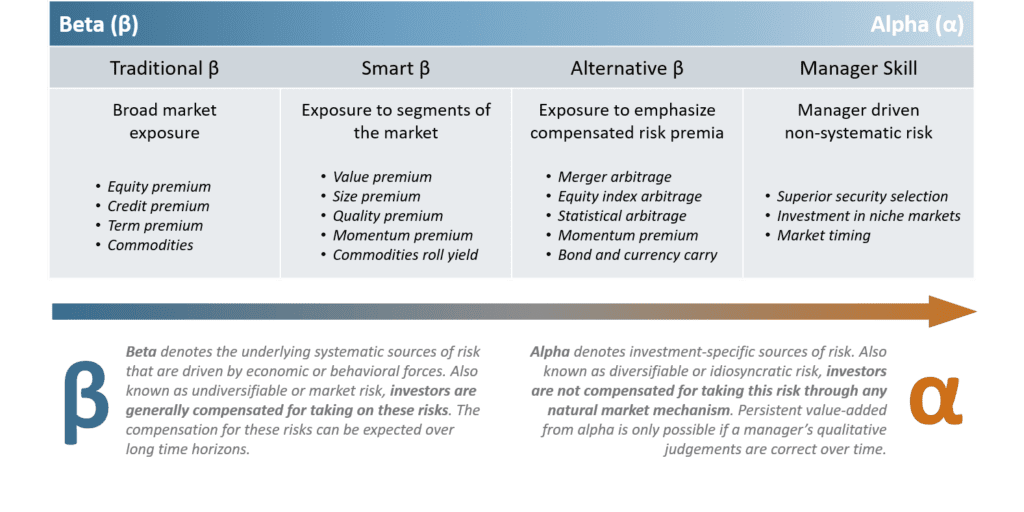

The first lever is the list of allowable investments. Investors often model traditional beta (market risk) but do not restrict a manager from purchasing something different. For example, if the model is based on the S&P 500 for U.S. Large company stocks, but an active U.S. Large company manager is chosen as the investment vehicle, implementation risk rises. Investors should understand the ways in which investments allowed could deviate from the asset class as modeled.

The second lever is the leeway the investor allows the manager to differ from the strategic asset allocation target weights. For example, the chosen strategic plan may have a target weight of 20% for U.S. Large company equities, but you may allow the manager to be +/- 5% from that target. Investors should understand and be comfortable with the differences in performance that could arise based on the leeway provided.

Final Thoughts

A deeper understanding of true risk exposures helps prepare investors for down markets and can prevent market-driven departures from sound investment strategies. The investment landscape is filled with risk, but an effective strategic plan doesn’t mean avoiding risk – it means knowing the risks you are taking. This mindset drives APCM’s strong focus on the importance of the planning process not only initially, but on an ongoing basis.

Vinay Sharma, CFA®, CIPM®

Senior Investment Analyst

10/2/19