After a market friendly October, investors find themselves back in a world of rising rates. The Federal Reserve communicated two main messages when it hiked 75bps last week: (1) the path of rate hikes will slow but (2) the end point is likely going to be higher. After the meeting, short-term Treasury yields hit their highest level since 2007. We expect further rate moves higher (albeit at a slower pace). As such, we remain defensive in our outlook while highlighting the value short bonds offer investors is currently the best in over fifteen years. Creating a high quality 5.3%.

Key messages from the November Fed Meeting

- FOMC is getting closer to slowing the pace. The Fed has been embarking on its tightening path since March. Policy tightening has three stages (1) raising rates rapidly to catch up (2) raising rates at a slower pace, and (3) holding rates at a given high level. We are transitioning from (1) to (2). 50bps hike is expected at the next meeting.

- Higher terminal rate than expected in September. They acknowledged a lesser chance of a soft landing. To quote the Fed Chair “We’ve always said it was going to be difficult.” “To the extent rates have to go higher for longer and stay higher for longer, that path has narrowed.” A new set of forecasts will be released on December 14th.

- No discussion on pausing. “I would also say it’s premature to discuss pausing. And it’s not something that we’re thinking about. That’s really not a conversation to be had now. We have a ways to go…..I would want people to understand our commitment to getting this done and to not making the mistake of not doing enough or the mistake of withdrawing our strong policy and doing that too soon.“

- Tough talk on inflation continued, and more flexibility needed going forward. “I have a table of the last 12 months, 12month readings and there’s no pattern. We are exactly where we were a year ago”. Two pieces of language were introduced to the meeting statement that, “monetary policy is sufficiently restrictive to return inflation to 2 percent over time” and “the Committee will take into account the cumulative tightening of monetary policy ”

A higher and higher path that peaks in May

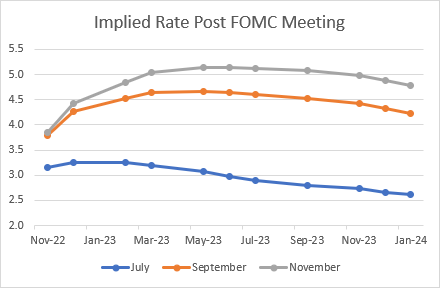

How does this affect portfolios? The chart below is the forward expected rate path for the US. Since summer, this has consistently been revised higher as inflation has remained more resilient. Currently the market is expecting rates to rise through May of 2023 with overnight borrowing costs peaking around 5.0%. In total there are an additional 125bps of hikes expected – with the consensus scenario of 50bps in December, 50bps in February and 25bps in March.

|

|

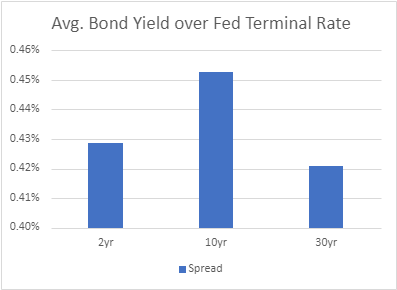

Source: Alaska Permanent Capital Management, Bloomberg. Spreads calculated versus Terminal Fed Yield starting January 1984 to December 2018.

We won’t portend this is the last “update” of the market’s outlook – but investors can see that upside revisions have gotten less and less (creating an upper bound on expected borrowing costs). Since investors generally require a premia on their cash for lending it out further into the future – we anticipate that bond yields would be fairly priced around 5.50% depending on the tenor. Since the mid-80’s, the spread premium (the amount that longer dated bonds yield over the discount rate) has averaged around 45bps as the Fed approaches peak rates. If the Fed’s terminal rate is at 5%, this is how we arrive at 5.50% as plausible.

Since this is roughly 75-100bps higher for yields versus today, we retain our cautious outlook.

A quick word on Bonds 101. At its simplest, bond prices are a stream of interest payments (the coupon) on an underlying principal and a return of that principal at maturity. Bond prices fall as yields rise as discounted future coupon payments are less when the interest rate increases. i.e. a rising rate means the value of the expected cash stream for the bond today is lower now than what an investor could get previously. Rising rates isn’t such a problem for short dated bonds (also called low duration) as they quickly mature and you can reinvest the principal at a higher rate. But if we are talking about the long end of the curve say 10-30 years in the future (high duration), that extra income is given up for a very long time. Of course, the exact opposite happens when interest rates fall – which is why bonds have been historically favored in contractionary cycles and recessions.

Positioning for a stable source of return – a “high quality 5.3%”

While we remain conservative, we are also anticipating the end of the fixed income bear market is approaching. An additional +100bps of higher rates is just about ¼ of the move captured over the past 6-months. To lift a baseball analogy, we’re already past the 7th inning stretch. At a certain point you have to weigh staying in your seat versus heading to the carpark.

In our previous blog we highlighted that despite a negative outlook, a large amount short-term and corporate debt is as attractive as its been in 15 years. This case has only strengthened since then. We can be bearish on rates, but because of bonds hold defined maturities, many short term bonds offer excellent returns at low risk. For conservative investors, that’s a welcome relief after years of being stuck at zero interest rates.

As an example – investors interested in 5.3% returns (duration of 2 years and volatility 2.3%) can construct a 50/50 portfolio of US Treasury Notes and Investment Grade Credit. The additional spread US corporates give over treasuries and low chance of near term default offsets the remaining negative rate risks. A 1-3 year all credit portfolio yields almost 6%. If willing to hold to maturity, investors can lock in the strongest returns in years that let you sidestep almost all market uncertainty in 2023.

Such value in the short end is one reason why fixed income managers tend to be more popular these days.

Richard Cochinos, CFA®, CAIA®

Senior Portfolio Manager

11/7/22