The stress in the markets has left no rock unturned. Pain in the equity and credit markets found its way to the municipal markets in March and April. Generally, municipals are stoic investment vehicles that are bought and stashed away into retirement accounts, never to see a trading desk again. These are instruments that historically have low default rates, little price movement, and give an investor a sense of calm.

Lately we have received many inquiries and questions regarding the municipal market both from our institutional and individual wealth management clients. Here, we attempt to shed some light on how APCM thinks about municipals.

Municipals can be broken out into many sectors and characteristics. The two broad classes of municipals are bonds that are either General Obligation bonds (GOs) backed by the government’s full faith and credit, or Revenue bonds that have a dedicated stream of revenue pledged for repayment of the bonds. Examples include transportation (e.g. airports and toll roads/bridges) or water/sewer bonds.

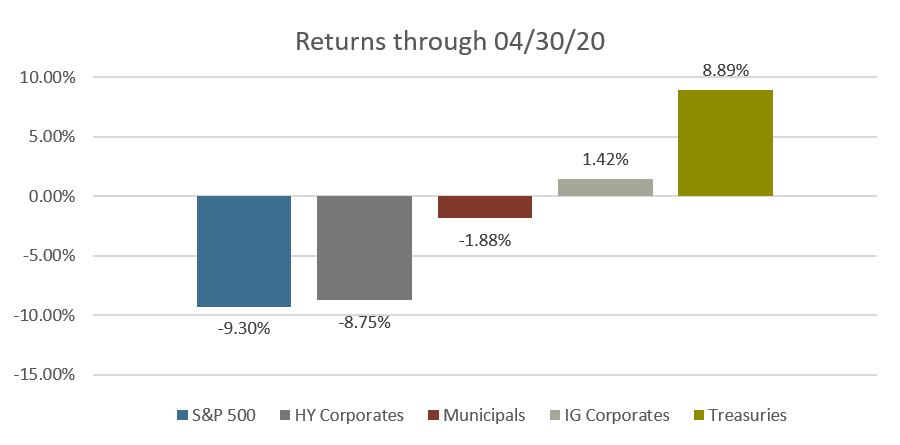

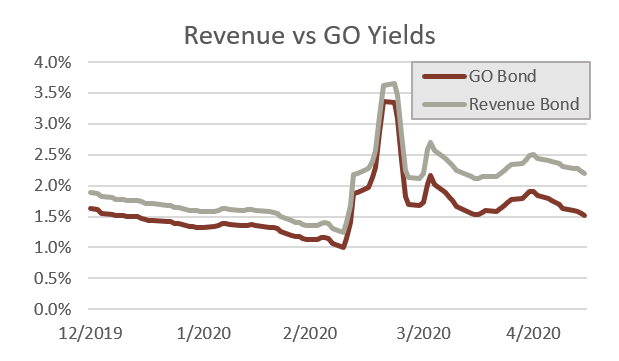

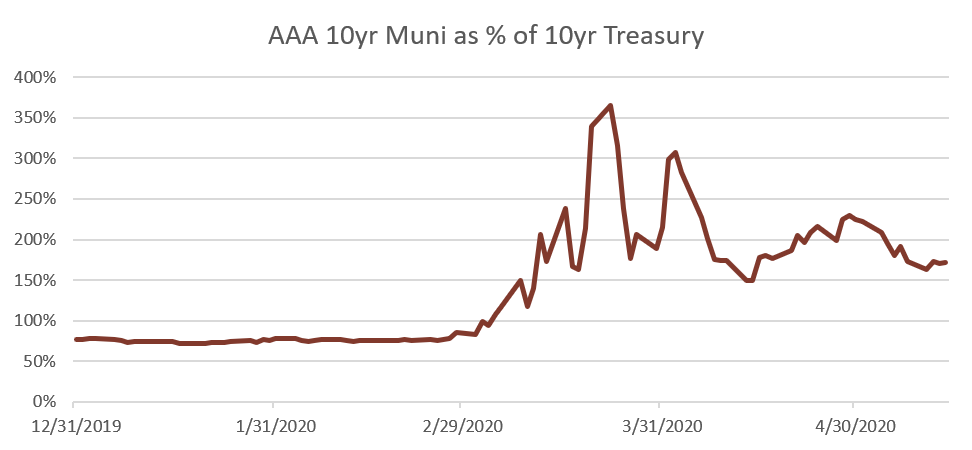

Municipals had a rough start to 2020, especially compared to Treasuries. The spread between the yield on a municipal vs a yield on a Treasury has widened significantly. Recently, short dated municipals were paying 4x what Treasuries paid. Longer term maturities were about 1.5x. In a normal environment municipal yields are below treasuries. The market dislocation in municipals stemmed from two main reasons, a “flight to quality” and also a “flight to liquidity” as demonstrated by the outflow of municipals. The greatest one-week outflow of funds from municipals happened in late March. It was 2x the previously greatest historical one-week outflow. During the peak, muni ETFs experienced weekly outflows of greater than $1.5 billion.

Although outflows have moderated, market participants have started pricing in weaker fundamentals for state and local governments. Looking back in history, state tax collections declined substantially after the Global Financial Crisis. Morgan Stanley points out that during the period of 2008-09, Real GDP was -2.5% while State peak to trough total tax collections, personal income tax collections, and sales tax was -9.5%, -14.5%, and -8.0%, respectively. Currently, economic consensus forecast for Real GDP is -5.6%, much more severe than the Global Financial Crisis. Tax revenue across all state and local governments will be impacted. Brookings Institution notes, “that state taxes fell 17% and personal income taxes fell 27% in Q2 2009.”

Volatility is expected to remain elevated in the municipal market but should be much less than experienced in Q1. APCM believes outright defaults in the short-term will remain muted. The Federal Reserve is finalizing the final details of the highly anticipated Municipal Lending Facility (MLF). This facility will help state and local governments issue short-term maturing notes. The MLF will help municipals in the near term but it will not fix long-term fiscal health problems brought on by potentially sustained revenue losses. State and local governments will have to balance budgets using austerity or will begin to deplete their reserves. None of the above tackles what ratings agencies view as the elephant in the room for many issuers … long-term unfunded pension liabilities.

Default rates for municipals are typically below corporate default rates. JP Morgan points out that, “rating agency default studies reflect slight avg annual default rates of 0.015% (1970-2018). The ten-year cumulative average annualized default rate for munis is a mere 0.2%, compared to corporates (7.7%) and sovereigns (6.7%). We expect the default rate to climb slightly over time but to remain very low when compared to corporate and sovereign debt.

More problematic in our eyes is the risk of downgrades by rating agencies which will create price volatility and idiosyncratic risk. However, for holders of municipal debt who do not intend to trade their muni investments and instead plan on holding positions through maturity, the impact of a downgrade is minimal assuming the debt will continue to mature as expected.

APCM Investment Approach

Our Muni fixed income investments are limited to investment grade issues, typically ‘A’ rated and above. Over the past month, where appropriate for our clients, we have been taking advantage of the increase in yields by selling treasuries and purchasing higher-yielding muni securities. We have leaned toward purchasing municipals whose repayment is based on sources that should be less affected by Covid-19. Examples include General Obligations, school district bonds or those revenue bonds secured by property taxes or water/sewer fees. We have also purchased muni securities that are pre-refunded as these securities have dedicated collateral in an escrow account pledged to pay for the bond when it matures. In general, we have avoided bonds that are backed by revenue streams such as bed or rental car taxes, hospital bonds, or transportation bonds (e.g. road/toll and bridge) as these could face head winds. The influence of the virus on the municipal bond market will depend on the length and severity of the impact of the virus. APCM will be closely watching the timeline of the reopening in different parts of the country and on changes of state and local revenues.

Bill Lierman, CFA®

CIO – Fixed Income

Charts Data Sourced from Bloomberg.

05/15/20