A new headline flashes across the bottom of the screen: “Stocks Fall and Bonds Rise on Trade Fears” and then mere hours later, “Stocks Rise and Bonds Fall on Trade Deal Progress.” It is natural for market participants to assign a specific reason for market reactions. But how do investors decide which information is relevant and impactful? Further, does this daily deluge of market information truly help investment decisions? Some news may simply be noise, temporary market moves that push assets away from true fundamental value. The idea of noise is surprisingly dismissed under the long-held tenet of classical finance theory, the Efficient Market Hypothesis (EMH). However, noise is embraced by behavioral finance, a supplement to traditional finance theory that considers how the human psyche impacts market behavior.

Under the Efficient Market Hypothesis, prices always reflect fair market value. Any market moves pulling assets away from their fair market value, market mispricing, would be noticed by rational market participants and brought back to fair market value via risk-free arbitrage. For this commentary we will consider the “Strong-form EMH”, which assumes the greatest market efficiency as well as fully rational market participants. These participants can process all available information, update their position as new information comes to light, and maximize their own self-interests. Unfortunately, there is an incongruency between this underlying assumption of full rationality and actual human behavior.

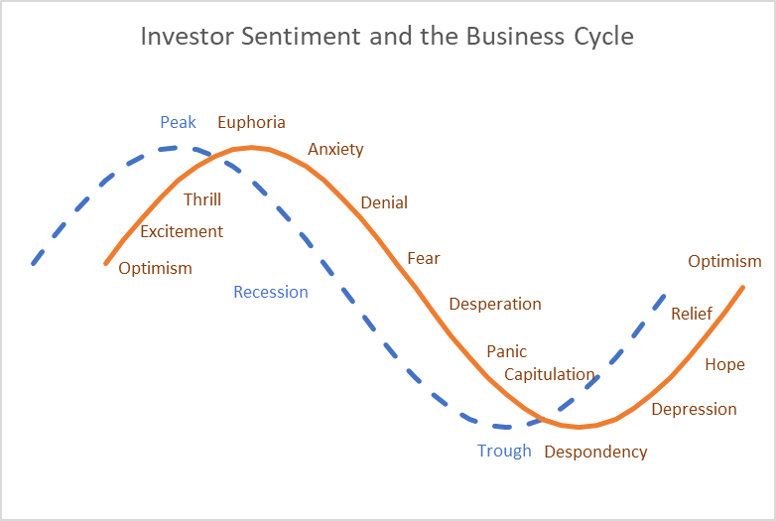

Behavioral finance arose to address this incongruency, offering a myriad of theories to explain the irrational investment behaviors surrounding bubbles and panics. Instead of assuming every actor is fully rational, the limits of human knowledge, bias, and mental capacity of market participants is considered. Our brains aren’t wired to be perfectly functioning machines, processing all information in real-time. Humans often think associatively rather than statistically, simplifying a string of complex relationships. One such method of simplification is the tendency to overweight recent or easily obtained information, formally known as the availability heuristic. This results in an overestimation in the likelihood of these recalled events. A classic example is the overestimation of the likelihood of a shark attack, despite the relatively few shark attacks experienced each year. Another method of simplification is seen in herding behavior, the tendency to follow others. This behavior puts the onus of critical thought on others, seeing herd reaction as a market signal. This creates noise and shifts in sentiment which can drive changes in prices. Consider these headlines from the WSJ in 2000.

Gen Xers’ Stock Vocabulary Is Missing One Word: Crash (March 27, 2000)

Nasdaq Plunges 4% as Investors Again Dump Technology Stocks (March 31, 2000)

Nasdaq Index Skids 199.66 Points, Spooked by Interest-Rate Concerns (May 24, 2000)

Nasdaq Composite Index Leaps a Record 7.94% (May 31, 2000)

EMH would argue that for each headline the market had updated its beliefs and that the new current prices during the bubble fully reflected all available information. Behavioral finance would argue that the bubble exhibited herding behavior by investors, pushing prices up to create the bubble, then subsequently pushing prices down to exit the bubble. Reacting to more recent events can trigger such herding, potentially driving an overreaction.

News cycles can create noise, whether it be a looming threat, a rare opportunity or ultimately meaningless. In late 2018 it was the impending doom and gloom caused by the unsustainability of the current credit cycle. 2019 was dominated by the China-US trade war, initially gloomy but ending on a positive note. 2020 news has already seen a potential middle east crisis, a U.S. Presidential impeachment trial, the U.S. election cycle and the Coronavirus outbreak. Distinguishing whether specific events are justifiably moving markets under EMH, creating enough noise via behavioral channels or will remain a mere footnote creates both challenges and opportunities for effective portfolio management. Turbulent markets are ripe with market noise, making identification of the more nuanced stories more difficult. APCM recognizes the potential pitfalls associated with the daily news cycle and the potential biases investors face. We are here for our clients in all market regimes, no matter how volatile.

Alexander Emili

Investment Analyst

2/5/20