We’ve received multiple questions on the outlook for rates and how much higher they will go. To reiterate our view at APCM – We favor a duration underweight relative to the benchmark, and are positioning portfolios for a flatter yield curve (short-term yields rising faster than long-term yields). In the real economy, this translates to higher mortgage costs and higher business costs in the future, which should be a part of planning and budgeting discussion now. Given the likelihood that higher volatility is going to be a part of most portfolios going forward, we anticipate active duration management to be a more significant source of alpha than in the past.

2022 is different from other hiking cycles with QE ending, rates expected to rise, and balance sheet reductions all expected to begin in the next few months. To put this in a historic context, this is expected to be the fastest pivot by the Federal Reserve exiting a recession in over 30 years. Currently a total of six 25bp hikes are expected in 2022 (starting in March). Consensus forecasts suggest a 10y benchmark around 2.2% by year end, rising to 2.5% in 2023.

Investors need to be defensive regarding interest rate risk. The US Federal Reserve isn’t acting alone – the UK, Europe, Canada, Australia and numerous Emerging Market countries have either signaled higher rates in 2022, or are already well into a hiking cycle. If 2020 and 2021 can be thought of as the great accommodation, 2022 is the great policy removal.

Focusing on the US, the dynamics for higher rates can be unpacked into three drivers:

- QE purchases will stop in early March 2022. Up until November the Fed was purchasing $80bn of Treasuries per month, and $40bn of agency debt. While this has been falling by 15-30bn/month since then, it falls to zero very soon. These structural purchases of course would need to be replaced by the private market, which they will, but private investors will always demand a higher return than the Treasury. 2022 is being marked by greater economic uncertainty and policy uncertainty than 2021. It is natural that the market will demand greater return for the risk.

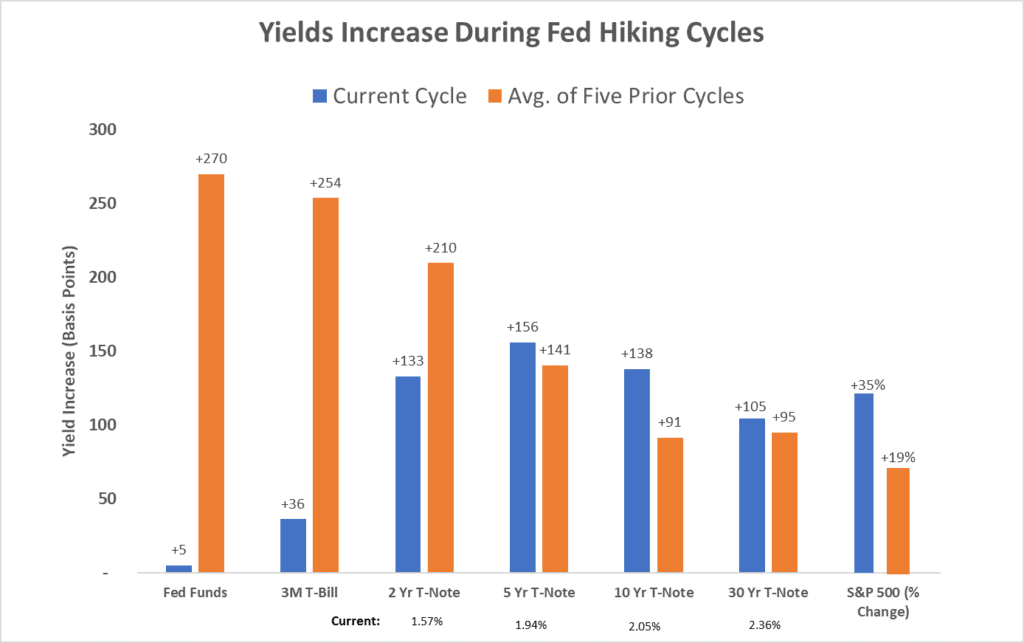

- The Fed is embarking on a multi-year tightening cycle – driven by tight labor markets and persistently high levels of inflation. Currently Fed hikes are expected in March, May, June, September and December of this year. Although the 5y, 10y, and 30y rates moves to date are similar to what markets have seen over the last five hiking cycles, the 3-month and 2-year notes have ample room to move upward (see Chart 1 below). In addition, the change in the Fed’s inflation mandate in September 2020 to allow inflation to extend above 2% from the previous fixed target of 2% has created additional uncertainty how much rates can overshoot when comparing to prior cycles.

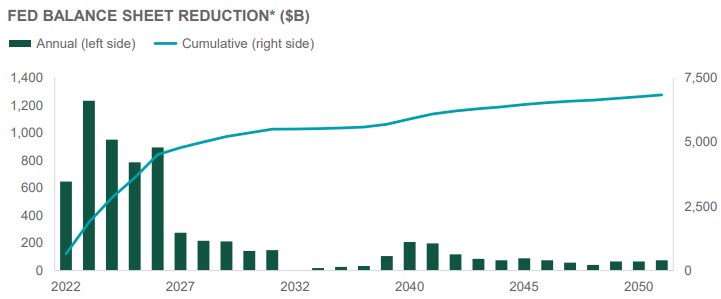

- The Fed’s balance sheet will fall when maturing securities are not reinvested. As bonds held on the Fed’s balance sheet expire, new ones won’t be bought and the money will be returned to the US Treasury. This is also what is known as Quantitative Tightening, and will lead to roughly $100bn reduction in the Fed’s balance sheet monthly, or $4.5tn over the next five years (Chart 2 below). While these number may seem large, the balance sheet has grown by over $4tn since March 2020. At a natural rate of attrition (meaning no active selling) it would still take until 2026 before the balance sheet regains its pre-COVID size.

Yield Increase During Fed Hiking Cycles

A Natural Wind Down – Fed Balance Sheet Can Normalize Without Selling

How three pivots work their way through markets

The asset view is never as clear-cut as the monetary adjustments laid out above. Although the direction of travel may seem obvious, there are usually potholes in the road keeping investors and portfolio managers humble. Market prices depend on (1) the pace of that which is expected comes to fruition, as well as (2) expectations on how that pace is changing (i.e. market sentiment).

We are cautious and proceed nimbly. How a portfolio has “felt” in the recent past is going to change. Elevated valuations across many asset gives us concerns that not only will market volatility be higher in the coming quarters, but the tails to long-run outcomes may indeed be getting fatter than in previous mid-to-late cycle adjustments. Kevin Warsh (a Former Fed governor) recently suggested in the Wall Street Journal financial stability is now a real risk given the length of the FOMC’s post-COVID response.

Without taking a stance on if a personal view is right or wrong – we are comfortable saying the overlap between Fed policy and Financial markets is now more intertwined than it was pre-2020. Hence, the upcoming months will be important in setting the path for many assets, not just fixed income. We want to remind readers this is not inherently negative. In expecting a wider range of outcomes, the tendency of media and strategists usually emphasizes too much on the downside, but investors should also be aware of the equally positive upside tails as well. All of which suggests that a discussion on risk and your tolerances early in 2022 is prudent if you’ve not had one for a while. Finding the right level of volatility you are comfortable with is critical in maintaining any long-run investment plan.

Wrapping it all up

“As an investor, you love volatility. You love the idea of wild swings because it means more things are going to get mispriced.” – Warren Buffet, 1997

Our bottom line is rates are likely to move higher with a more uncertain path than investors have experienced since 1994 when Allen Greenspan raised the overnight rate by 3% in the span of a year, the Fed eventually had to cut. Defensive strategies regarding interest rate risk make sense to us. The fed is likely to pull three monetary levers in the near term, which for all practical purposes suggest to us higher yields and more expensive borrowing costs that need to be factored into retail and institutional planning. You can reduce sensitivity to rising rates by leaning toward an underweight to portfolio duration. Despite the likelihood of heightened volatility throughout 2022, this can provide an attractive opportunity set for investors. We expect duration management to become a more important factor in investment returns than in the past.

Richard Cochinos, CFA®, CAIA®

Senior Portfolio Manager

2/16/22