Short Squeezes are spooky – they raise market volatility and can lead to forced selling helping drive markets lower (as was the case with Game Stop and AMC last week). That said, their effect is generally short lived and not a problem for investors that are properly diversified. We’re going to cover the basics below and include a few historical examples that help put last week’s moves in context. It’s important to remind our readers that APCM’s investment approach mitigates many of these risks, and for investors that hold long-run objectives, such periodic sell-offs present opportunities.

We’ve all read about GameStop – so what happened?

Short selling is a strategy where investors borrow shares of a stock from a broker (at a certain price) with expectations the price will fall. They sell these shares on the open market and buy them back when it’s time to close out their position with the broker. If the price of the stock is lower than when they borrowed them, the investor keeps the difference, and the strategy is profitable. See the figure below.

Source: Financial Times

So, what’s the problem with such an approach?

Wherever there is potential for profit, there is also potential for loss. The risk of short selling would be if an unexpected piece of favorable news caused the stock price to jump. Good news happens just as often as bad, and in such an instance, short sellers would need to buy back the stock at a higher price taking a loss. Here is the problem, they might not have enough available cash to do so, in which case they must sell other stocks to raise the money.

A short squeeze results when short sellers move to limit greater and greater losses by covering their positions, purchasing large volumes of stock relative to what would be normal. Of course, simply repurchasing the stock raises the value of the shorted stock, triggering more short sellers to cover their positions and buy back the stock. This dynamic results in a cascade of stock purchases, an even bigger jump in share price, a rise in volatility and greater pressure to sell even more assets to cover them.

Short squeezes are most likely to occur in stocks with a small number of traded shares, small market capitalization and small floats. Short squeezes may also happen when a large percentage of a stocks float is short, or when large portions of the stock are held by people not tempted to sell.

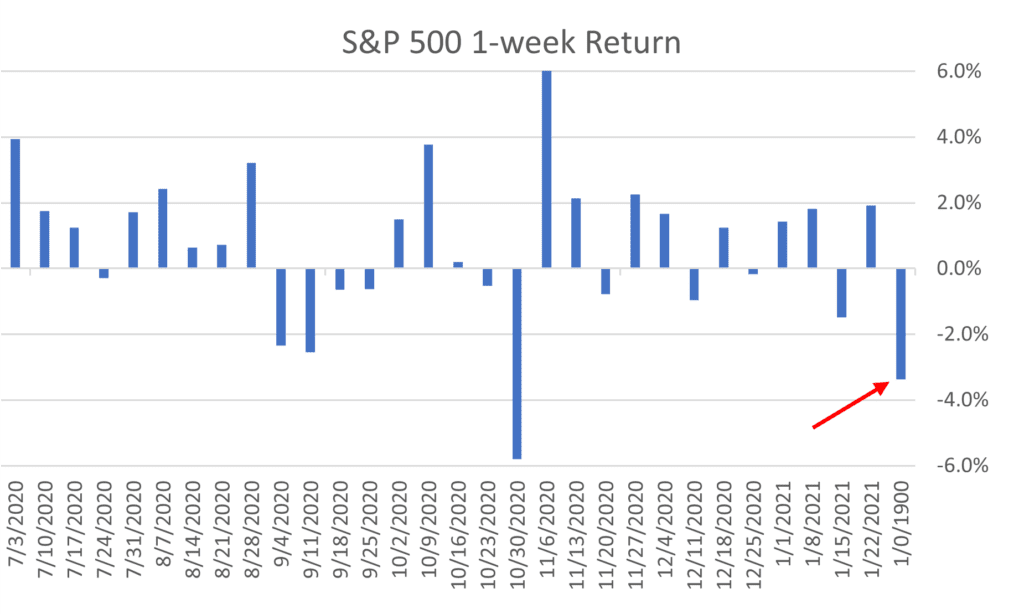

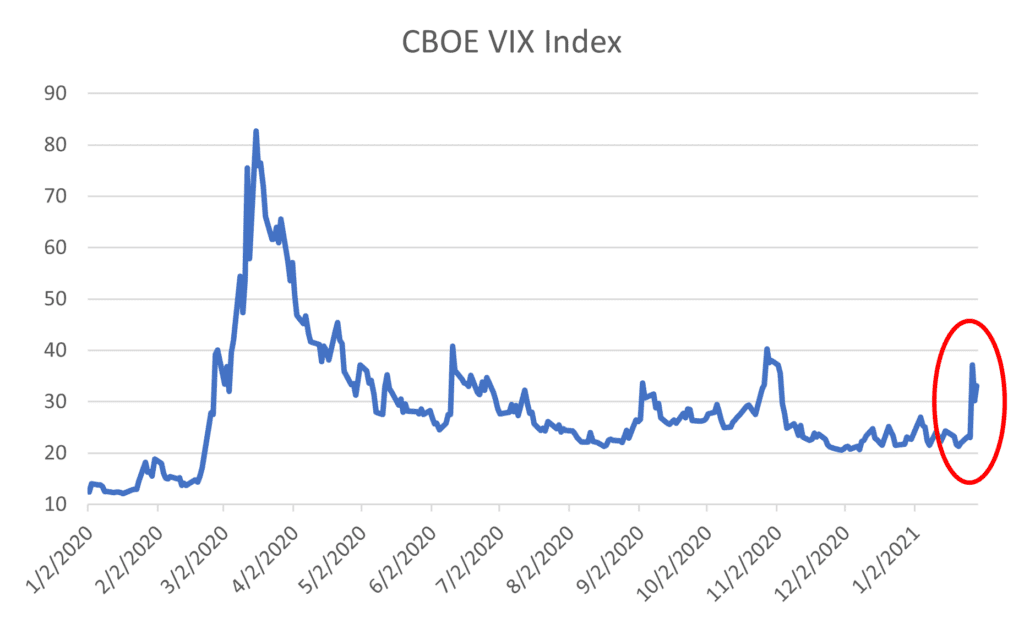

Wall Street’s Worst Week Since October

These dynamics unfolded last week, and markets logged their worst performance in over three months. The CBOE VIX Index – an index of options volatility and dubbed Wall Street’s fear gauge – closed the week at 33.09, well above its 15-year average of 18.9. Such a rise in volatility typically encourages investors to reduce risk – helping to explain the market decline from record highs earlier in January.

Source: Bloomberg, Alaska Permanent Capital Management

Is such a trigger likely to repeat?

Yes. Market history is filled with examples, but the market always recovers. Two well-known examples that hold parallels to last week:

- Hill & J.P. Morgan battled with E.H. Harriman over control of the Northern Pacific Railway in 1901. Neither party were looking to sell their holdings, and eventually the two parties owned over 94% of available shares. That triggered a sell-off in the rest of the market as short sellers had to liquidate their other holdings to raise the capital needed to buy back Northern shares. The ensuing stock market crash is what is known as the Panic of 1901.

- October 2008 – An attempted takeover by Porsche drove shares of Volkswagen AG over 400% in two days, briefly making Volkswagen the most valuable company in the world (Wikipedia). Hedge funds are estimated to have lost some $30 billion by betting VW’s price would decline. Ultimately, Porche’s CEO, Wiedeking, was charged with market manipulation over his role in the event. A point to emphasize here is although the squeeze had a dramatic effect on price, within two months it had returned to normal levels.

Other examples include:

- Cornelius Vanderbilt and the Harlem Railroad – 1862

- Clarence Saunders and Piggly Wiggly – 1923

- Bill Ackman and Herbalife – 2012

- Household names such as Netflix, Tesla and Barnes and Noble all have been subject to short squeezes on their share price at times.

How does the APCM approach avoid such volatility and risk exposure?

As a firm we do not take short positions, nor do we invest in single stock names. My colleague has a framed photo on the wall behind him of “No Big Bets”. That summarizes nicely our philosophy and approach to diversification and risk control.

The choice of asset classes and the subsequent weighting within the allocation strategy will have more impact on the long-term performance of an investment portfolio than any other, including dislocations like last week.

In portfolio construction, we limit implementation risk by using investment vehicles that provide the purest exposure to the asset classes modeled. Idiosyncratic risk is eliminated by APCM’s approach of investing cost efficient index funds to provide clients with precise portfolio exposure.

More broadly, we see three sources of portfolio return: strategic asset allocation, tactical asset allocation, and security selection. While strategic asset allocation is the primary driver of long-run returns, APCM’s investment process is designed to add value in each of these areas. Volatility from short squeezes and market dislocations is an opportunity for us to rebalance and reinvest along these long-term goals.

In short, APCM’s approach is to provide clients with a diversified portfolio exposure that minimizes idiosyncratic risk and is designed to outperform actively managed accounts through multiple market environments.

Richard Cochinos, CFA®, CAIA®

Senior Portfolio Manager

2/1/21