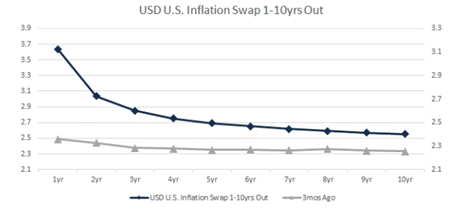

Whether you are hosting a dinner party or building a new home, things are noticeably more expensive. Inflation is climbing higher – a significant departure from expectations earlier in the year. When we published our annual outlook, consensus expectations were for a modest rise in inflation from +1.4% to +1.7%, below the Federal Reserve’s +2.0% target. Just three months ago investors expected +2.5% inflation over the next year vs. +3.7% now (inflation swap graphic below). Temporary supply constraints, excess demand driven by unprecedented stimulus, labor shortages, and the Fed’s firm commitment to accommodative policy; are all contributing to inflationary pressures (April 2021 Core PCE 3.1%).

Some investors remain worried that the Fed will have to tighten rates aggressively to offset persistent or higher than anticipated inflation, challenging the generally positive outlook for the stock market. We evaluate the contributors to inflationary pressures below and note that it is too early to conclude we have entered into a new higher inflationary regime (after the past decade’s failure to reach the Fed’s 2% target) and thus maintain our modest equity overweight. We are closely monitoring inflation dynamics as we remind ourselves that the pandemic has created an unprecedented market environment. Policymakers are making decisions that have never been tested and the evolution of inflation and labor dynamics, I suspect, will also be unique relative to history.

Temporary supply constraints

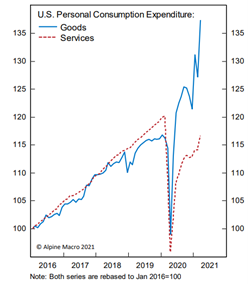

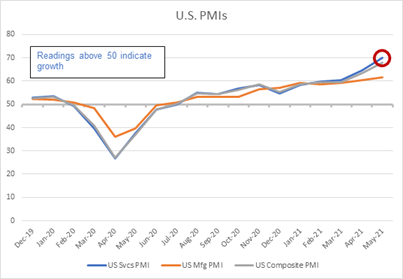

Despite the tumultuous period we have experienced with the emergence of COVID, personal income actually rose during the recession, and American households’ net worth has surged more than $20T from a year ago. Consumption habits shifted from services to goods as service sectors shut-down (US Personal Consumption graphic below), while global producers of commodities (i.e., lumber) scaled back expecting the opposite reaction. Instead, producers ended up with a surge in demand as people set up home offices, invested in home improvements, and bought automobiles so they could avoid public transportation. This supply and demand imbalance has allowed companies to increase prices for now, but the pace of price increases is slowing, which suggests we may have seen the peak. In the coming months, we expect strong domestic demand to persist, contributing to modestly higher inflationary pressures as supply imbalances normalize. We should see a pick-up in inflation as the service sector fully reopens, but also some deflationary pressure from the goods sector as consumers shift spending back to the service sector (US PMI graphic below).

|

Source: Alpine Macro |

Source: Markit |

Labor Shortage

Employers have been reporting difficulties filling open positions despite over 8M more unemployed workers versus pre-pandemic levels. The factors contributing to this labor shortage are clearly linked to the pandemic as many people still face significant barriers to returning to work. Health reasons, supplementary unemployment insurance benefits in excess of regular income, and lack of childcare are the primary challenges. These barriers should be significantly reduced when schools reopen in the fall and unemployment benefits expire in September. When it’s hard to fill jobs, employers have to raise wages to attract workers. Employers may then need to raise prices to cover the rising wage bill. That is not transitory inflation! This is a hugely important issue for the Fed because if the stock of available workers is high, wage growth should stay subdued and contain inflation.

Patient Fed

For investors, the inflation outlook is important because it affects Fed policy, and thus interest rates and equity valuations. The Fed has clearly communicated it will not hike rates until the 12-month PCE inflation is 2% or higher (this has already occurred) and labor market conditions have reached a level consistent with the Fed’s assessment of maximum employment (unemployment rate currently 5.8% vs. 3.5-4.5% target). Labor market developments are a key indicator to watch in the coming months. For the Fed to attain their goal, we will need to see large gains in average monthly nonfarm payroll growth. Adding 830k jobs per month would attain full employment by the end of 2021 and 412k per month would get us there by the end of 2022 (latest print 559k). It is possible to see gains of this magnitude as barriers to returning to work fall. But there is still enormous uncertainty as it is probable the pandemic drove changes to consumer behavior which will influence future employment trends.

Portfolio Positioning

We still forecast that a strong global recovery will support robust corporate earnings and stocks will outperform bonds in 2021, but we now acknowledge the risk of higher or more persistent near-term inflation. The dispersion of possible economic outcomes has increased as strong re-opening demand is outpacing supply constraints. Currently, we expect supply constraints to ease, and higher inflation prints to be transitory, but this will take time to sort out. There is some risk that we get too much inflation (either higher or more persistent than expected) and the Fed is pushed into policy normalization earlier than currently projected. This would exert downward pressure on risk assets. We expect this risk to slow the pace of equity returns in the near term. To change our View, we would need to see inflation expectations (rate in which consumers and businesses expect prices to rise in the future) moving higher, persistently higher inflation in both goods and services, and a trend towards higher wages.

Given this backdrop, we remain modestly overweight global equities and infrastructure and have decreased portfolio sensitivity to rising rates. Importantly, portfolios have exposure to several asset classes that perform well during inflationary periods including TIPS, commodities, infrastructure, and real estate.

Brandy Niclai, CFA®

Chief Investment Officer – Multi-Asset Strategies

06/07/21