Bottom line: What’s driving returns in your portfolio is shifting from predominantly equities, to alternative assets, and specifically real assets. Such shifts help signify a maturing recovery and investment cycle (where you need to be more selective). The good news is the path is still UP for risky assets, but you should expect more 2-way markets and greater selectivity. These are markets that require patience. Reducing overall beta (which reduces portfolio volatility) but retaining positive risk tilts is our investment advice. We began making these changes in May.

Drivers of Portfolio Returns Change With Time

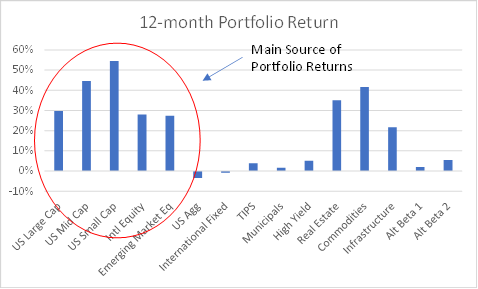

In our balanced portfolios we employ 15 asset classes to achieve your returns. These predominantly are grouped into Equities (Large Cap, Mid Cap, Small Cap, International and EM), Fixed Income (US Agg, International Bonds, TIPS, 1-5 Year Gov/Credit, High Yield and Municipals), and Alternatives (US REITs, Commodities, Infrastructure and Alternative Beta Funds). Chart 1 and Chart 2 below are a selection of those asset class returns over the past 12-months and the past 3-months.

Sources of Portfolio Returns over the Past Year and Past 3-Months

We want to highlight two points:

- Over the past year, Equities contributed the most to your bottom line – about 65% of the total returns was from the five equity asset classes.

- In the past 3-months, this has shifted to Alternatives being the main driver (55%). These are all asset classes you have exposure to.

The rise of inflation and a maturing of the recovery cycle are the main reasons for this shift. Real Assets perform better in terms of holding long-run value. We would point out that equities (which are the bread and butter of most investing) are still exhibit positive returns, but it is less then before. In inflationary environments, not all companies are able to pass through higher prices on to consumers. Where they can’t, such companies can find their margins eroding, thus end up underperforming. While this is not the only reason for broad market moves, price competitiveness does rise in importance as cycles mature.

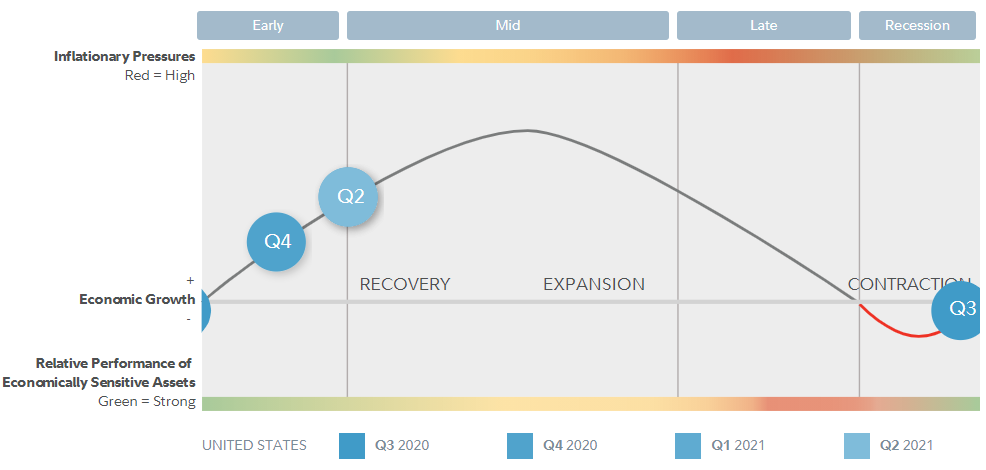

The chart below is taken from Fidelity highlight which measures US growth against Inflationary pressures and relative performance of cyclically sensitive assets. These investment clocks are good rules of thumb when you want to remember the transitions in markets. Recovery is well underway globally, there is no reason to expect the trades of last year’s recovery to perform as well going forward. In fact, what markets are telling us is we’ve shifted from early cycle (when you can buy almost everything) to more mature expansionary cycle (where portfolios need to be more selective).

United States: Transitioning from Early to Mid-Cycle

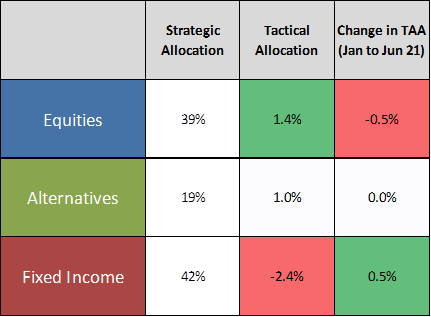

Portfolio Matters – Long Risk and Real Assets, But With Less Weight

The good news is we’re still in the expansionary cycle. US growth is positive and accelerating, so for investing purposes we will be retaining the positive tilt to cyclical and risk assets. While markets seem to be moving faster and more volatile of late, this is an affirmation to stay focused on your long-run objectives and remember where you are in the bigger picture.

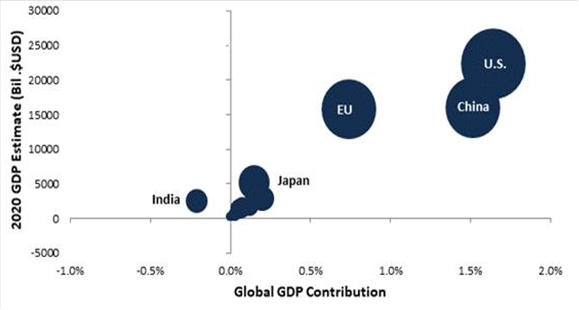

That said, positioning is always a concern in market transitions despite the positive outlook – and so we think it only prudent that some risk be paired back. To reduce the overall volatility in our portfolios, we halved the overweight’s in US small cap equities and emerging market equities. As asset classes, they hold the some of the highest historical volatility. By far, the largest tactical tilt in the portfolio is an underweight on US fixed income. US contributes more to global growth than any one country, US inflation is higher than all other developed countries, so we continue to expect greater pressure on US yields over the remaining year. For the portfolio team, this story remains just as valid to us in June as it did in January.

Asset Allocation and Composition of Global Growth:

Richard Cochinos, CFA®, CAIA®

Senior Portfolio Manager

Multi-Asset Strategies

8/23/21