2020 has been an unprecedented year in financial markets and the world at large. We have seen a global pandemic, social unrest, the fastest selloff in S&P 500 in history, and a subsequent recovery. We will look at the returns in both the equity and bond markets through the downturn, the subsequent recovery, and the year as a whole, as well as which asset classes were the best and worst performers in each period.

Drawdown

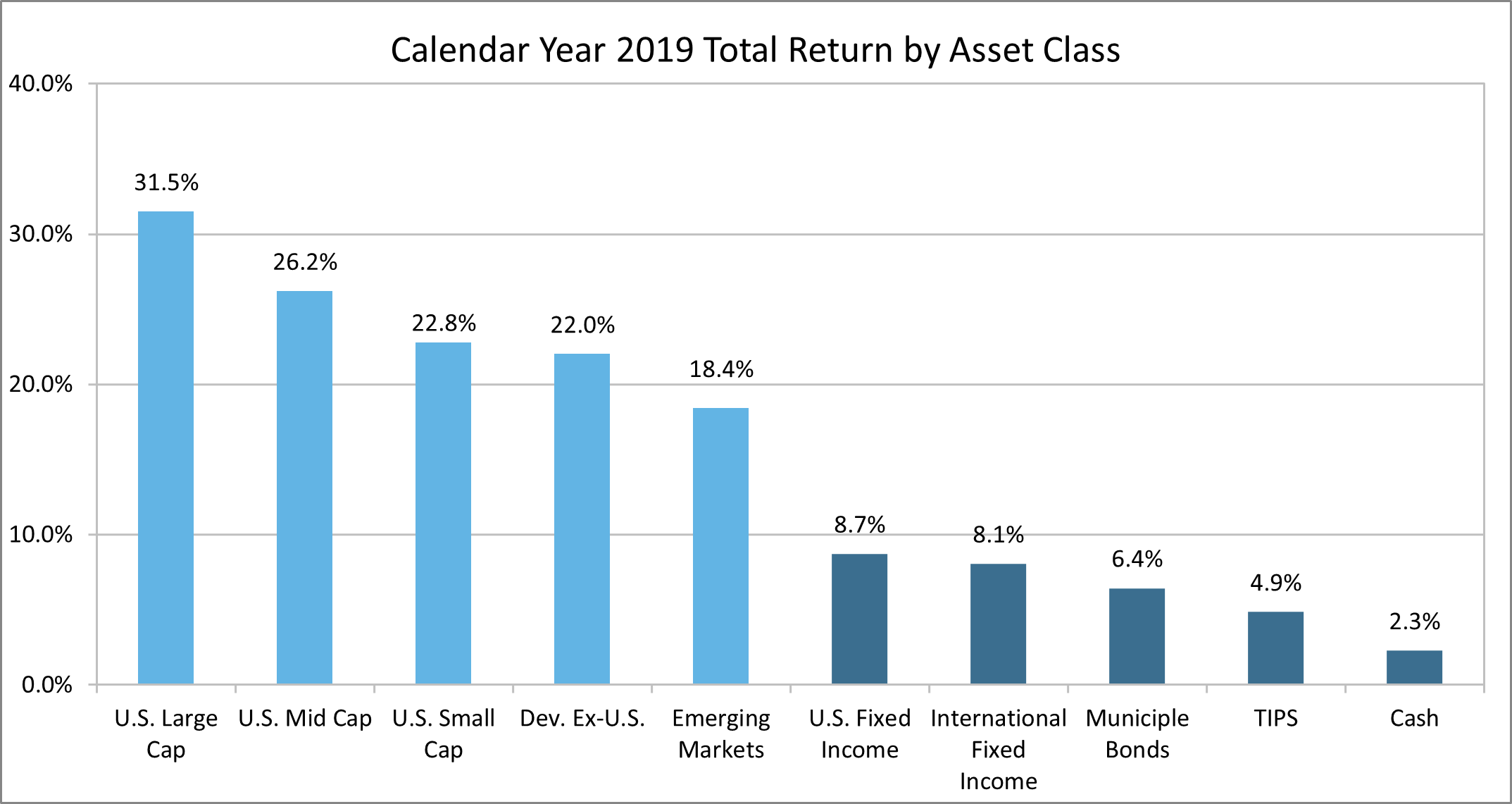

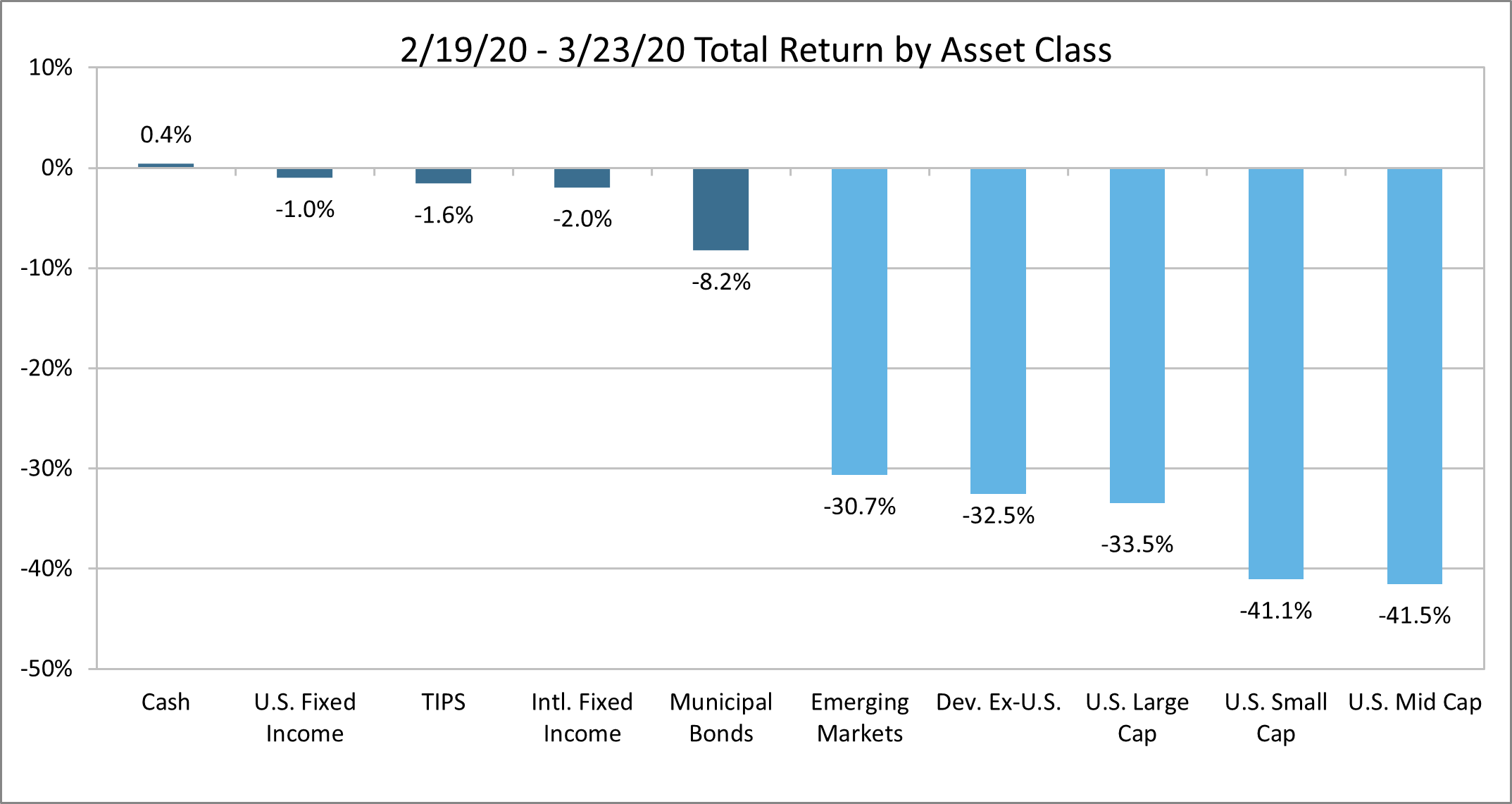

At the start of 2020, equity markets were coming off an extremely strong 2019. We then saw the S&P 500 peak on February 19th at 3,386. Following this, we saw the fastest selloff in history, bottoming out on March 23rd. Over this 33-day period, the S&P 500 large cap Index returned -33.8%, the S&P Midcap Index returned -41.8%, and the S&P Small Cap Index returned -41.2%. Overseas, Developed Markets returned -32.7% and Emerging Markets returned -31.2%, outperforming US equity markets over this period. However, prior to this period, International Equities trailed U.S. equities as the virus began its spread.

Bonds generally fell during the downturn as well. Cash equivalents were up 0.4%, the Bloomberg Barclays U.S. Aggregate Index returned -1.0%, 0-5 Year TIPS fell -1.6%, International Bonds dropped -2.0%, and Municipal Bonds fell -8.2% as spreads widened dramatically. Over this time, bonds strongly outperformed equities, offering the downside protection expected.

Recovery

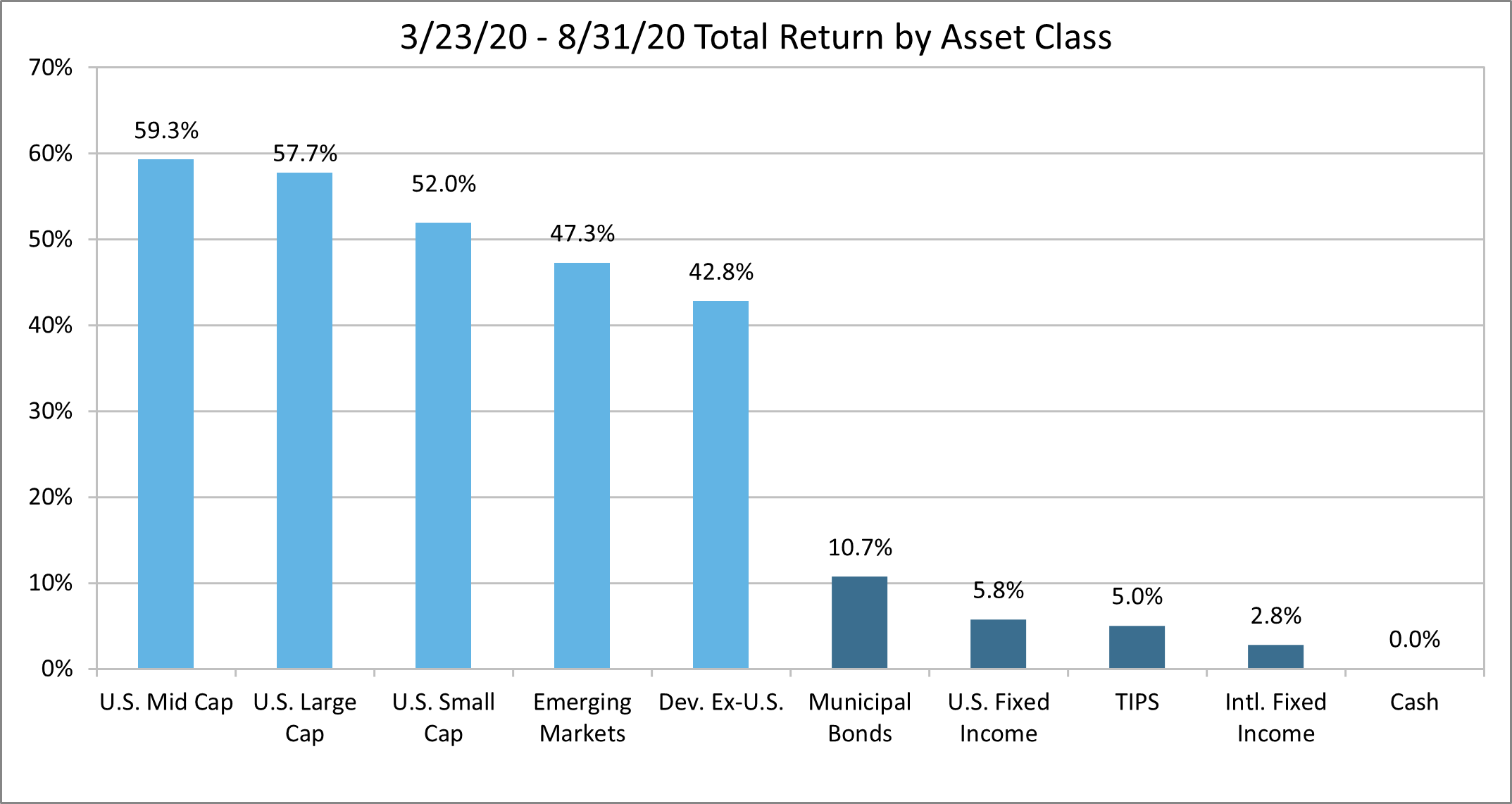

After the S&P 500’s bottom on March 23rd, equity markets rallied back. From March 23rd to August 31st, the S&P 500 returned 57.7%, S&P Mid Cap returned 59.3%, and S&P Small Cap returned 52.0%. Internationally, Developed Markets returned 42.8% and Emerging Markets returned 47.3%. With this recovery, Emerging Markets and the S&P 500 are still the only equity asset class to have recovered to its February 19th levels.

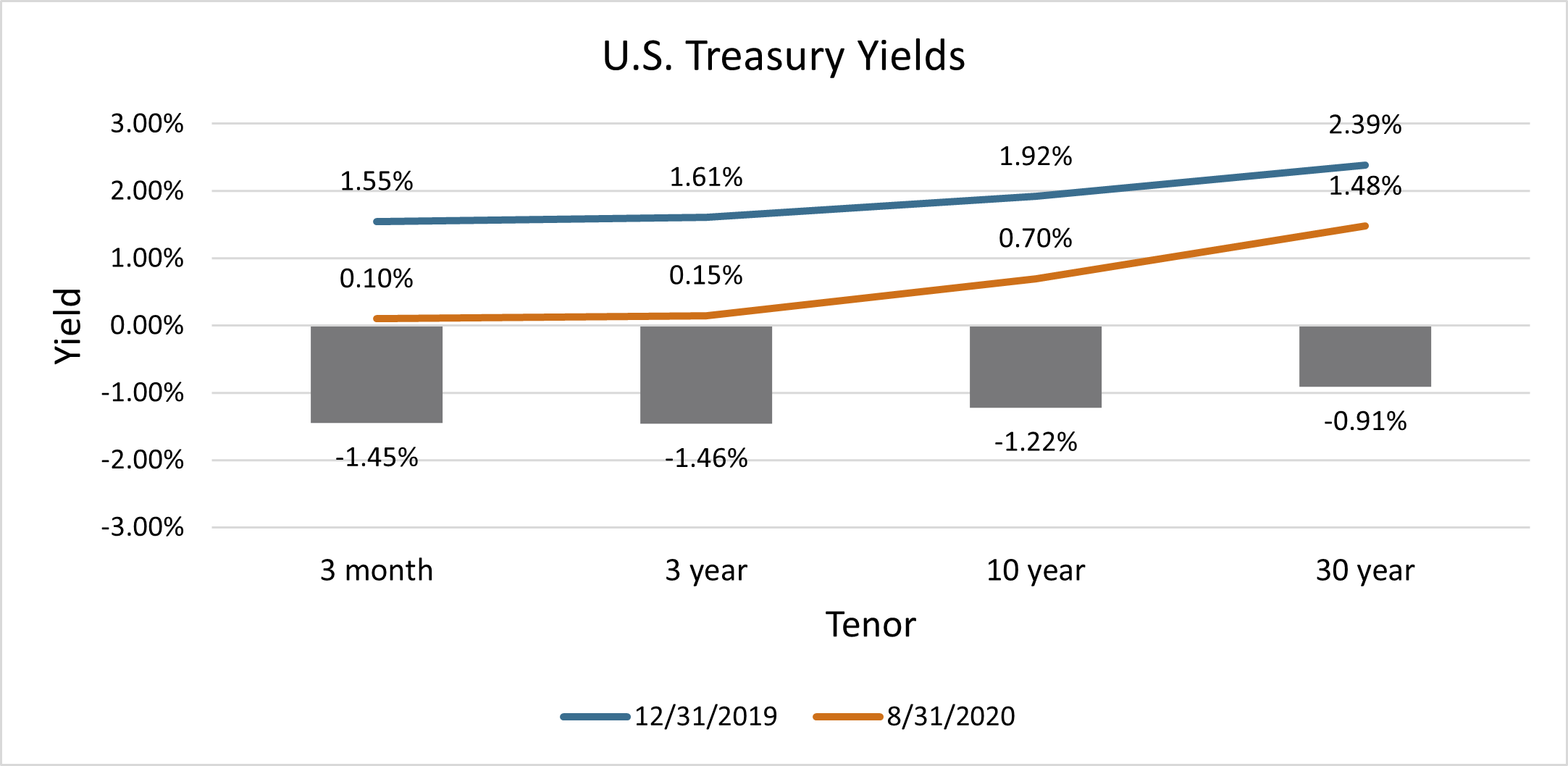

Bonds rose as well over this period following rapid and sweeping policy responses from central banks around the world. Municipal Bonds returned 10.7%, the U.S. Aggregate Index returned 5.8%, TIPS returned 5.0%, International Bonds returned 2.8%, and cash has remained flat. All bond indices discussed have positive returns since February 19th. However, this return was driven primarily by a reduction in yields signaling a lower expected return for bonds in the future.

Year to Date

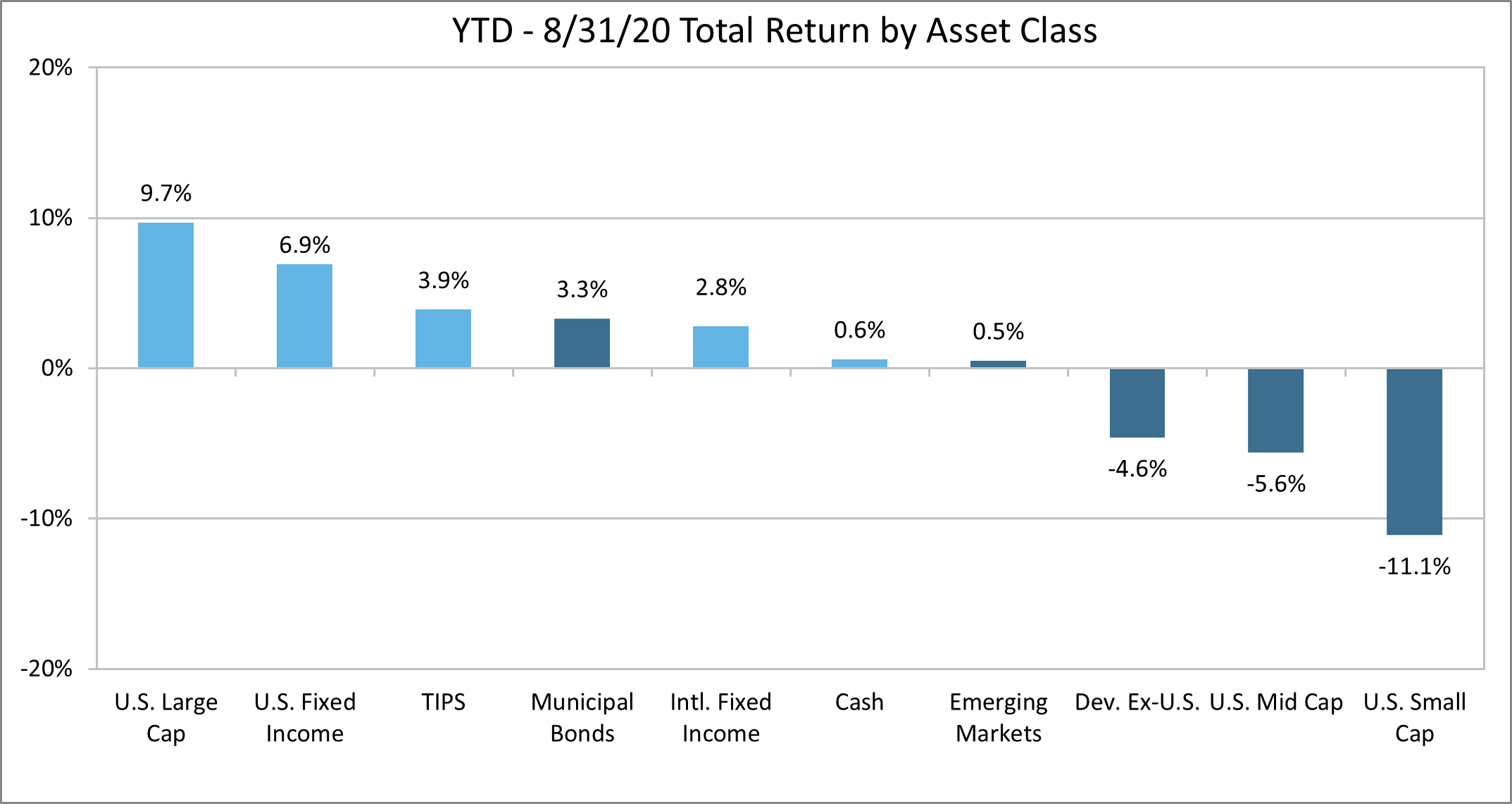

Looking at the year up to this point, we see the top performing asset classes are the U.S. Agg and U.S. Large Cap Stocks. Bond returns have all been positive and riskier equity asset classes generally remain negative on the year, with the notable exceptions being U.S. Large Cap equities and Emerging Markets, more than half of which is comprised of China which has handled the virus well according to official Chinese sources.

Going forward, uncertainty remains high. Many are hopeful for an effective virus treatment which would be a boon for equity markets. However, some expect an uptick in infections as we enter the winter months. While strong bond returns have been beneficial, it has come at a cost. Yields, the primary driver of bond returns over the long term, have fallen. A reduction in yields pushes expectations for bond returns lower going forward. There are still four months left in 2020 and while we cannot predict exactly where the year will end, APCM has been evolving our outlook and developing new investment strategies to help our client’s navigate current market conditions. Uncertain times like these are why we work with our clients on creating and regularly reviewing a plan to help them meet their goals.

Charlie Scott

Investment Analyst

09/08/20