I will speak from the point of view of bonds and interest rates. APCM has been receiving some questions and concerns regarding rising interest rates. Rising interest rates do not necessarily equate to a negative investment landscape.

I started off my career in 2002 when the 10-year Treasury rate was above 5.00%, and reached a peak of 5.43%. My colleagues suggested that interest rates were going to move up. Their experience investing in the mid 80’s suggested so. How time has changed especially coming out of the global financial crisis. Years later, in September 2015 I sold some three-month treasury bills at negative yields. Oh, how my college professor was wrong about interest rates! I still have the copy of the trade ticket on my wall here at the office to remind me how you cannot predict the future.

Interest rates are basically a component of three things: a real interest rate, inflation expectations, and a term premium (additional compensation for holding a long maturity security).

There are multiple catalysts that affect the components above and drive nominal interest rates up:

- Inflation expectations moving up

- Real yields increase by way of an improving economy

- Increased supply

- Decreased demand

Inflation expectations have moved upwards over the last 2 years (Chart 1). The low point of the 5-year inflation expectation measured by the Treasury Inflation Protected Securities (TIPS) breakeven was 0.94%, and rose to 2.02% today. The main factors that caused inflation expectations to rise are increased energy prices and wages, which pushed up the Consumer Price Index (CPI). Today, the CPI was released. Month-over-month CPI came in at 0.5% a healthy surprise of .2% vs expectations. Year-over-year CPI is now at 2.1%, helping the Federal Reserve meet its inflation target.

Low but steady inflation is a positive for the economy and risky assets. This is what investors and the Federal Reserve are looking for. Extreme and unexpected inflation due to energy shocks or low currency valuation would be seen as a negative.

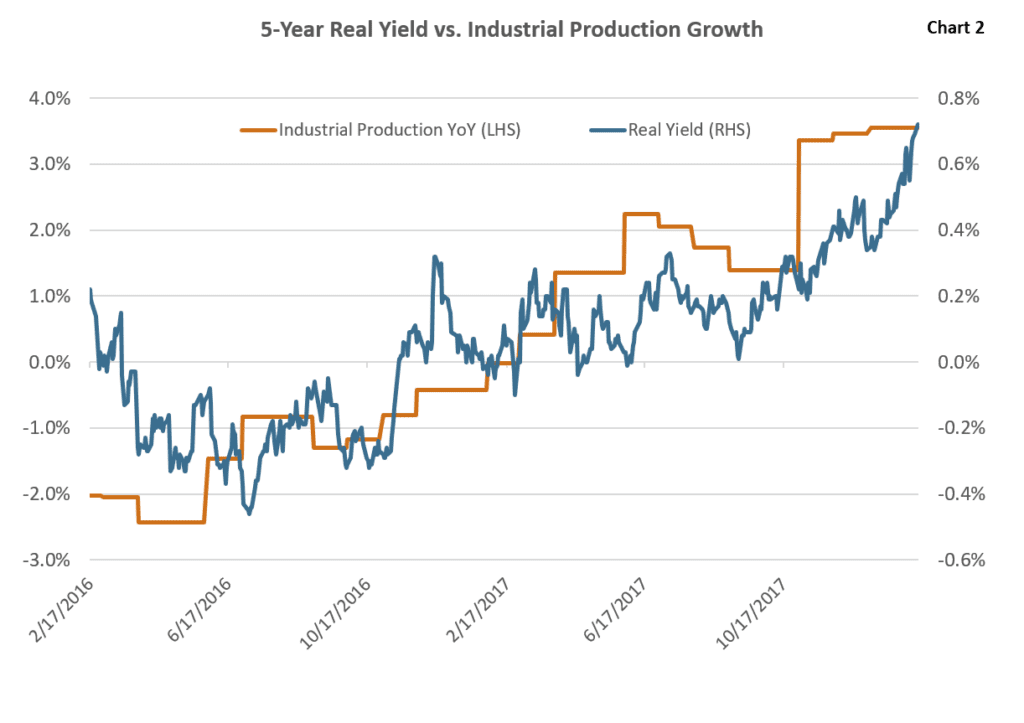

The 5-year real yield has increased since August 2017 (Chart 2). Real interest rates should increase with an improving economy, ceteris paribus “all else being equal”. A decent proxy for the health of the US economy is Industrial Production a measure of output of industrial establishments following mining, manufacturing, and public utilities.

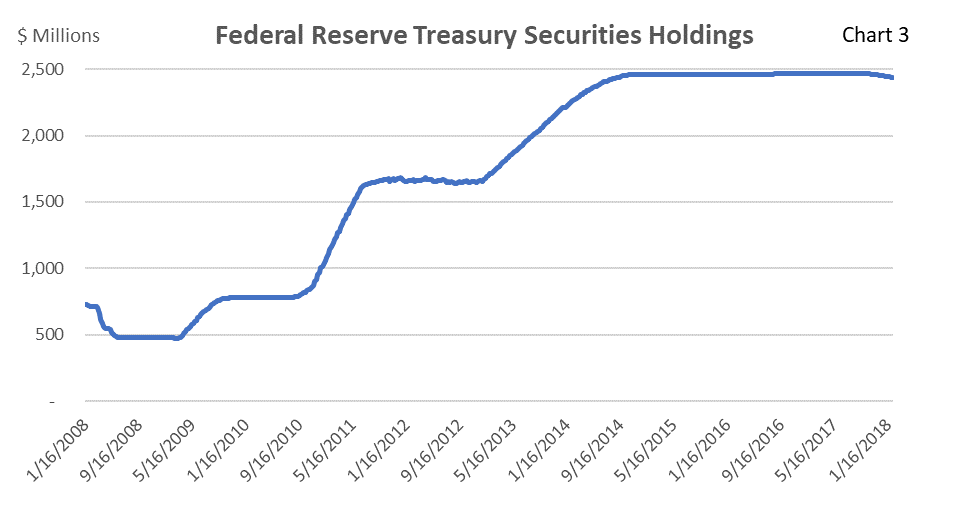

The basic rules of microeconomic supply and demand apply to the bond market every day. The supply of treasuries will be increasing over the next few years to fund the federal government deficit (Table 1). JP Morgan projects a gross issuance of $2.38 trillion of Treasuries for the year 2018, up from $2.05 trillion in 2017. The largest buyer of Treasuries has been the Federal Reserve Bank. The Fed currently holds $2.44 trillion (Chart 3), slightly down from its peak of $2.466 trillion. We expect this to decline over the next few years in an orderly fashion as the Fed normalizes its balance sheet.

I take solace in the fact that US interest rates are moving up for positive reasons. We have been in a low interest rate world that has affected assets/liabilities. Looking at periods of history in different countries with prohibitively high interest rates that had a negative impact on its economy; In Germany during the 1920s, hyperinflation caused German bonds to become worthless, elevated inflation in the 1970s in the UK and 1980s in the US, loss of confidence in currencies as seen in the 1997 Asian financial crisis, and most recently the loss of confidence in the government of Venezuela, where the 10-year interest rate reached 50%.

The Federal Reserve will continue to increase the fed funds rate as the economy runs at more than full employment and inflation continues at an expected clip. Market consensus expects the Fed to hike 3-4 times this year. APCM expects a more cautious 3 rate hikes. There will be bumps in the road and nothing will be smooth as the Fed unwinds its balance sheet. I do think interest rates will be in position to rise due to positive economic factors as normalcy will be built back into markets similar to when I started in 2002. We expect rates to rise comparable to other hiking cycles. How fast we get there will be the story of the next couple of years.

Here at APCM we remain diligent and monitor our clients’ bond portfolios to make sure the sensitivity to interest rates is within risk tolerance, and cash flows and liabilities are met. There is no reason to run from bonds. Bonds will continue to play a role in investment portfolios as an income generating asset or an insurance against an exogenous shock to the markets.

Bill Lierman, CFA

CIO, Fixed Income

2/14/18