Both revenues and earnings are higher than last year. Earnings grew +24.7% year-over-year while Revenues grew +9.0%.

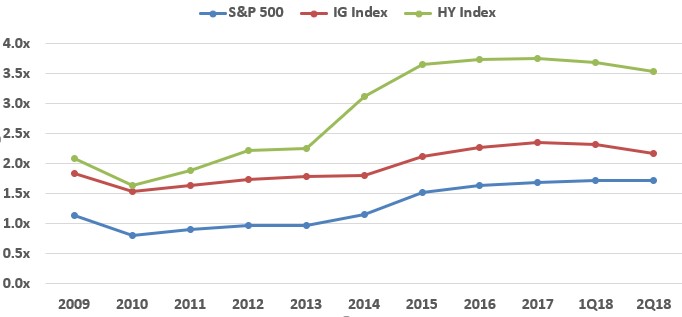

Corporate borrowing levels are stable relative to EBITDA (Earnings Before Interest Taxes and Depreciation) versus prior years for the S&P 500. For both the Investment Grade and High Yield bond indices, the Leverage Ratio (specifically Net Debt/EBITDA) declined. This indicates that corporations are not borrowing excessively.

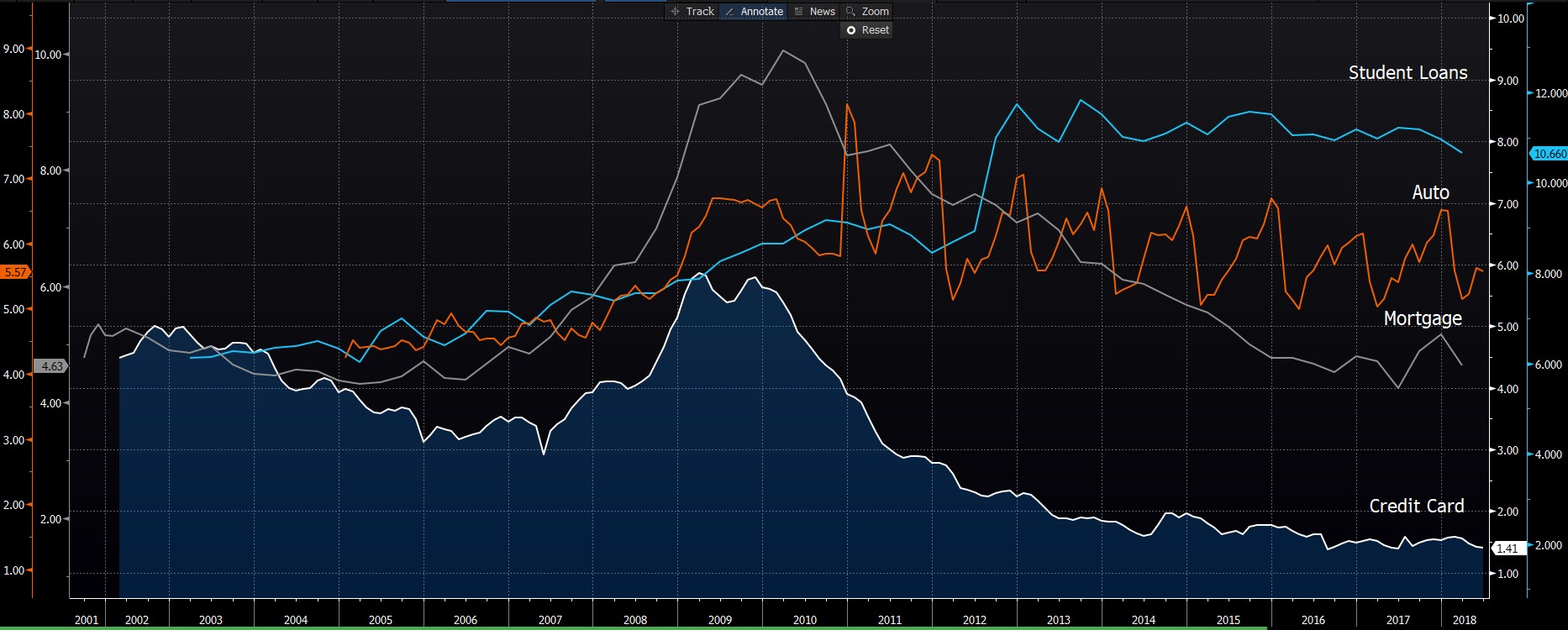

Additionally, delinquencies in four major consumer borrowing segments declined slightly from prior periods. Good consumer financial health is a positive for the customer base of many corporations.

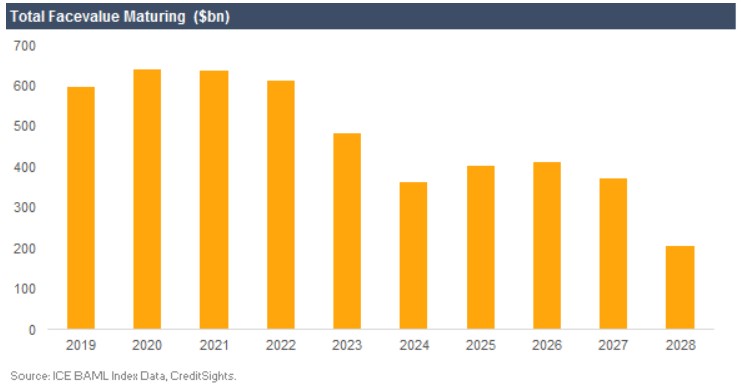

From a balance sheet perspective, the biggest concern is that higher borrowing costs are coming. The US has just gone through a multi-year period where short term rates (1-4 years) have been extremely low. As a result, the debt structure for many corporations is heavily weighted towards the short term. With interest rates rising, corporations are going to have to either repay or refinance (at a higher rate) their maturing debt when it comes due. With an extremely strong economy, this should not be a problem. However, it will cause a slight drag on future earnings growth or reinvestment.

The S&P500 recently set a record for its longest bull market. The 1990-2000 expansion lasted 3,452 days and the current expansion surpassed that mark on August 22. As with any lengthy bull market there may be many things to worry about (e.g. trade, emerging markets, geopolitical crisis) however the fiscal health of corporations in the United States is not showing any sign of weakness.

The latest earnings season’s results are but one piece of a much larger economic picture. However they help support our view that we see no signs of a recession in the near future.

Paul Hanson, CFA®

Portfolio Manager

9/5/18