Leading into 2018 the market expected 3-4 interest rate hikes by the Fed with an additional 3 or so in 2019. The economy got a fiscal boost in 2018 by tax legislation that contributed an estimated 0.4% GDP pushing GDP growth in Q3 to 3.4%, well above trend growth of 1.75-2.0%. The Fed continued a path to tighter monetary policy by increasing rates and allowing its balance sheet to normalize.

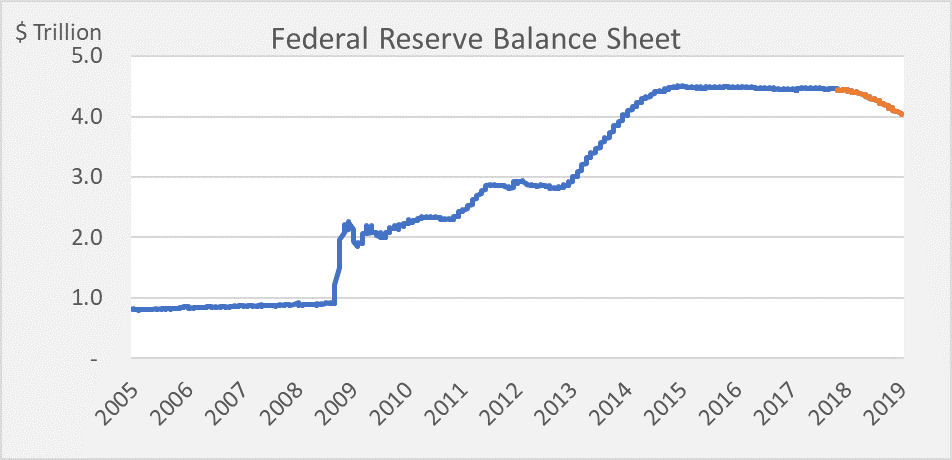

For a history lesson the Fed had completed three separate quantitative easing (QE) programs during the global financial crisis that brought its balance sheet to a high of $4.5 trillion. The Fed bought securities to provide much needed liquidity to the market and bring down interest rates in the long end of the curve. The 10 and 30-year yields declined 140 and 115 bps from start of QE (Oct 2008) to end of QE (Oct 2014).

As 2018 rolled into the 4th quarter, the markets started to get jittery about the pace of Fed rate hikes (9 rate hikes since Dec 2015) albeit well below the normal pace of previous tightening cycles. This presented a problem for the Fed. The markets also had concerns over the US and global economies, negative effects of a trade war, a toxic political landscape both in the US and abroad, and a focus on debt laded non-financial US corporates. Equities got pummeled in the 4th quarter, as the S&P 500 was down 19.32% and international stocks represented by EAFE was down 13.43% at their lows. The 10-year Treasury declined 38 bps over the quarter ending the year at 2.69%. The move in Treasury yields was an indicator that stress in the market was pushing investors out of riskier investments into risk-free assets.

The Fed has continued to communicate to the markets that they will be “data dependent” as they determine what path to take forward. This requires patience as data points over time are analyzed. In between data releases markets continue trading, using projections about future releases. Markets can experience volatility (both up and down) around these economic releases as participants try to project future economic growth rates and Fed actions. I believe the Fed’s dual mandate, unemployment and inflation, are currently supportive of the Fed’s stance. Unemployment was a healthy 4.0% for January, while CPI of 1.9% remains close to the Fed’s target inflation of 2%. The S&P 500 and International stocks have bounced back from the fourth quarter weakness, returning a solid 9.1% and 6.6%, respectively over the month of January.

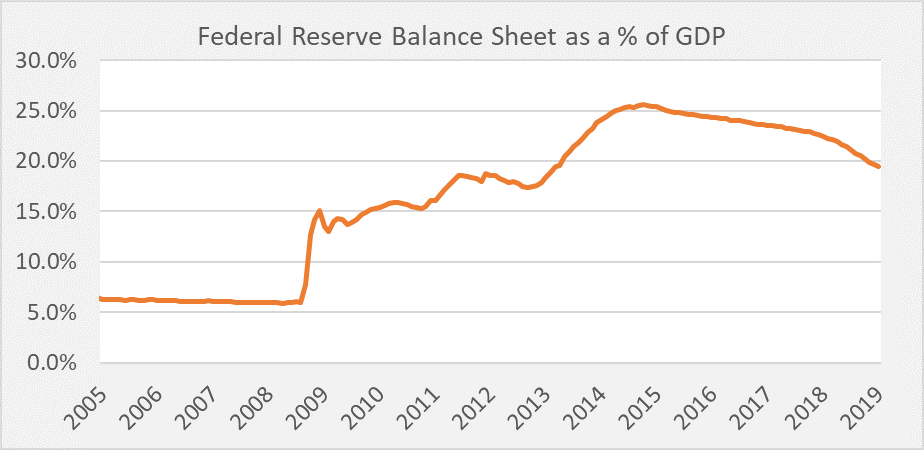

At the January FOMC meeting, the Fed remained committed to data dependence and maintained its rate at 2.25-2.50%, but softened language about balance sheet normalization and future rate hikes. This will give them more options and flexibility down the road, a move towards a more dovish Fed. The Fed’s balance sheet has the current capacity to roll off, roughly $50 billion a month. The Fed balance sheet represents less than 20% of US GDP while at the peak of QE it was north of 25%.

During and after the Global Financial Crisis there was synchronized global monetary policy. If you want an inside peek read Former Fed President Ben Bernanke’s book “Courage to Act”. The Fed was quick to lower the Fed Funds rate, create programs to offload illiquid securities by banks, allowed banks to have access to overnight lending, and purchased trillions of government securities.

The Bank of England cut rates and had an Asset Purchase Program (Gilts and high-quality debt) totaling €435bn, the European central bank cut its deposit rate to -0.40% and purchased Asset backed Securities, corporates, and public sector debt, the Bank of Japan continues to target the 10-year yield around zero and purchased equity, REITS, and corporate bonds. While there was synchronized easing globally the Fed was first and the most aggressive central bank to stabilize its economy.

The US today sits at a much better position relative to other global economies to withstand an economic downturn. The US started their tightening cycle significantly before other economies and have hiked nine times reaching an upper target rate of 2.5%. For comparison: Bank of Japan has kept their rate constant at -0.1%, European Central Bank will begin considering rate hikes during the second half of 2019, Bank of England has hiked twice reaching a policy rate of 0.75%. Coupled with Fed balance sheet reductions, the US Fed has significantly more tools available at their disposal. In addition, the US banking system is in a far better place than before the crisis. US banks are less leveraged and have a greater capital cushion than before. International banks are relatively weaker, lagging their US counterparts in both profitability and capital.

As I look forward, risks continue to percolate throughout the system some of them are knowns (China, Brexit issues, politics, and weaker global economic data) and some are unknowns. The Fed has tools to dampen a downturn if one comes. They will be able to decrease interest rates, restart quantitative easing programs (our back of the envelope estimate for a QE4 could see close to a $2 trillion program to the get the balance sheet back to 25% of GDP), or even target different assets for purchase such as corporate bonds or leverage loans depending on need. This will not be the case for other economies as many non-US central banks have depleted many of their options. I did not agree with the Fed when they left rates low as long as they did. Although, I will give them credit that the US is in better shape to deal with future exogenous shocks and a global economic downturn.

Bill Lierman

Chief Investment Officer

Xander Emili

Investment Analyst

2/7/19