Credit cracks have started to develop, and the market took notice in October and November. Corporate bond returns were -1.46% and -0.17% for those respective periods. Negative performance was driven by credit downgrades, such as GE and Anheuser-Busch. We have taken stock of these movements and have had a cautious outlook to corporate bonds. A particularly pressing issue within investment grade corporates is the ever-growing BBBs.

BBB debt, the lowest rating rung in the investment grade space, has been consistently growing since the financial crisis. As of 2018, BBB rated bonds, weighted by market value, constitute roughly 50% of the investment grade index. Further, 14% of the bonds are in the absolute lowest rated tier of BBB’s, BBB-. Three factors caused this: increased issuance by BBB’s relative to higher rated bonds, downgrades from higher rated tiers, and leniency by credit rating agencies. As firms have aggressively borrowed, they now face the challenge of higher interest rates and the operational risks associated with M&A (mergers and acquisitions) in the face of a potential credit cycle down turn.

*Index data on ICE BofAML US Corporate Master Index.

Growth in Debt

The investment grade index has grown from $2.8 trillion in face value to just under $6.5 trillion in face value from 2010 to 2018. BBBs have grown the most during this period. In Q3 2018, BBBs accounted for 42% of total issuance, higher than any other category. This massive amount of debt has mainly gone into M&A and stock buybacks, helping equity returns at the expense of larger balance sheets. Companies pushing into increasingly large M&A deals willingly turn towards issuing cheap debt to raise funds for these ventures. Some previous examples include: CVS, Anheuser-Busch, and Bayer. More recently announced deals include IBM’s $31bn purchase of Red Hat and Comcasts $40bn purchase of Sky. The 10 largest completed M&A deals since 2015 can be seen in the graph below. A flurry of activity in 2015 marked the rise in M&A deals.

Source: Bloomberg Finance, L.P

Fundamentally Weaker

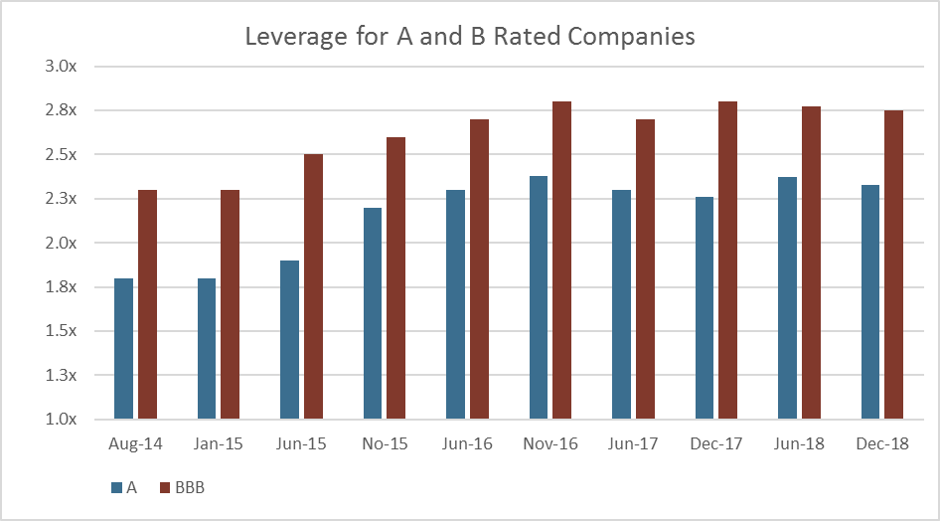

Aggressive debt usage debt has fundamentally weakened the balance sheets of lower rated debt. BBB+ names now have similar median leverage to that of BBB, using total debt to EBITDA as the measure for leverage. The good news is that interest coverage (a firm’s ability to pay the interest payments based on its current earnings and debt levels) has remained stable. Still, many of these highly levered BBBs have characteristics seen in high yield.

Source: Bloomberg Finance, L.P.

Leniency

Rating agencies (Moody’s, S&P, and Fitch) seem to be more lenient in downgrading companies despite weaker fundamentals. Statements by the agencies cite potential synergies created by these M&A activities as a reason to stave off the downgrade. Assuming the company can operationally succeed, it is possible to delever the balance sheet back to an acceptable range for their rating. Assumptions are only good if realized. Another key factor for rating stability is management’s commitment to deleveraging post acquisition. Comcast is a good example of this. Despite the massive acquisition, $40bn for Sky, rating agencies have held their rating constant, with a stable outlook! Agencies cited management’s ability and commitment to deleveraging from prior acquisitions. Comcast’s leverage post acquisition sits at 3.6x debt to EBITDA, in line with median leverage of 3.8x for high yield communications companies.

Even the strongest rubber band only stretches so far before it snaps. Downgrades have still been present within the investment grade companies. General Electric got double downgraded after 3Q18 earnings from A to BBB+ bringing their $114bn in debt into BBB. ConAgra was downgraded to BBB- (cusp of high-yield) due to increased leverage from acquisitions. Lowe’s from A- to BBB+ due to more aggressive financing policy by their new management. Currently Ford sits on BBB- and is a prime example of an investment grade company that has characteristics of high yield.

Downgrades to High Yield

What happens when an issuer gets downgraded to high yield? Many investment managers are required to only hold investment grade bonds. This creates a forced selling environment. Usually the position has up to 90 days before the bond must be sold. Still, it creates an undesirable situation for the managers. The company also faces difficulty. Going forward, it now faces higher lending costs to compensate investors for the increased risk. Additional requirements may include an increased number of covenants, which offer protection to bondholders.

Conclusion

The BBB space has expanded and there is potential for downgrades to high yield. As we enter the late credit cycle, this risk is increased. As such, this space calls for increased levels of monitoring. Forward looking statements and expectations have enormous weight and show management’s willingness and ability to achieve their goals. Here at APCM we see these risks as pockets of stress, not systemic. As such, our current motto is “Up in quality.”

Xander Emili

Investment Analyst

1/9/19