After another quarterly earnings season has come and gone, it’s always prudent to take a step back and think about why investors care about earnings reports. Simply, earnings are a fundamental driver of equity returns, as earnings grow a companies’ value tends to increase holding other variables constant.

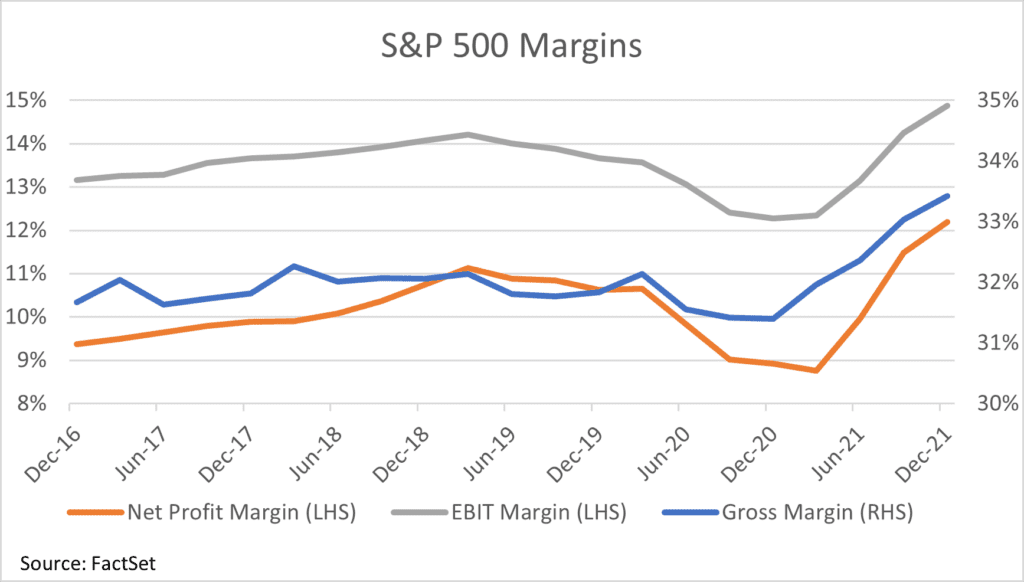

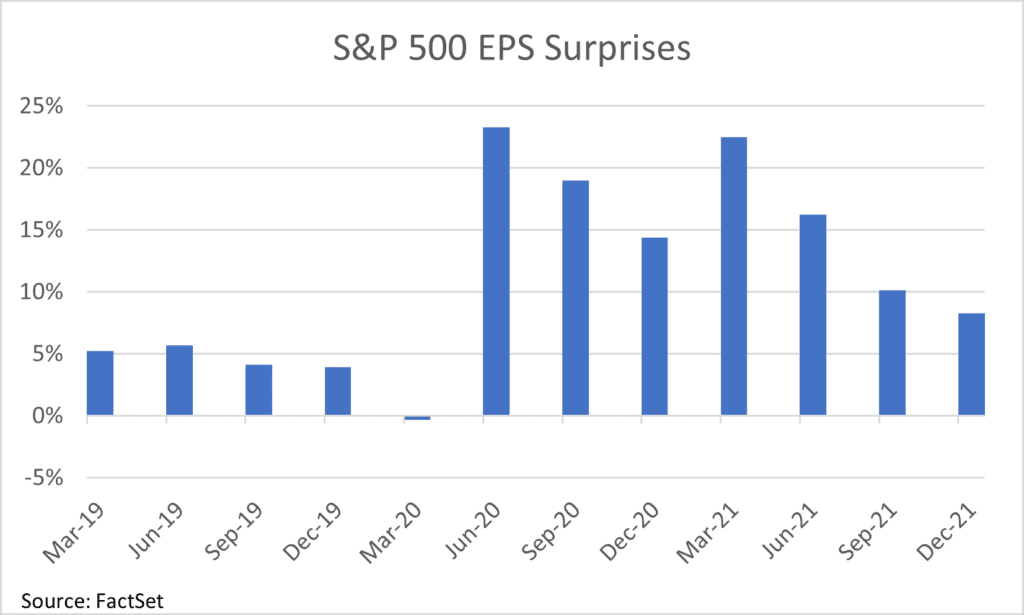

Earnings growth occurs when companies increase their Earnings per Share (EPS) through increased net income and/or share repurchases. Positive earnings surprises occur when a company reports better earnings than what analysts predicted. It is important to understand that earnings growth tends to be a long run driver of equity market performance while earning surprises result in short term price movements. Forward guidance given from companies during their quarterly report plays a role in price movements as well. Margins are another important piece in determining how well a company is performing. Gross, Earnings before Interest & Taxes (EBIT), and Net Profit are a few key margins that should be monitored. Of course, this is only one piece to the overall puzzle of digging through a company’s quarterly report, but it is an important one. Let’s take a quick look at earnings growth and margins, then finish with how earnings surprises are faring.

Overall, EPS is set to continue growing in 2022 with FactSet predicting an EPS of $223.43 for the S&P 500, up from $206.41 in 2021, an 8.3% growth rate, above trend growth expectations. Continued U.S. economic growth should continue to support growth in EPS which is a main determinant in equity returns. Companies managing the costs of labor and inputs will be vital in being able to continue growing EPS, this is observed by analyzing companies’ margins which will be looked at next.

In addition, margins have been strong up to this point as shown below. This will be important to monitor going forward to assess if companies are able to pass through the increased costs we are seeing due to inflation. If consumers begin to push back against the increased prices charged by companies, this could erode corporate margins which in turn would lead to lower profits. So far, the demand from consumers has been very strong which has allowed for corporations to pass through these costs and even increase margins. Margins finished the quarter at multi year highs, with a gross margin of 33.4%, EBIT margin of 14.9%, and net profit margin of 12.2%.

Lastly, fewer large cap companies are beating earnings estimates for the quarter that ended 2021 compared to the same quarter a year ago. According to FactSet, out of the 99% of companies that have reported so far in the fourth quarter, 77% have beat earnings estimates compared to 79% a year ago. We are in the midst of slowing earnings beats as shown in the graph below, but the beats are still above long-term averages. Earnings surprises were still positive at 8.3% in aggregate, compared to 14% a year ago. It is important to note that when the initial Covid shock occurred analysts did not know what to expect from companies, so estimates were lowered dramatically. This led to large beats as stimulus measures kicked in. When companies performed better than expected, earnings surprises jumped to an extraordinarily high pace. This pace was not going to be able to continue and would return to a more normalized pace of beats, which we are seeing now.

Altogether, this was another solid quarter of earnings, but the market focuses on the future prospects of companies. This does not mean that we will begin to have negative earnings surprises and growth in the near term, but that we have exited the recovery phase of the business cycle and entering the expansion phase. Generally, as monetary policy becomes less accommodative, interest rates will rise, and the yield curve will flatten. Focusing on companies with attractive debt profiles and robust free cash flow generation becomes ever more important in a world where debt becomes more expensive and starts to eat into companies bottom lines (earnings).

Jack Straub

Investment Analyst

3/7/22