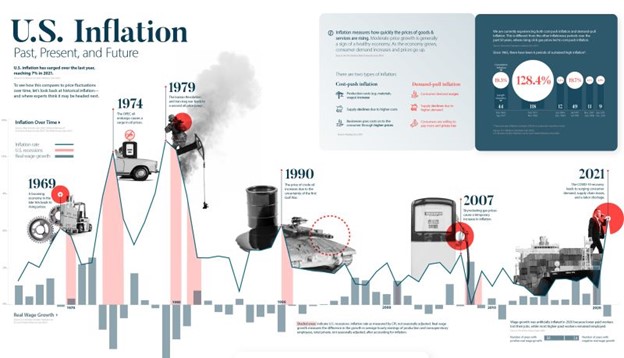

Inflation has been a heavily discussed topic, and for good reason. Inflation hasn’t been this high since the early 1990s (see graphic). There have also been many media stories, blogs, and expert articles predicting that this high inflation is here to stay, especially after the Federal Reserve (the Fed) took the “transitory” label off its inflation expectations.

First, let me talk a little about the type of inflation measure to pay attention to and why the Fed chooses to focus on core personal consumption expenditures (PCE) rather than the headline consumer price index (CPI), which is the measure most commonly referenced in the news. First, the difference between core and headline is the exclusion, or not, of food and energy, respectively. Second, CPI measures the price changes of a fixed basket of goods, while PCE measures what you and I are actually buying. So, for example, if a bottle of ketchup from the brand in the CPI basket goes up in price by 40%, I will be buying a different brand that didn’t go up in price like that. PCE picks up that change in my behavior and tracks how much more I am spending, but CPI does not.

What would it take for core PCE to stay significantly higher than pre-COVID? Quite a number of things would have to work together to keep inflation well above the Fed’s 2.0% target for an extended period of time. Some of the most influential would be:

- long-term inflation expectations would need to average well above 2.5%,

- the global output gap would need to be chronically positive,

- real wage (pay after inflation and taxes) growth would need to stay out of negative territory more often than not to support demand levels,

- the U.S. dollar would need to weaken over a long time period,

- and real GDP growth would need to remain positive.

APCM’s expectations are that all these inflation drivers will not “conspire” to push inflation above the Fed’s target over the long term. Since 1958, the period from 1970 to 1980 was the only period during which inflation was high for a 10-year period – a decade that included the removal of the gold standard, the OPEC oil embargo, and the Iranian Revolution.

Included is a graphic from the Visual Capitalist that can help us understand the history. It shows CPI inflation (higher than PCE, but still provides a gauge of whether inflation is above average), real wage growth, and negative real GDP growth periods (recessions). Only once, in 1970, an inflation spike did not result in negative real wage growth. Once real wage growth turns negative, the demand causing the inflation (input cost inflation and/or finished goods inflation) must fall in the future. The only places consumers can get the money to continue to demand as much as they have is from their earnings or their savings. And savings eventually run out.

There are a great deal of economic data points, theories, and interactions that will determine whether the Fed is successful in meeting its 2.0% average inflation target. And it is completely plausible that the Fed will tolerate inflation above its target for a time past 2024 and allow the next recession to push the average inflation rate back to its target over the long term (i.e., take opportunistic advantage of the disinflation that occurs during recessions). This was by no means an exhaustive treatment of why APCM does not think we are on the cusp of a higher inflation regime. But for the sake of brevity, and since I know that not everybody likes to think about this in their down time, I thought focusing on one piece that is pivotal would provide some understanding of the basis for our expectations.

With APCM’s expectation that the Fed will successfully manage inflation over the long run to its target, our long-term inflation expectations are just slightly higher than previously at 2.25%. The increase is because we know inflation this year, and likely next, will be higher than target. So, two to three periods higher than 2.0%, and the other seven to eight moving down to average 2.0%, gets us an average over ten years of 2.25%.

As always, your team here at APCM is available and happy to address any questions or provide further information on this or any investment topic.

Vinay Sharma, CFA®, CIPM®

Senior Portfolio Manager

06/07/2022