You may recall my introductory blog as the winter 2021 Private Wealth Intern, I am grateful to be re-introduced as the newest Associate Financial Advisor for AWMI. With my BA in Financial Economics in hand, I am ecstatic to start the new year in this new capacity. My knowledge of financial planning topics has grown exponentially over the last year, and I’m eager to continue ‘sponging’ information from my coworkers. Learn and Grow as Industry Experts is a firm value; which is no surprise since our firm was named the fastest growing Registered Investment Advisor (RIA) in Alaska by CityWire RIA.

Out of everything I’ve learned, the power of the Roth Individual Retirement Account (IRA) is unparalleled. If you are or know a young professional who is starting to earn income, this blog is for you.

History

The Roth IRA was introduced by its legislative sponsor, William V. Roth Jr., a senator from Delaware, in 1998 via the Tax Relief Act of 1997. Mr. Roth is owed a huge thank you for the benefits this account type provides its participants, and the robust legacy that Roth assets can provide as they pass to the next generation.

Roth IRAs allow contributions to grow tax free, forever (as the current tax code stands). To contribute to a Roth IRA, you must have earned income that is greater than or equal to the amount of your contribution. So, if I made $1,500 in one year, I could only contribute up to $1,500 for that year to the Roth IRA. You can also help fund a Roth for your children or grandchildren as long as their earned income for the year is equal or greater than the amount deposited into the Roth. This also applies to Traditional IRAs.

Who is Qualified?

You are qualified to contribute to a Roth IRA if you meet BOTH of the following:

- Have earned income, which means income from active employment as opposed to passive investment or rental activity or if you have a spouse with active income.

- Are under the income limit of $129,000 in Modified Adjusted Gross Income (MAGI) for single filers or $204,000 MAGI for married filing joint (both have phase-outs above that income limit). For more information about MAGI or how other tax filing statuses affect Roth contributions, consider this resource: https://www.schwab.com/ira/roth-ira/contribution-limits

- If you are over this income limit, ask your employer if they offer a Roth 401(k). This will allow you to have Roth assets despite higher income.

Why Leverage a Roth?

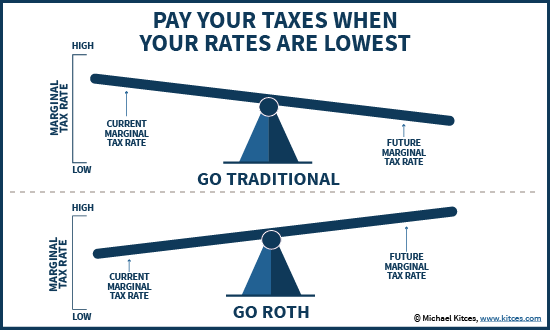

Tax implications: Tax rates are not concrete, they wax and wane alongside municipal, state, and federal administrations who have varying goals. For example, the current tax code sunsets in 2025, meaning that Congress will either address and change the code, or allow it to revert to 2017 levels. Securities in Traditional IRAs will be subject to these changes when withdrawing money in retirement. However, money withdrawn from Roth IRAs will not since they have already been taxed (as the laws are currently written).

Speaking to young professionals, our first decade or two of work are not our highest earning years. Most of those years are spent seeking higher education from Master or Doctorate degrees, seeking certifications, all the while gaining on-the-job expertise. All these efforts are (in theory) rewarded and provide a raise in your wages. With that, the highest earning years are typically the last years of employment before retirement, or at least are toward the end of your career. This implies that the money that you’re being taxed on today for your Roth will be lower than what you will pay later in life.

Source: Kitces.com

Required Minimum Distributions (RMDs): Unlike Traditional IRAs, Roth IRAs do not require minimum distributions. This means that you are not forced to withdraw money and pay taxes on it in retirement unless you want to.

Say you were a real estate mogul in your working years, and now have enough rental income to live out your days comfortably. If you solely have pre-tax assets, you will be required at 72 to take a minimum distribution from your account and pay taxes on it, which could potentially bump that income into a higher tax bracket. If you were using Roth assets, you would not be required to take RMDs, thus you would be able to use as much or as little of the assets you’d like. Heck, you could never use them and leave the Roth IRA for your heirs, and it would still be growing tax free during their distribution phase. This is what makes Roth IRAs compelling vehicles for generationally transferring wealth.

Access for “Life Events”: For starters, you can withdraw whatever money you invest into a Roth without any tax consequences. You cannot withdraw the account growth until in the first five years AND until you are 59.5 years old or qualify for a special exception, per current tax rules, without tax implications. There are special exceptions for which you can access the account’s growth such as: if you’re a first-time home buyer, are funding medical expenses, higher education, and several others. You can find more special instances here: Roth IRA Withdrawal Rules (investopedia.com).

With that mentioned, if you’re young and qualify, consider investing in a Roth IRA. Investing can be intimidating, but the content produced on APCM’s Blog is an incredible resource to keep up with market news and relevant financial topics.

If are looking for a meaningful gift, invest in your loved one’s future and gift them money to contribute to a Roth IRA and inspire a habit of saving. Of course, ensure that they have the earned income to qualify them to contribute, and are under the Roth income limit. The amount of time that Roth contributions have to grow is on their side.

Katelynn Toth

Associate Financial Advisor

1/24/22