I was driving into newly rented office space in downtown Anchorage (a temporary move on my part to relieve the congestion of running a business from home while also sharing space with two teenage boys) and I noticed how many cars were parked on Anchorage’s streets. Presuming people were paying for these parking spaces the much higher utilization is good news for the city’s economy and its much-beleaguered community development authority which depends on parking for revenue. Now at the same time, I’ve also noticed that the pay lots in Anchorage’s downtown, which are more frequently rented monthly by businesses for employees, are still less than 50 percent full. This situation tells me there’s still a gap between “what was” and “what is” in the economy. In the same vein, while leaving said office for the occasional coffee I’ve seen that many downtown restaurants have been absolutely packed during the lunch hour. Conversely, while traveling last month I was amazed at how few dining options were open at Ted Stevens Anchorage International Airport and at Seattle and Atlanta’s airports. Here again gaps between what was the economy of 2019 (pre-pandemic) and what is the economy peri post-pandemic.

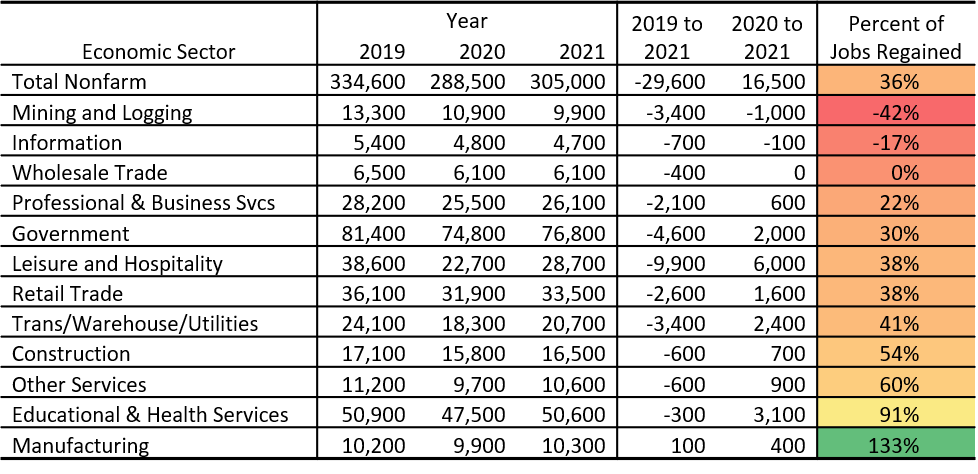

My mind stimulated by the dual effects of getting out of the house and having a writing deadline I wondered where the state’s employment numbers are now compared to where they were. The short of the story is that we still have a long way to go, but some sectors have much, much farther to go than others. Table 1 below shows estimated May wage and salary employment number for 2019, 2020, and 2021 per the Alaska Department of Labor and Workforce Development.[1] The three rightward columns show, respectively, the change in jobs from May 2019 to May 2021, the change in jobs from May 2020 to May 2021, and the percentage of lost jobs regained between May 2020 and May 2021. The pain and destruction that the pandemic inflicted on Alaska’s employment numbers is still broad and deep with just 36 percent of lost non-farm wage and salary jobs regained. Just one sector, Manufacturing, employed more people in May 2021 than it did in May 2019 and even then, just 100 more people. Let’s consider this increase a recovery rather than an indication of real growth. Also nearly recovered is the Education and Health sector which in Alaska is largely comprised of private healthcare jobs since there are few private education jobs. This sector has recovered 91 percent of lost jobs. On the flip side, two sectors Mining and Logging (i.e., oil & gas) and Information are in worse shape now than May 2020. Oil & Gas jobs were slower to respond to the pandemic than say Hospitality jobs and will come back more slowly. I’m unclear what’s affected the jobs in the Information sector. I thought they might have been hit by GCI’s relocation of jobs to the Philippines, but I believe that transition does not start until August. Wholesale trade, which lost 400 jobs (6.1 percent), is not showing any signs of recovery while the remaining sectors have recovered between 22 percent and 60 percent of lost jobs regained.

Table 1. Alaska May Wage and Salary Employment, 2019-2020.

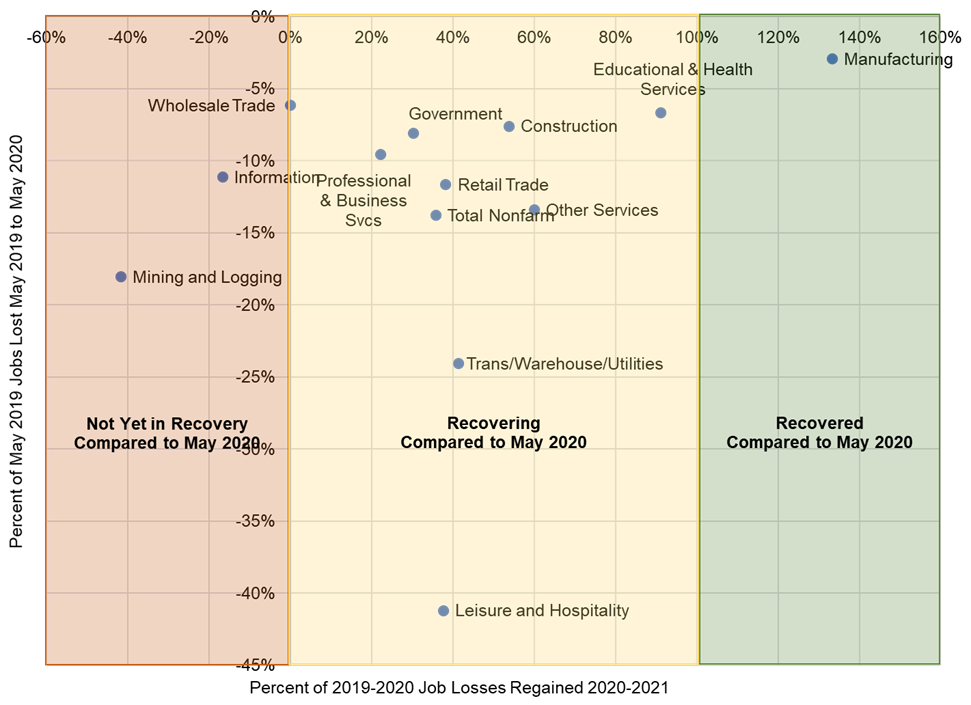

As noted above and as shown below, Alaska’s economic sectors have fared very differently in terms of both the damage caused by the pandemic and their recovery process. Sector-specific percentage job losses ranged from three percent in manufacturing to 41 percent in Leisure and Hospitality. Generally, those sectors which lost less than five percent of their jobs are near recovery while those that lost between five and fifteen percent of their jobs have recovered 20 to 40 percent of their losses. The stories for the most heavily affected sectors (Mining and Logging, Transportation/Warehousing/Utilities [TWU], and Leisure and Hospitality) where job losses ranged from 18 percent to 41 percent are highly varied. Both TWU and Leisure and Hospitality have recovered roughly 40 percent of lost jobs. However, Mining and Logging slipped more than 40 percent on top of May 2019 to May 2020’s job losses.

Figure 1. Percent of Jobs Lost May 2019 to May 2020 vs Percent of Jobs Recovered May 2021 to May 2022

Our recovery will continue to be uneven. I expect the Leisure and Hospitality and TWU will improve substantially over the summer months. A recovery in Mining and Logging will take continued stable oil prices above $65-$70. There are some sectors that I don’t think will recover in the near term. There are jobs in Retail Trade, Information, and Professional and Business Services that are simply gone or gone until some future significantly positive economic event.

Jonathan’s Takeaway: Our summer of healing is off to a solid start. However, significant gaps remain in our economic ecosystem. Recovery in some sectors will be quick and painless while other sectors face years of healing to return to their 2019 (let alone their 2015) strength.

Jonathan King is a consulting economist and Certified Professional Coach. His firm, Halcyon Consulting, is dedicated to helping clients reach their goals through accountability, integrity, and personal growth. Jonathan has 24 years of social science consulting experience, including 17 years in Alaska. The comments in this blog do not necessarily represent the view of employers and clients past or present and are Jonathan’s alone. Suggested blog topics, constructive feedback, and comments are desired at askjonathan@apcm.net.

[1] The good folks at the Alaska Department of Labor and Workforce Development would want me to remind the reader that the data for May 2021 is preliminary.