Twelve months ago, oil prices were in the early stages of a recovery from a major slump caused by a slowdown in economic activity. This not only had ramifications for Alaska’s financial stability and health, but also for the U.S. as both Alaska and the U.S. are net oil exporters. Today, oil prices have nearly doubled in six months as demand has outpaced supply. This has been positive overall for Alaska’s economy given how much of our state’s revenue is provided from oil. This surge in oil prices along with other commodities that my colleague Brandy Niclai has written about has raised questions on the prospects for inflation, causes for this inflation, and the Fed’s stance. For the reasons discussed above, APCM continually watches potential inflation indicators in the commodities sector.

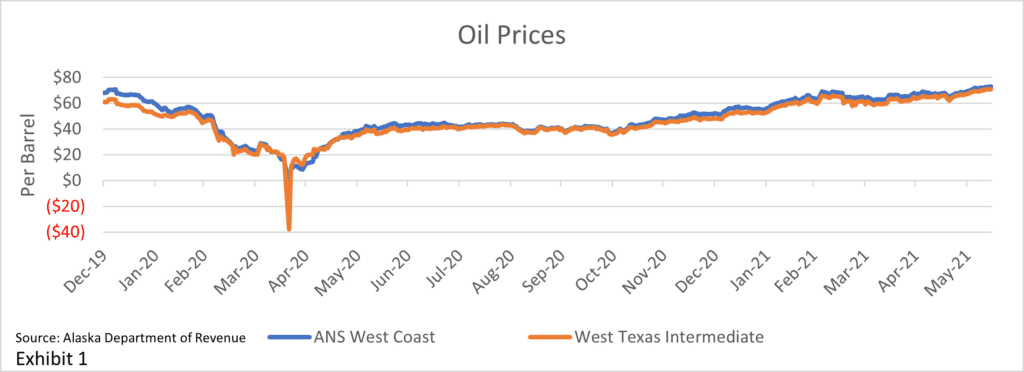

As most commodities, oil prices are in part a function of supply and demand between consumers and producers. When the global economy came to a halt early last March, economic activity decreased drastically as country lockdowns pummeled oil demand. As a result of this shift in human behavior, less oil was demanded by consumers and supply built up. Producers had to act accordingly because there is limited storage for oil. On April 20th, 2020, West Texas Intermediate (WTI) and Alaska North Slope (ANS) had negative prices for the first time since data has been tracked! This means that sellers would pay a buyer to take a barrel of oil off their hands and store it. This issue is more complex than explained above due to the use of derivatives, but none the less occurred. Exhibit 1 below depicts the massive demand shocks to oil prices because of the pandemic and the gradual climb to higher prices today.

Demand

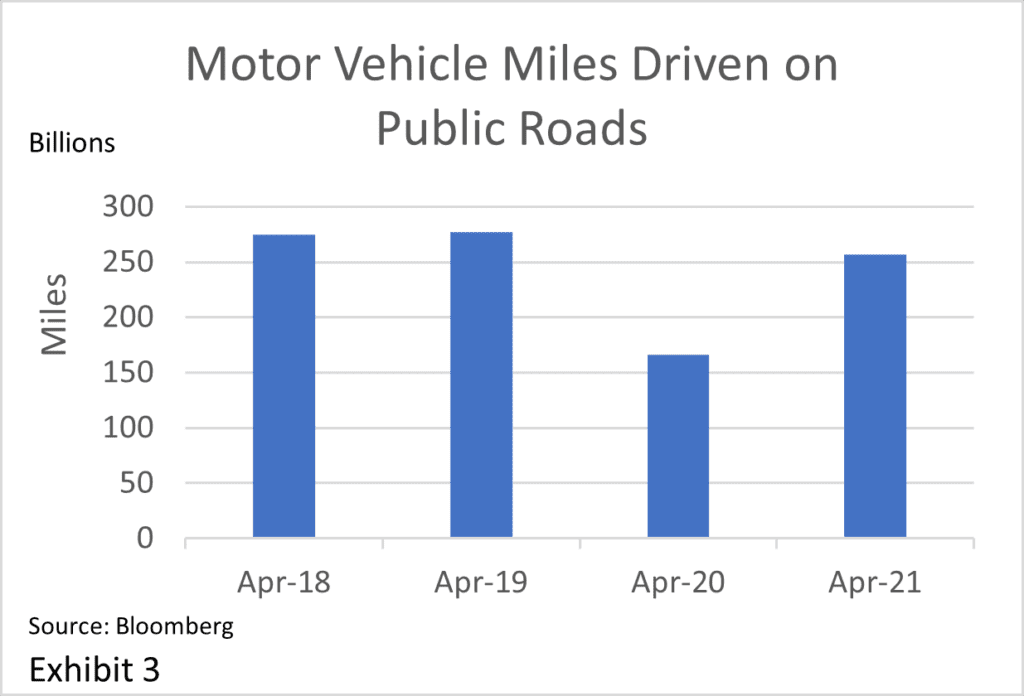

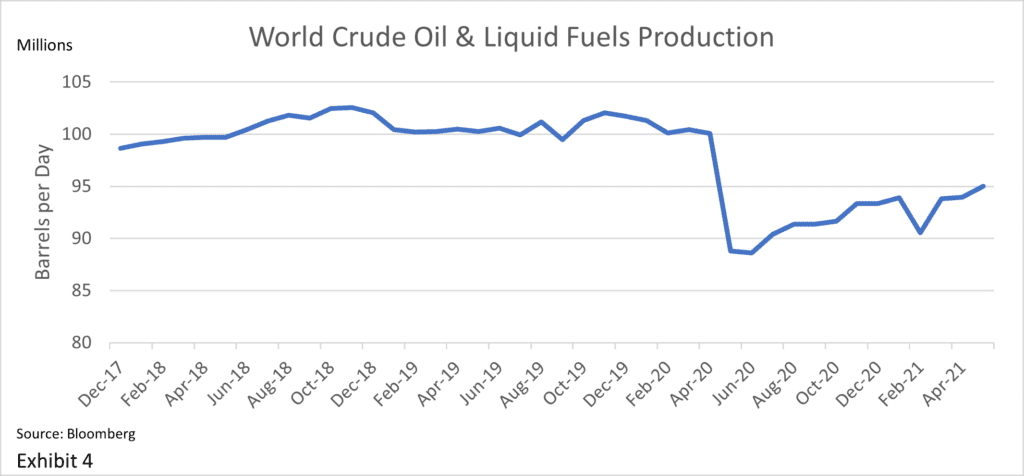

When the initial demand shock occurred, the demand curve shifted down causing oil prices to continually reset at new equilibrium prices. Producers of oil needed to decrease their supply to counter the fall in demand. This is much more difficult to do, especially during a pandemic. However, demand has since rebounded sharply along with the price of oil and has even exceeded pre-pandemic levels. The increase in demand can largely be attributed to the reopening of economies as Covid restrictions ease. The demand for oil can be determined by looking at the demand for high oil using activities. There are a few metrics to be aware of while measuring demand for these activities and where it is potentially headed. One of those metrics is the number of travelers that go through TSA checkpoints daily. There was a large decrease in March of 2020 as shown below. However this has rebounded significantly since early February of 2021. As more COVID-19 related travel restrictions ease and vaccinations increase, the demand to fly should continue to increase towards pre-pandemic levels. Another demand metric to look at is the number of miles driven on public roads, this also saw a steep decrease in April of 2020 and has since rebounded as demand increases. With demand rebounding sharply, there is upward pressure on oil prices which will continue until supply increases to offset this demand.

Supply

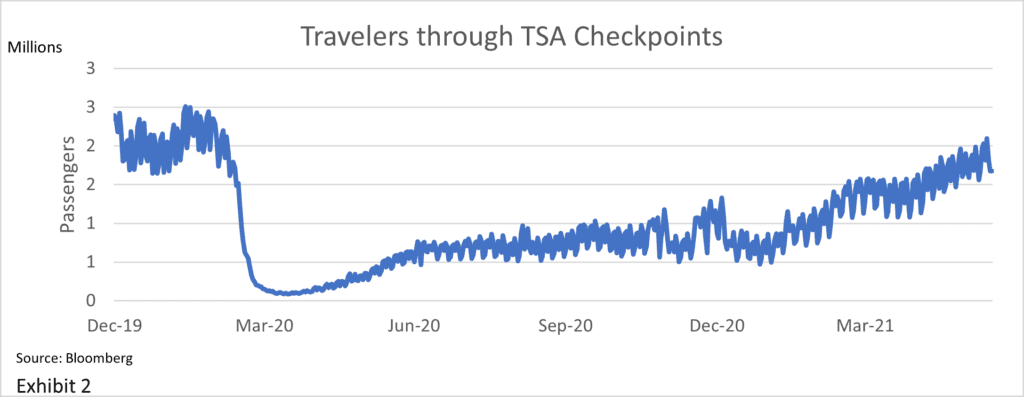

The second variable for the function of oil prices is the supply, or future production. When producers became unsure of what demand would like in the near term for oil and as inventories swelled in April of 2020, producers were forced to cut supply to alleviate the downward pressure exerted on oil prices. This rapid reversal in demand has now caused the need for more production from U.S. shale companies and OPEC+ members. It may seem easy and quick to pump more or less oil to match demand, but it is more complicated and time consuming. An increase in supply at this moment has been stubbornly slow and will continue to be in the near future due to a reduction in producers capital expenditures, political uncertainty, and potential exogenous shocks. Large oil exporting countries and Alaska will benefit more from higher oil prices whereas large oil importing countries will not.

Conclusion

The combination of an increase in demand and lack of growth in supply have continued to push oil prices higher. As producers adjust to the strong demand from consumers, oil prices will continue to reset and find a new equilibrium. A couple of data points to follow if you are interested to see how this pricing scenario plays out are the demand indicators (TSA travelers and vehicle miles driven) and supply indicators (U.S. and OPEC+ production). This has been a simplistic approach to this topic to describe basic elements in the oil market in today’s world.

Jack Straub

Investment Analyst

8/2/2021